Source: Brookfield Infrastructure Partners

Growing concerns about a slowdown in China and oil prices crashing to 13 year lows have combined to generate the worst start to the year in market history. Yet long-term investors know that this isn't a reason to panic and sell, but rather to load up on some great, high-quality dividend stocks. Take for example, Brookfield Infrastructure Partners (BIP +2.58%).

Down about 20% over just the last few months, I'm convinced that this world class, best in breed, diversified utility could be just the thing to help dividend investors lock in some fantastic long-term, market crushing returns over the next five to 10 years.

Find out three reasons why Brookfield Infrastructure deserves to be on every income investors radar, and probably in your diversified income portfolio as well.

Business models don't come much better than this

Few utilities are as diversified as Brookfield Infrastructure Partners, which operates in four different utility segments on five continents after recently announced its first investment into Indian toll roads.

Better yet, the adjusted cash flow from operations or AFFO, that fund the quarterly distribution is extremely predictable and stable. That's because 90% of it is comes from assets operating in either highly regulated industries or are under long-term contracts, 70% of which are indexed to inflation.

Payout not just sustainable, but likely to grow as well

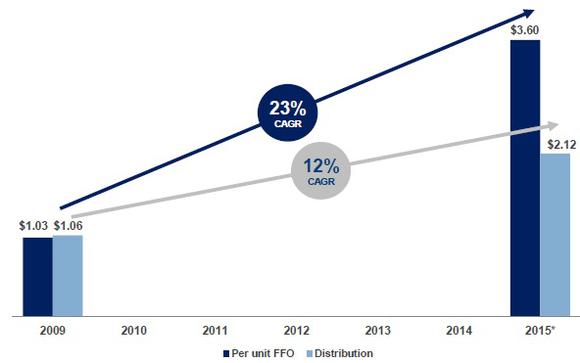

Source: Brookfield Infrastructure Partners investor presentation.

Utilities are a favorite among income investors because of their high yields, with an industry average of 4.0%.

Brookfield far surpasses that with its 6.5% yield, but dividend investors need to focus not just on the current payout, but also on the two other components of a distribution profile: sustainability and long-term growth potential.

Which is why I love Brookfield Infrastructure's conservative payout principle of growing the distribution slower than funds from operation per share as well as AFFO. This does two things.

First it results in a highly sustainable payout. For example, year to date Brookfield Infrastructure has paid out 69.7% of AFFO per unit as distributions. It also creates a growing river of excess AFFO ($205 million on an annualized basis) that can not only support modest distribution growth but can also be reinvested into the partnership's backlog of organic growth projects, which stands at $1.3 billion of growth investment over the next two to three years.

When combined with the nearly $1.1 billion in cash Brookfield Infrastructure has on its balance sheet you can see that the partnership can fund its entire organic backlog without needing to tap the debt or equity markets. Instead Brookfield Infrastructure can save these two forms of growth capital funding for major acquisitions.

Such deals, put together by Brookfield Asset Management (NYSE: BAM), the partnership's sponsor and general partner, are one of the biggest reasons I consider Brookfield Infrastructure Management a true "buy and hold forever" utility.

Commodity crash is a fantastic growth opportunity for Brookfield

Brookfield Asset Management is one of the world's oldest and largest infrastructure -- over 100 years old and $225 billion in assets under management -- real estate, renewable energy, and private equity managers in the world.

This expertise and scale lets Brookfield Asset Management find highly profitable deals for Brookfield Infrastructure to invest in, especially during times when crashing commodity prices and economic distress put quality assets in places like Brazil, Europe, or Australia on sale.

Risks to be aware of

No matter how great an investment is, no stock is without some risks. For Brookfield Infrastructure I see two major short to medium-term threats.

First, many of its key markets, especially in South America, are commodity dependent developing economies. With 40% of its cash flows exposed to volume risk should commodity prices remain very low for several more years there is a chance that Brookfield's AFFO could take a hit large enough to make management's payout growth guidance 5% to 9% CAGR no longer feasible.

Second, rising interest rates could potentially hurt the profitability of the partnership's future growth projects. For example, Brookfield Infrastructure recently sold $125 million in preferred stock that yields 5.5% for the next five years after which the yield is reset to the greater of either 5.5% or 4.53% + the yield on 5 year Canadian bonds.

While 5.5% is slightly lower than the partnership's 5.6% borrowing costs to date, there is a chance that rising interest rates in years to come could make future acquisitions less accretive than those that have propelled Brookfield Infrastructure's growth thus far.

Bottom line:

Given its wide moat business model, consisting of cash flow rich assets, the quality of its management, and exceptional long-term growth prospects, I am highly confident that Brookfield Infrastructure Trust will make an excellent dividend growth investment over the next five to ten years.

Even with the risk of recession in some of its key markets, given the low AFFO payout ratio, I believe the current 6.5% yield represents a substantial mispricing of this partnership. By investing at today's highly undervalued levels not only can you lock in a yield three times the market's average, but also set up your portfolio for substantial capital gains when Wall Street realizes its mistake.