A junk bond is debt, known as a corporate bond, issued by a company that does not have an investment-grade credit rating. Junk bonds are also known as high-yield bonds because the interest payments are higher than for the average corporate bond. Companies that issue junk bonds pay these high interest rates to entice investors to take on the higher risk of lending them money.

While an investment-grade credit rating denotes little risk that a company will default on its debt, junk bonds carry the highest risk of a company missing an interest payment (called default risk). Yet even when considering default risk, junk bonds still are less likely than many stocks to generate permanent portfolio losses since a company is obligated to repay bondholders before shareholders if it goes bankrupt.

Companies that issue high-yield bonds have credit ratings below what is considered "investment-grade" by at least one of three ratings agencies:

Bonds issued by companies with a credit rating of BB or lower by S&P or Fitch, or Ba or lower by Moody's, are considered junk bonds. A fallen angel bond is debt originally issued by an investment-grade company that has since been downgraded to "junk" status by a credit rating agency. This may occur if the business starts losing money, issues too much debt, or operates in an industry in secular decline.

How do junk bonds work?

Bonds can usually only be bought in relatively large increments, such as $1,000 or $5,000, and can trade for above or below par, which is the same as the face value of the bond. The face value is what the debt issuer pays back to the bond investor at maturity.

The price at which a bond trades is influenced by the outlook for the business, average interest rates in the market, and a company's financial results. Bonds of companies perceived as risky tend to trade at discounts to the bonds' face value, while bonds from lower-risk companies trade at premiums to par.

Notably, bond prices are not much influenced by a company's stock price. While stocks represent company ownership, bonds are just loans to corporations. The face value of a bond at redemption, plus the interest that it pays, is essentially what a bond is worth.

Rising junk bond prices tend to denote improving health of the economy overall. Declining junk bond prices are generally indicative of poor or worsening economic conditions.

Why would investors buy a junk bond?

Junk bonds offer the potential to earn more money than investment-grade corporate bonds and bonds issued by the federal government and other government agencies. Because junk bonds pay higher rates of interest, some investors are willing to back companies with below-investment-grade credit and higher chances of defaulting on their loans.

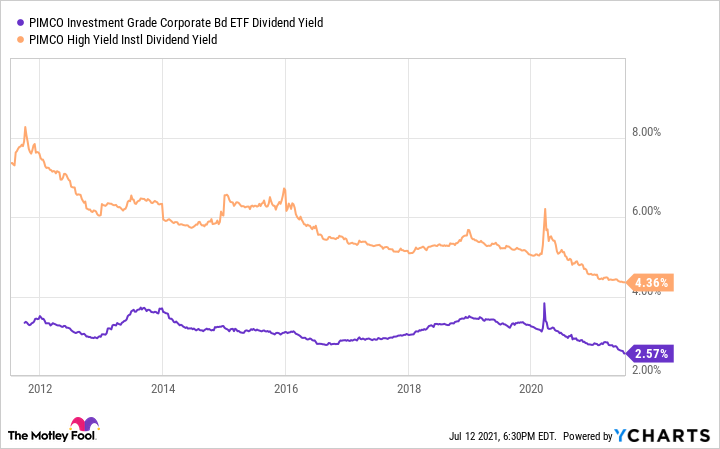

To demonstrate the difference in return potential, the chart below compares the interest rate paid by the PIMCO Investment Grade Corporate Bond Index Fund (NYSEMKT:CORP) with that of the PIMCO High Yield Fund (NASDAQMUTFUND:PHIYX):

The PIMCO High Yield Fund, which invests in carefully selected junk bonds, pays investors an interest rate that is nearly two-thirds higher than for the investment-grade bond fund. That's a lot of extra income potential, and plenty of individual junk bonds offer even higher yields than these two funds.

Examples of junk bond companies

Quite a few well-known companies have below-investment-grade credit ratings. Notable businesses with credit ratings that give them "junk" status include:

- Ford (NYSE:F): Ford has been rated as investment-grade in the past, but the company lost its investment-grade ratings in 2020 due to the coronavirus pandemic and global economic collapse. Its junk bonds still trade at a premium, reflecting the company's legacy status.

- Tesla (NASDAQ:TSLA): Tesla is a younger, newer company, and its junk-rated debt is a product of its financial track record. Its focus on growth has caused Tesla to only very recently start generating positive free cash flow, although the company is making progress toward becoming investment-grade.

- Netflix (NASDAQ:NFLX): Netflix also falls into this category of growth-oriented companies. The company generated negative free cash flow for years to pay for new content creation for its streaming service, issuing junk bonds as part of its strategy to fund in-house production of movies and TV shows. Netflix's bonds, which also trade at a premium, have gained slightly more value as the company has gotten closer to producing positive free cash flow. The company's improving credit rating makes it likely that Netflix will eventually achieve investment-grade status.

Related investing topics

How to buy junk bonds

A bond listing in the secondary bond market might look like this: Ford Motor Co Bond 6.625% 2/15/2028. First is the name of the organization that issued the debt, followed by the coupon rate, which denotes a percentage of the face value of the bond at maturity, and finally the maturity date, which is when the bondholder will be repaid.

Buying junk bonds is simple and similar to buying stocks. Many full-service brokerages participate in a secondary bond market to buy or sell bonds on your behalf and to also access new bond issuances.

Are junk bonds a good investment?

Although they pay higher yields, junk bonds also have unique risks that investors should be aware of before making any investment. Here are some the advantages and disadvantages of investing in junk bonds:

| Pros | Cons |

|---|---|

| Higher interest rates than for investment-grade bonds. | Comparatively high risk of the bond issuer missing an interest payment. |

| Lower risk of losing money as compared to stocks. | Greater fluctuations in trading prices relative to investment-grade bonds. |

| Junk bond prices are less volatile than stock prices during periods of economic uncertainty. | Subject to a partial or total loss of value if the issuing company declares bankruptcy. |

| Provide a steady stream of income at an attractive interest rate. | Not suitable as short-term investments since junk bond prices fluctuate in the years before maturity. |

High-yield bonds can be an excellent choice for investors with an appetite for risk and portfolios that are already diversified. Which specific junk bonds are right for you depends on the length of time you want to invest, how much income you are seeking to earn, and how much risk you are willing to take. When choosing junk bonds, focus on managing risk, not just earning the highest yield.

Also, since bonds can usually only be bought in relatively large increments, you can consider purchasing shares in a high-yield bond index fund or high-yield bond mutual fund instead. Not only are shares in these types of funds more affordable, but high-yield bond funds invest in large, diversified baskets of junk-rated bonds. Holding the bonds of dozens -- or even hundreds -- of companies lowers the fund's risk by the magic of portfolio diversification.

Nicholas Rossolillo owns shares of Tesla. The Motley Fool owns shares of and recommends Moody's, Netflix, and Tesla. The Motley Fool has a disclosure policy.