Source: Brookfield Infrastructure Partners

Finding little followed dividend stocks is a passion of mine, because it can result in phenomenal, market and industry crushing total returns. Take for example, Brookfield Infrastructure Partners (NYSE: BIP), which has proven itself a standout among utilities such Dominion Resources (NYSE: D), Exelon Corp.(NYSE: EXC), Sempra Energy (NYSE: SRE), and National Grid (NYSE: NGG) since its 2008 IPO.

BIP Total Return Price data by YCharts

Of course past performance is no guarantee of future greatness but there are three specific reasons why, not only do I think all dividend investors need to consider owning Brookfield Infrastructure Partners, but why it remains one of the best utilities you can own.

Solid earnings in face of global slowdown

| Metric | Q1 2016 | Q1 2015 | YoY Change |

| Revenue | $584 million | $537 million | 8.8% |

| Adjusted EBITDA | $322 million | $280 million | 15.0% |

| Adjusted Funds From Operation (AFFO) | $209 million | $163 million | 28.2% |

| Quarterly Distribution | $0.57 | $0.53 | 7.5% |

| AFFO Payout Ratio | 62.8% | 79.1% | (20.6%) |

Sources: earnings presentations

As you can see Brookfield Infrastructure had a very good year, despite concerns over slowing global economic growth. Better yet, while some of the growth was a result of newly acquired assets, Brookfield Infrastructure Partners saw strong organic growth as well as the first trickles of dividends from its recent Asiano purchase, which owns over 30 Australian ports and should provide large AFFO growth in its transportation segment.

Also note that, while the distribution rose by 7.5%, right in management's long-term target of 5% to 9% annually, the AFFO payout ratio declined substantially. This means that Brookfield's 5.3% yield is more sustainable than ever. It also means that Brookfield Infrastructure is retaining substantial amounts of cash flow with which to fund its organic capital expenditure program, which grew almost 35% from $1.3 billion to $1.7 billion.

Superior payout profile to its bigger utility peers

| Utility | Yield | Q1 2016 Payout Ratio | 7 Year Annual Dividend Growth Rate |

| Brookfield Infrastructure Partners | 5.3% | 62.8% | 13.7% |

| Dominion Resources | 4.0% | 79.5% | 7.7% |

| Exelon Corp. | 3.7% | 167.1% | -6.8% |

| National Grid | 3.2% | 75.5% | 5.6% |

| Sempra Energy | 2.9% | 59.5% | 11.1% |

sources: earnings releases, Morningstar, Yahoo Finance

Dividend investors need to look at the complete package when selecting long-term investments. That means not just checking the yield, but also the payout ratio, and long-term payout growth potential.

On all fronts Brookfield's profile stands heads and shoulders above its larger utility peers. Which likely means that, if management can deliver on its long-term distribution growth guidance, it should result in total annual returns of 12% to 15%, far superior to the market's historic 9.1% return since 1871.

BUT as tempting as that guidance may be, NEVER simply take management, (or any analysts') guidance without a grain of salt. Ask yourself "does this company have a realistic path forward to the kind of growth that can make those kind of returns likely.?"

When it comes to Brookfield Infrastructure Partners, I believe that growth runway is not just in place, but capable of providing potentially decades of superb, sustainable, income growth and strong returns.

Superb asset portfolio with plenty of growth potential

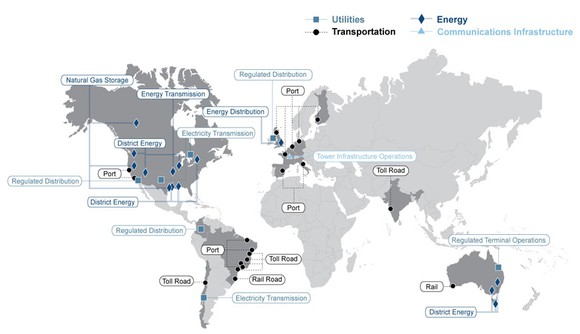

Source: Brookfield Infrastructure Partners

Source: Brookfield Infrastructure Partners

Brookfield's cash flow comes from 38 assets located on five continents, not just providing it with broad diversification its peers can't match, but also rich opportunities to invest into further local economic growth.

With traditional utilities such as Exelon and Dominion Resources, their ability to grow is far more constrained by the fact that they operate in far more mature energy markets.

In addition, Brookfield Infrastructure Partners has a growth ace up its sleeve, in the form of Brookfield Asset Management (NYSE: BAM), one of the oldest and most established asset managers on the plant. Brookfield Asset Management serves as both management and a rich source of highly profitable, needle moving acquisitions. It puts together consortiums to acquire multi-billion dollar global assets that are selling at low valuations, and then includes Brookfield Infrastructure Partners as a minority partner; thus allowing Brookfield, who still lacks the scale or capital resources to pull of such deals solo, to grow much quicker than other utilities.

However, while Brookfield Infrastructure is still relatively small, those capital resources are growing. For example its existing liquidity to invest into new deals or asset expansion was up 27% from just last quarter, to over $3 billion.

Risks to be aware of

Investors interested in Brookfield Infrastructure need to be aware of a few risks that its larger utility peers don't share.

First, the same global diversification that gives this utility such strong growth potential also exposes it to short-term currency risk. While management has hedged 75% of cash flows over the next 18 to 24 months, should US interest rates rise the dollar may once more rise and result in weaker results in coming quarters.

Second, Brookfield Infrastructure has far higher volatility compared to most utilities, as measured by beta (a beta of one equals same volatility as S&P 500):

- Brookfield Infrastructure Partners: 1.27

- Dominion Resources: 0.27

- Sempra Energy: 0.68

- Exelon Corp: 0.13

- National Grid: 0.55

While 90% of Brookfield's cash flow is either regulated, or under long-term contract, meaning the income it pays investors is highly stable, none the less its unit price can be far more volatile than most utility investors may be used to.

Bottom line:

Whether searching for high, sustainable yield, or quick dividend growth, Brookfield Infrastructure Partners offers an alluring option that deserves to be in your diversified income portfolio.