Series I savings bonds -- sometimes referred to as “I-bonds” -- spent much of the past decade being overlooked. But, like inflation, they have recently returned to the radar screen.

Let’s run through a brief overview of what I-bonds are, how they work, the pros and cons of owning them, as well as how to buy them. We’ll also answer some of the most commonly asked questions about I-bonds.

What are Series I savings bonds?

Savings bonds are long-term loans that you can make to the federal government. You buy savings bonds, and the government will pay you a certain rate of interest over the term of the bond. When the bond matures, you receive your principal back, plus any accrued interest.

Series I bonds pay interest according to a composite return. This return comprises two pieces: a fixed interest rate, plus a semiannual inflation rate, which is indexed to inflation levels at the time of bond origination.

How do Series I savings bonds work?

Series I bonds accrue interest, which is added to the bond’s principal every six months. The next period’s interest is calculated using the new principal amount.

The process continues until the bond is redeemed, or after 30 years, whichever comes first. You must hold Series I bonds for at least a year, and, if you decide to redeem them before five years have passed, you forfeit the previous three months’ worth of interest.

In the following example, imagine a $10,000 initial savings bond purchase and a beginning interest rate of 9.62%. Let’s also assume that the composite interest rate remains the same for the second semiannual period.

After six months:

$10,000 x (9.62% ÷ 2) = $481

$10,000 + $481 = $10,481

$10,481 = Bond’s new starting principal for the following period

After the following six months:

$10,481 x (9.62% ÷ 2) = $504

$10,481 + $504 = $10,985

$10,985 = Bond’s value after one-year holding period

This process will repeat over a span of 30 years, although the bond can be redeemed at any point after a year has passed.

This example also assumes a constant composite interest rate; over a 30-year period, the composite rate will certainly fluctuate. Even though inflation rates are spiking at the time of this writing, there is no guarantee they will remain high for any future period of time.

What are the pros and cons of owning Series I bonds?

Series I bond ownership comes with a variety of pros and cons.

Pros

- Guaranteed return for semi-annual periods: Although it won’t be accessible until you redeem the bond, and the amount can fluctuate greatly, I-bond interest is guaranteed. During bear markets, you’ll be glad you own them.

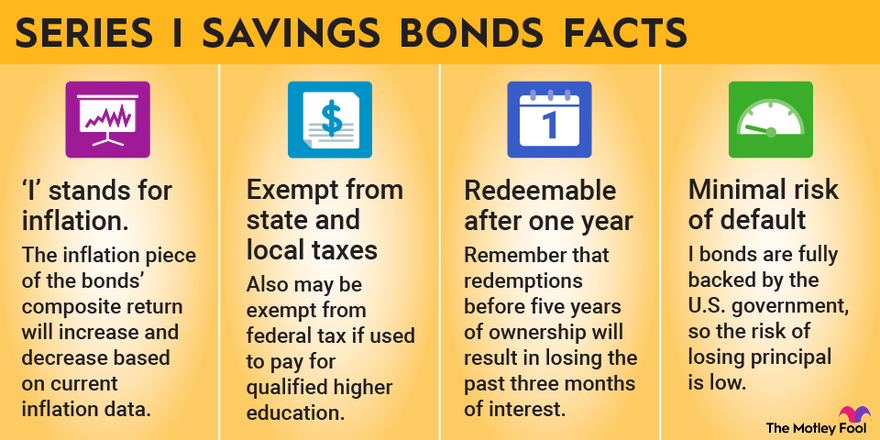

- Minimal risk of default: Series I savings bonds are fully backed by the U.S. government, so the risk of losing principal is remote.

- Helpful to own during inflationary periods: I-bonds remain one of the few true inflation hedges since the inflation piece of the bonds’ composite return will increase and decrease based on current inflation data.

- Redeemable after a year: In the scheme of things, a one-year minimum holding period is very short. If you decide after a year you want your money back, you can cash in. Remember that redemptions before five years of ownership will result in losing the past three months’ of interest.

