Building wealth is a goal most people have, regardless of age. But what it means to live a wealthy life is different for everyone. From a purely financial perspective, there are some general guidelines for building wealth over time.

Here are some ways to build wealth and plan for your future: Find active and passive sources of income, stick to a budget, and invest consistently for the long term.

Step 1: Making money

Earned vs. passive income

While it may seem obvious -- especially if you haven't inherited a large sum of money or if your start-up hasn't gone public -- you'll need to find a way to make money in one form or another. This can happen in one of two ways.

First, there's the concept of earned income, sometimes called active income. This is the money you earn from working a job, freelancing, side-hustling, or any other activity that requires your active participation.

Second, you can work toward making passive income. Passively earned income is money that derives from some other investment and requires little to no maintenance to generate indefinitely.

Examples of passive income include rent from investment real estate, book royalties, or passively held stock investments. In most, if not all cases, there is usually some sizable up-front investment in the form of either time or money to generate a reliable stream of passive income.

Income and expense management

A popular phrase within the financial planning community is, "Mind the gap." Here, the "gap" refers to the difference between your income (the sum of both your earned and passive income) and your expenses (how much you spend over a given period). The greater the gap between your income and expenses, the more you'll have left over to save and invest.

Consider your expenses and how much leftover money you have today. You have a few different levers to pull if you'd like to increase the amount you have after accounting for expenses.

First, you can find ways to increase your earned income. For example, you could add a freelance job. Second, you can reduce your expenses by being especially mindful about every dollar that goes out and ensuring you're receiving some benefit from it. Third, you can invest some of your leftover money in assets that generate passive income.

Any combination of these will lead to a greater surplus for your discretionary use every month.

Earning money for the long term

It's a good idea to pursue an earned income -- that is, something you get up and do every day -- that's sustainable in the long term. Ideally you focus on something you enjoy, something you're good at, something that pays well enough to meet your expenses, and something you're qualified for (or can obtain the qualifications for).

The reality is not quite that easy. Most jobs don't offer all of these attributes at once, but it's good to have an idea of what the ideal job might be, and then strive to get closer to it over time. Having a strong earned income in a vocation you enjoy will make it that much easier, enjoyable, and mathematically simpler for you to build wealth over time.

Step 2: Saving money

A great first step in the process of saving money is to track your monthly expenses. This can be done on paper, in a spreadsheet, or in an app. The main goal is to understand what your financial needs are on a month-to-month basis and then take the active step of controlling them.

Spending is typically divided into fixed and variable categories. Fixed expenses include things you can't avoid spending money on that don't vary much from month to month. Rent, transportation, and utilities generally fall into this category. Variable expenses fluctuate on a month-to-month basis, and you have the ability to modify them if necessary. Some variable expenses might include restaurants, entertainment, or other non-necessities that people tend to spend money on.

When it comes to spending and budgeting, it's good practice to continuously evaluate your expenses to see if there are things you no longer use or need. This can help you find expenses you can cut or minimize, which will, in turn, increase your leftover surplus each month. Remember that a greater surplus leads to higher numbers for savings and investment.

Another way to go about this is to work backward. To do this, you can determine a monthly savings contribution and have that go to a separate account every month first. Then you can use your remaining income to cover expenses.

Using a real-world example, many people deduct 401(k) contributions from income before they ever have access to the money.

You may find this useful because you don't ever have the money available to spend in the first place. It's diverted to savings before you can do anything else with it. You can also adjust the amount you're saving if your circumstances change or if you need extra money in an emergency.

Building a separate emergency fund of three to six months' worth of total expenses is a worthy goal for most people. If you're in a two-income household with a high degree of stability, perhaps three months could work for you; if you're dependent on only one income and have a lower degree of stability, six months is a better choice.

Taking advantage of your employer's 401(k) matching contribution (and any other financial benefits your company may offer) is another way to build your net worth more quickly. Your employer's match is essentially the same as an automatic return on any retirement contributions, so you'll build your capital base faster by participating. Even though you won't immediately have access to 401(k) money, you'll still be increasing your net worth in a meaningful way.

Step 3: Investing money

Investing money is the final -- and undoubtedly critical -- step in the process of building wealth. Properly investing money in the stock market can make you a millionaire over time, while careless planning and misguided speculation can leave you in a worse place than you started from.

To begin, get a sense of what your risk tolerance is, or how willing you are to put your hard-earned money at risk. More risk-tolerant investors might have more money in assets such as stocks and cryptocurrency, while more risk-averse investors might opt for more cash and bonds.

Regardless, one way to mitigate risk is to have a globally diversified portfolio that adheres to a pre-determined asset allocation, or how your portfolio is divided across different investments. This can all be documented in an investment policy statement, which describes your goals, risk tolerance, asset allocation target, and how your money is to be invested.

As mentioned above, your asset allocation should represent the bedrock of your investing strategy. An asset allocation is usually described in percentages. A sample asset allocation might be 40% U.S. stocks, 20% international stocks, 20% bonds, and 20% real estate. While this is only one of an infinite number of asset allocations, it's an example of how one might be presented to the average investor.

Remember that you also have many investing options to choose from, all of which may be incorporated into your asset allocation: stocks, bonds, mutual funds, exchange-traded funds (ETFs), cryptocurrencies, non-fungible tokens (NFTs), commodities such as gold and silver, and real assets are just some of the choices at your disposal.

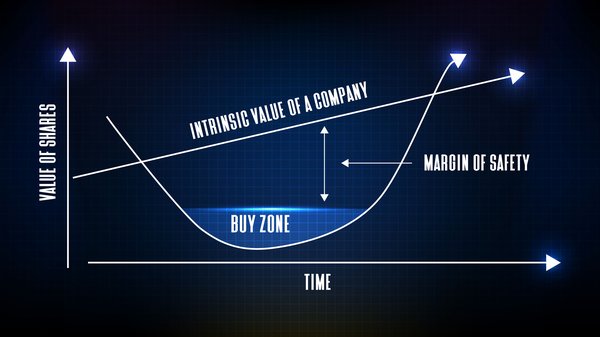

Here at The Motley Fool, holding investments for the long term is at the very core of what we believe about wealth generation. When you hold for the long term, you give yourself the best chance to be successful, both from a return perspective as well as a tax perspective. We adhere to the Foolish Investing Philosophy, which emphasizes buying great companies (individually or via index funds) and holding them for as long as possible.

Related investing topics

Building wealth requires certain steps

While building wealth might seem difficult or even impossible, it's certainly attainable as long as you follow some very basic steps. First, you'll need to earn money in either an active or passive manner, ideally both as time progresses. Next, you'll need to actively save enough money through careful budgeting. Finally, you'll need to invest in a sensible way that sets you up for long-term success.

It's also smart -- but admittedly difficult -- to be patient. Today, vast fortunes are won and lost overnight. But the majority of those who are successful in building wealth over the long term have done so gradually and with a sort of stoic patience.

We live in a world now where instant gratification is expected, but it's not really applicable to the vast majority in the wealth-building game unless you're incredibly lucky or well positioned. It's practical to take a systematic approach and stick to it for the long term.

Like with most things that appear difficult, a great way to start is to take small, basic steps toward your idea of success. Over time, the compounded power of taking so many small positive steps can translate into major change and, hopefully, major wealth. With enough discipline and patience, it's definitely possible to achieve your financial goals.