In my opinion analyst downgrades need to be taken with a dump truck worth of salt because most of the time "sell" advisories don't arrive until share prices have already cratered and other analysts have piled on with their own downgrades. In other words I think most analysts have a bad case of short-term focus and a herd mentality, and to be honest often times downgrades don't arrive until a stock is so beaten down its actually a great long-term buying opportunity.

Take for example TransCanada Corporation (TRP 0.22%), which between August 4 and September 11th received one upgrade and three downgrades from analysts.

Since August 4th TransCanada shares are down 15% and many income investors might be nervous about the growth prospects of this gas and oil pipeline operator, especially with so many analysts downgrading the stock and the prospect of cheap energy prices potentially stretching on for years.

Let's take a systematic look at TransCanada's business model, growth plans, and most importantly its dividend growth profile, to how risky it is to buy shares at today's beaten down price.

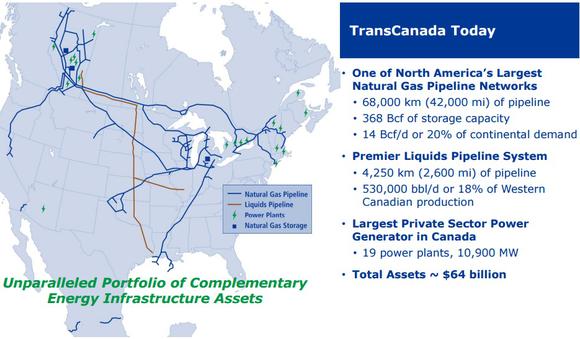

TransCanada at a glance

Source: TransCanada investor presentation.

TransCanada earns its money by operating an enormous system of natural gas and oil pipelines and extracting toll-booth like fees under long-term contracts. The predictable cash flow this generates allows it to fund its dividend and help pay for its enormous growth backlog of projects -- $46 billion of projects already secured by long-term commercial contracts with another $50 billion worth management is currently considering.

TransCanada also serves as general partner of TC PipeLines (TCP +0.00%), an MLP that is 28.2% owned by the company and serves as a source of funding via drop down sales of assets. A perfect example of how this works is the company's recent drop down sale of TransCanada's 30% stake in Gas Transmission Northwest to TC PipeLines for $457 million; $264 million of which was in cash, $98 million of assumption of debt, and $95 million in new class A TCP units.

Basically, by selling its assets to its MLP, TransCanada gains cash and debt assumption to help offset the cost of building the asset, and then the larger equity stake in TCP results in larger distributions to the general partner. This recurring and growing cash flow is joined by TransCanada's incentive distribution rights or IDR fees, which grant it an increasing percentage of TCP's distributable cash flow or DCF up to 50% once the quarterly distribution hits a certain level.

Dividend profile: solid yield, strong growth but...

TransCanada's current yield -- 6.4% based on its latest quarter's $.52/share dividend -- is generous and management is guiding for eight to 10% dividend growth through 2017, which is far faster than its historic dividend growth rate.

Source: TransCanada investor presentation.

Management expects the next three years worth of dividend growth to come from the $12 billion in small to medium-sized projects it plans to put into service over the next 3.5 years.

In order to maintain that kind of impressive dividend growth long-term TransCanada plans to fall back on its $34 billion in large scale projects such as its: $12 billion Energy East project, $8 billion Keystone XL pipeline, and $5 billion Prince Rupert Gas Transmission project or PRGT.

All told, the $46 billion in secured growth projects are expected to add around $5.75 billion in annual EBITDA, basically doubling TransCanda's current earnings before interest, taxes, depreciation, and amortization.

All this talk of dividend growth is nice and all, but as important as future payout growth is current dividend sustainability. The best way to calculate that with a distribution coverage ratio which compares distributable cash flow to the cost of the dividend.

Unfortunately TransCanada is a Canadian company and due to the a lack of maintenance capex data in its regulatory filings calculating its DCF isn't possible and so we're forced to rely on the dividend payout ratio, which compares the dividend to TransCanada's earnings per share or EPS.

The reason this isn't ideal is because in a highly capital intensive industry such as pipelines non-cash charges can cause wild swings in EPS, something that is avoided when looking at DCF.

TransCanada's three and six month earnings payout ratios were 87% and 90% respectively indicating the dividend is sustainable though to safely achieve the eight to 10% growth management wants will require good execution of its large growth projects, which represents the biggest potential risk for dividend investors.

Bottom line: Dividend is secure but future payout growth faces regulatory risk

Whether or not TransCanada can achieve its targeted eight to 10% dividend growth in the long-term will depend on completing its large scale projects such as Keystone XL and PRGT. That will require regulatory approval from the US congress, the government of British Columbia, and the Federal government of Canada.

This regulatory risk -- which as seen with Keystone XL can result in years of delays -- is something current and prospective long-term dividend investors need to keep in mind before investing their hard earned money.