If you're ready to start investing in the stock market but aren't sure which stocks to choose, you've come to the right place. There are a few characteristics of stocks that are good for beginners, as well as some practices beginners should specifically avoid when selecting the first companies for their portfolios.

Here's a rundown of what every beginner investor should look for and stay away from when choosing your first stocks, as well as a few examples of excellent beginner-friendly stocks to help get your search started.

1. Define your investing goals

First off, ask yourself why you are investing in the stock market. Do you want to build wealth for retirement, save for your kids' education, or just collect some money for a rainy day? A general rule of thumb is that you shouldn't invest in stocks with money you'll need within the next three to five years, and longer time horizons are even better. The stock market can fluctuate quite a bit over shorter periods, so before you invest, be sure you understand your risk tolerance and that you're mentally prepared to ride out the ups and downs.

2. Set yourself up for success

Before you start investing in stocks, you'll need to open a brokerage account. You can compare the features of some of the best online brokers to find one that is the best fit for you. Some offer excellent resources for beginners such as educational tools, access to investment research, and more. Also, be aware that while basic online stock trading is generally free at all major brokerages, many have other fees you should know about, and some have minimum investment amounts.

3. Look for a wide moat when investing

You might hear experienced investors talk about the concept of a "wide moat," especially if you're reading anything about Warren Buffett's investment style. Just as a wide moat around a castle makes it difficult for enemies to invade, a sustainable competitive advantage will prevent competitors from stealing a company's market share. That's the kind of moat a great beginner investment will have.

Such an advantage can take many forms, but they aren't terribly difficult to spot if you know what to look for. The majority of sustainable competitive advantages typically fall into one of these categories:

- Network effects: In simple terms, a network effect occurs as more people use a service or product and the product or service itself becomes more valuable and desirable as a result. Think of companies such as Facebook (NASDAQ:FB). As more and more people join Facebook, it becomes more difficult for people not to use the platform in their daily lives.

- Cost advantages: A business can have a few different types of cost advantages. For example, an efficient distribution network can make it cheaper for a company to get its product around the country. A well-known brand name can give a company the ability to charge more than its rivals. A proprietary manufacturing process can make it cheaper to produce a product.

- Intangible assets: In addition to a brand name, patents are a great example of an intangible asset that can protect a company against its competitors. For example, its portfolio of more than 44,000 patents is one of the main reasons BlackBerry (NYSE:BB) still has quite a bit of value, even though it doesn't sell many phones these days.

- Sector leadership: Most of the best starter stocks are either leaders in their respective fields or very close to it.

4. Understand basic metrics

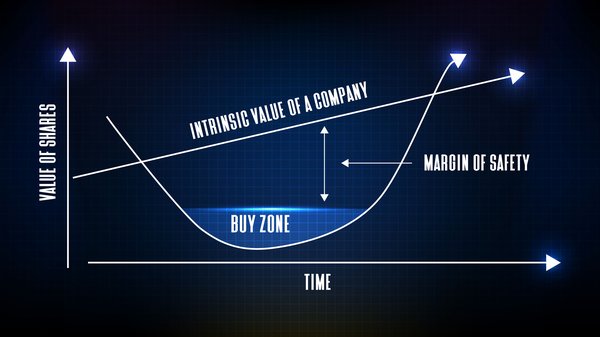

Knowing how to identify great businesses is more important than being able to identify cheap stocks. A great business will typically be a good long-term performer, even at a bit of an expensive valuation. On the other hand, a bad business you invest in at a cheap valuation will seldom work out well.

Once you've learned how to find good businesses, some basic stock investment metrics can help you narrow them down:

- P/E ratio: The price-to-earnings ratio is the most widely cited valuation metric. Simply divide a company's current share price by its past 12 months' worth of earnings. You can also use the projected earnings over the next 12 months to calculate the forward P/E ratio.

- PEG ratio: The price-to-earnings-growth ratio levels the playing field for P/E shortfalls. Simply divide the company's P/E ratio by its projected earnings growth rate. For example, a company with a P/E of 30 and a 15% expected growth rate has a PEG ratio of 2.0.

- Payout ratio: The payout ratio measures the annual dividend rate expressed as a percentage of its earnings, which sheds light on dividend stability. For example, if a company paid out $1 in dividends per share last year and earned $2, it has a 50% payout ratio.

You can learn many other investing metrics, some of which can help you find value stocks and some of which can help you evaluate fast-growing companies or growth stocks.

5. Know which stocks to avoid

The last thing we need to cover is what you should avoid as a beginning investor. Investing in the wrong type of stock can make your portfolio's value look like a roller coaster and can even cause you to lose your entire investment.

With that in mind, here's what you'd be wise to stay away from at first:

- Rapidly growing companies: This is especially true for companies that have yet to turn a profit. Growth investing can be a great way to build wealth, but it can be volatile. It's a good idea to wait until you've built up a base for your portfolio and understand stocks better before you try to invest in the next big thing.

- Penny stocks: Loosely defined as stocks with a market value of less than $200 million, share prices of less than $5, or don't trade on major exchanges, penny stocks should be avoided by all investors, not just beginners.

- IPOs: IPOs, or initial public offerings, are how companies become publicly traded. Investing in newly public companies can be highly volatile and is generally not a good way for beginners to buy stocks.

- Businesses you don't understand: Here's a great rule of thumb that works for beginners and expert investors alike. If you can't clearly explain in a sentence or two what a company does and how it makes money, don't invest in it. There are literally thousands of publicly traded companies to choose from, and you should be able to find plenty of opportunities in easy-to-understand businesses.

Related investing topics

How to get started investing in the stock market

Once you've decided that you want to buy stocks, the next step is to open a brokerage account, fund the account, and buy shares. After you've done that, it's important to keep a long-term mentality. For example, if your stocks go down, it can be very tempting to panic and sell. Remember how carefully you chose them and avoid selling your stocks without fully exploring the company's situation.