A shining beacon of yield in a miserably low interest rate environment, mortgage REIT Two Harbors (NYSE: TWO) sports an eye-popping 10% dividend yield. But yield is not the only reason you should consider buying, rather, it is the company’s incredible diversity of assets that separates it from the pack.

Better spreads

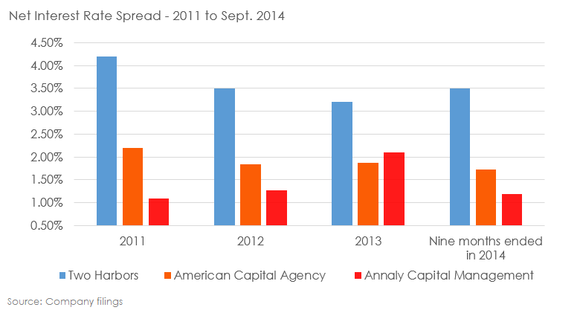

When you boil it down, mortgage REITs earn the difference between what it cost them to borrow, and the yield on their assets. As you can see in the chart below, Two Harbors spread is consistently larger than its peers.

Mortgage REITs, like Annaly Capital Management (NYSE: NLY) and American Capital Agency (NYSE: AGNC), invest almost exclusively in plain-vanilla, low-risk, and low-yield assets. While Two Harbors also invests in these types of assets, they are willing expand the beyond the usual, and seize the best available opportunity.

For instance, following the financial crisis in 2009, subprime mortgages – high-risk loans to borrowers with iffy credit – were selling at sizable discounts. Seeing the potential, Two Harbors loaded up and made an absolute killing as the economy rebounded.

However, those same assets are not nearly as attractive today, so, the company moved on to the next best thing, securitizations – collecting residential mortgage loans, turning them into bonds, and selling them. And, more recently, Two Harbors has plans to take on the newest next best thing, commercial mortgage debt. In fact, the company suggested that $1.5 trillion in commercial loan debt maturing over the next several years, and should create significant demand for new loans at attractive yields.

Ultimately, because different types of mortgage assets will perform best in varying environments, the company's flexibility to invest in traditional as well as non-traditional mortgage assets makes Two Harbors extremely dynamic.

Rising interest rates

If you are skeptical, it may be because companies that earn higher yields are often taking more risk. And, in short, that is true here. About 25% of Two Harbors' portfolio is exposed to credit risk, or the risk borrowers will default on their mortgage payment.

But, the benefits far outweigh the risks and here’s why:

While Annaly and American Capital Agency's assets that are protected from defaults, their performance is often at the mercy of interest rates. For instance, when interest rates rise, the market value of currently owned bonds falls and their yield increases to match prevailing interest rates. Because mortgage REITs invest heavily in bonds, when their value falls, the companies book value falls, and the value of the company falls. All told, this is the reason mortgage REITs tend to perform miserably when interest rates rise.

As you can see in the chart above, mortgage rates spiked in 2013 and Annaly and American Capital Agency took dramatic hits to their book value. Two Harbors' book value, however, was much better protected. One reason for this is that assets exposed to credit risk will often adjust in price based on the economy, and are less influenced by the rising and falling of interest rates.

Moreover, because Two Harbors’ portfolio carriers a higher yield, the company does not need to use as much leverage. This also helps protect against interest rates.

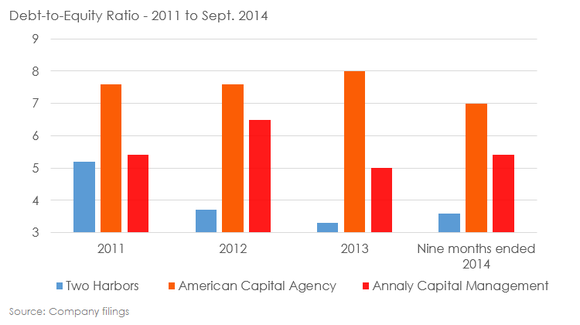

Lower leverage

Leverage measures of how much debt a company has compared to its equity. Think of it like a mortgage on a house, if you put $10,000 down on a $100,000, you have a debt-to-equity ratio of nine, or you have nine times as much debt as equity -- $10,000 in equity and a $90,000 mortgage.

Here’s where things can get messy: If your new house loses 10% of its value, you lose your entire investment. It works exactly the same for mortgage REITs.

As the chart shows, while Two Harbors can amp up its leverage like in 2011, they will consistently use less. This is because, again, their higher-yielding portfolio allows them to create returns without the use of excessive leverage, and, ultimately, this helps protect Two Harbors from potential swings in the value of their assets.

Diversity is king

Interest rates will rise and fall and the economy will strengthen and stumble, but their is always opportunity. Because Two Harbors' business model allows them to pursue anything and everything, they will always have opportunity.

This is the major reason Two Harbors' has been one of the best performing mortgage REITs over the past six years, and since I expect that tread to continue, I think Two Harbors' is the best high-yield stock you can buy today.