- They retain some tax benefits: I-bond interest is exempt from state and local tax and may also be excluded from federal income taxes if you use the bond proceeds to pay for qualified education expenses. This exclusion is only available to those with incomes under the IRS-defined limit.

Cons

- Minimum 1-year holding period: This isn’t an issue if you don’t need the liquidity for a year, but it can be a problem if you need the money to cover immediate expenses. Take a look at your entire financial picture to determine if you can afford to part with the cash.

- Interest rates fluctuate with inflation: In periods of low interest rates, like we saw during the 2010s, I-bonds were an afterthought for most retail investors. Now that inflation has returned, I-bonds have come back into the limelight. However, there can be long periods of time when I-bonds aren’t yielding much at all relative to stocks.

- Buying I-bonds can be complex: The only place to purchase electronic I-bonds is on the TreasuryDirect website. You’re still able to buy paper bonds at tax time, although this is a less-common way to purchase them. You won’t be able to buy I-bonds through a standard brokerage or retirement account.

- Some interest forfeiture is possible: If you redeem the bonds before five years have passed since purchase, you’ll lose the past three months of accrued interest.

- Annual purchase limit of $10,000: If you’re working with a large portfolio, a $10,000 bond purchase won’t be a huge amount. But it still can serve a useful purpose if you’re trying to increase portfolio diversification.

How to purchase Series I bonds

You can buy I-bonds either electronically or in paper form, although it’s far more common to buy them electronically.

Electronic bond purchase process

The only way to buy I-bonds electronically is by setting up an account on the U.S. Treasury retail website, TreasuryDirect.gov. From there, you’ll be able to buy electronic I-bonds in $25 increments up to a maximum of $10,000 per year.

The good news is that the $10,000 limit applies per taxpaying entity, so if you’re married, have children, or have established a revocable living trust, you could theoretically purchase $10,000 worth of I-bonds for each person (the trust is a “person” in this context).

There is a low-to-medium probability that you’ll be required to fill out additional paperwork during the account opening process. You may need to obtain a medallion stamp for identity verification purposes, and it may take a few months to finally have the account open.

Once the account is open, purchasing bonds electronically is very straightforward.

Paper bond purchase process

The second -- and much less common -- way to buy I-bonds is to purchase paper securities with your tax refund. This requires you to actually have a refund, meaning this option is off the table if you owe money to the IRS when you file.

With your tax refund, you can buy paper I-bonds in increments of $50 up to a maximum of $5,000 per year. You’ll just need to include Form 8888 when you file and indicate your intent to purchase Series I savings bonds with your refund.

Related investing topics

The bottom line

Now that inflation has resurfaced as a major economic hurdle, it’s more important than ever to ensure you’re doing all you can to combat it. I-bonds can help, although it’s critical to understand what you’re buying before getting involved.

The TreasuryDirect website is your best bet for updated I-bond offering data, as well as more information about purchasing bonds.

Series I Savings Bonds FAQs

Where can I buy Series I savings bonds?

The easiest way to purchase Series I bonds is online at TreasuryDirect.gov. You can also buy paper Series I bonds with your tax refund by filling out Form 8888.

How long does it take for Series I savings bonds to mature?

Series I bonds take 30 years to fully mature. You can redeem I-bonds as early as one year after purchase, but any redemptions before five years will result in losing three months’ worth of interest.

How do you calculate the value of Series I savings bonds?

I-bonds earn interest based on a composite rate with two components. The first component is a fixed interest rate (currently 0.00%) and a semi-annual inflation rate (currently 4.81%).

Every six-month period will have a new composite interest rate. The bonds compound interest on a semiannual basis. If you were to buy $5,000 worth of Series I bonds, you’d earn 4.81% for the first six months and then a different composite interest rate for the following six months.

In practice:

$5,000 x 1.0481 = $5,241 (Balance after first six months)

Now, imagine the composite interest rate fell to 3.68% for the second six month period.

$5,241 x 1.0368 = $5,434 (Balance after first year)

This process would continue for 30 years until the bond matures.