Source: Holly Energy Partners

The worst oil crash in 50 years has made Wall Street hate pretty much every oil and gas related stock. That includes even such high-quality midstream MLPs such as Holly Energy Partners (NYSE: HEP) which has crushed larger competitors such as Energy Transfer Partners (NYSE: ETP) and the market in general over the past decade.

HEP Total Return Price data by YCharts

In fact Holly Energy Partners is down 30% since its June 2015 highs, creating a potentially spectacular long-term income opportunity that dividend lovers won't want to miss.

Distressed yield ignores rock solid business model

| MLP | Forward Yield | 5 Year Average Yield | Price/Operating Cash Flow | 10 Year Average Price/Operating Cash Flow |

| Holly Energy Partners | 8.8% | 5.9% | 6.6 | 12.2 |

| Energy Transfer Partners | 16.0% | 7.4% | 3.5 | 8.9 |

As you can see both Energy Transfer Partners are trading substantially below both their historic yields and price/operating cash flows. However, with yields this high the market is signaling that it thinks both MLPs' payouts are at risk from crashing commodity prices. In fact, the differences between the payout sustainability of Holly Energy Partners and Energy Transfer Partners couldn't be more stark.

Payout not just sustainable but likely to keep growing during oil crash

| MLP | Q1-Q3 2015 DCR | Q1-Q3 2015 Excess DCF (Annualized) | 5 Year Analyst Projected CAGR Payout Growth |

| Holly Energy Partners | 1.15 | $24.3 million | 8.0% |

| Energy Transfer Partners | 0.97 | -$115 million | 4.3% |

Sources: Earnings releases, 10-Qs, Fastgraphs, management guidance

Both Holly Energy Partners and Energy Transfer Partners's cash flows are predicated on long-term fixed fee contracts. the main reason that Holly Energy Partners' distribution coverage ratio or DCR -- the best metric for determining long-term payout sustainability -- is so much better than Energy Transfer Partners' is because almost all of its contracts have minimum volume or revenue commitments that guarantee the security of its distributable cash flow or DCF no matter what energy prices do.

Source: Holly Energy Partners investor presentation.

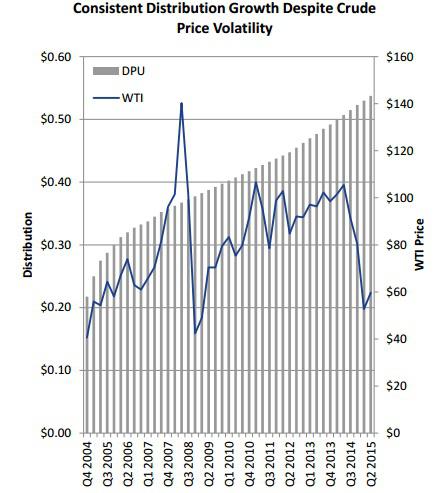

This allows Holly Energy Partners to provide impressive distribution growth consistency. In fact it just announced a 6.6% year-over-year distribution hike, its 45th consecutive distribution increase.

What allows Holly Energy Partners to gain such attractive contract terms? The answer lies in its sponsor, manager, and general partner HollyFrontier Corp. (NYSE: HFC).

Because HollyFrontier Corp. owns a 39% stake in its MLP, as well as the lucrative incentive distribution rights, it has a strong incentive to drop down all of its midstream assets that supply its refineries to Holly Energy Partners. And since it knows how much volume these assets usually entail, it can provide Holly Energy Partners with an enviable amount of cash flow security that allows for consistent growth in distributions, both to it, and investors.

Strong balance sheet resulting in highly profitable growth potential

| MLP | Debt/EBITDA (Leverage) Ratio | EBITDA/Interest Ratio | Average Interest Rate | WACC | ROIC |

| Holly Energy Partners | 4.1 | 6.4 | 3.8% | 5.18% | 13.91% |

| Energy Transfer Partners | 7.0 | 4.0 | 3.5% | 6.2% | 5.51% |

Sources: Morningstar, Gurufocus

The lifeblood of the midstream MLP industry is access to growth capital, which in today's market conditions, means that highly leveraged MLPs such as Energy Transfer Partners face a major problem.

With such a large debt load its unlikely that it will be able to borrow enough cheap debt to complete the billions of dollars of new projects it needs to over the next few years in order to both secure and continue its nine consecutive quarters of rising quarterly payouts.

With Energy Transfer's unit price in the toilet equity growth capital access is essentially cut off and the MLP's sky-high yield is and indication that investors are betting that, should oil prices stay low for the next year or two, the MLP will need to slash its payout in order to use its DCF to fund growth investment and pay down its debt.

On the flip side, Holly Energy Partners' much less levered balance sheet and low weighted average cost of capital or WACC, combined with its high return on invested capital or ROIC, means that it is likely to find an easier time of funding highly profitable investments in the years to come that will continue allowing consistent distribution growth.

This is especially true given that management is only targeting around $425 million in growth capital spending between 2015 and 2017, meaning that Holly Energy Partners' growth capital needs are far smaller than Energy Transfer Partners' or other large, highly leveraged midstream MLPs.

Bottom line:

Given Holly Energy Partners' superb commodity insensitive business model and realistic growth prospects over the next five years I think its clear that Wall Street is greatly undervaluing the MLP.

This is why I am so confident that Holly Energy Partners will continue to crush both the majority of its peers as well as the market at large over the next five to 10 years. That's why I think it deserves consideration for a spot in your well diversified income portfolio.