A thousand dollars may not seem like much in the grand scheme of things, but don't knock the power of the money you invest. Even $1,000 is a fantastic start in building toward long-term financial flexibility.

In this day and age, there are ample investment options to choose from. It's wonderful to have so many choices, but deciding which direction to go in might be overwhelming. Here are seven investment options to help you get started.

1. Start (or add to) a savings account

With the best annual interest rates below 1%, putting money into a savings or money market account may not seem like much of an investment at all. However, millions of households don't have adequate funds on hand in case of an emergency. If you're in that boat, this is a great place to start.

Here's why putting money into basic savings is a great investment: Rainy days are inevitable. While predicting life's twists and turns -- and when they'll occur -- is impossible, being prepared with some cash on the sidelines will always help to cushion the blow. And, if it keeps you from borrowing money at high interest, like via a credit card, then that small return from the savings account was well worth it. Strive to have at least three to six months' worth of cash stashed away.

2. Invest in a 401(k)

Who doesn't want a pay raise? While many are dissatisfied with their compensation, they may be overlooking an extra pay perk their employer offers: a matching 401(k) or similar company-sponsored retirement plan account contribution.

The mechanics are simple. If your company offers a match, the business will double your contribution, usually up to a certain percentage of your gross salary. For example, if a company offers a 3% match, it will contribute $30 for every $1,000 of your paycheck -- usually only if you opt to add the same 3% of your pay to your 401(k) or similar retirement account. If your employer offers it, it's a quick and easy way to double your money -- not to mention a great way to save some dough on taxes since your contribution usually enters your account before taxes.

But don't stop at the matching contribution. For 2022, most 401(k)s allow for $20,500 in total employee contributions (and an additional $6,500 if you're older than 50). If you have $1,000 to invest, check with your HR department or benefits specialist about how to set that money aside for retirement.

3. Invest in an IRA

If you don't have access to a work-sponsored retirement plan or your plan won't allow you to add extra money, you aren't out of luck. That's where individual retirement accounts (IRAs) come in.

There is no company match with an IRA, but if you have earned income (like through your job or self-employment), this option is worth considering. There are two basic types of IRAs: traditional and Roth. A personal contribution to a traditional IRA is often tax-deductible, and earnings grow tax-deferred until they're withdrawn. A Roth IRA is an after-tax contribution, so it gets no deduction. However, contributions can be withdrawn penalty-free, earnings grow tax-free, and those earnings can be withdrawn once you turn 59 1/2 as long as the account was established at least five years earlier.

If you have $1,000, starting an IRA at an online brokerage is a great way to start working toward long-term wealth generation. For 2021, investors can deposit up to $6,000 into an IRA and up to an additional $1,000 if you're older than 50.

4. Open a taxable brokerage account

If you've exhausted the first three options and still have $1,000 to invest, opening a taxable investment account is another solid option. Think of this like a savings account since any realized earnings and interest will be taxable each year. However, the potential upside is higher than with a savings account.

Granted, all investing involves risk, and there's no guarantee you won't lose your $1,000 in this process. However, there are plenty of options available in brokerage accounts to help mitigate the turbulence that comes with investing (more on that below). Also, remember that depositing $1,000 should only be the start. Investing works best if you make regular deposits -- the more frequent, the better. Once you establish a brokerage account, consider setting up a recurring deposit (perhaps monthly or quarterly) to continue building toward your financial goals.

5. Invest in ETFs

After you open an IRA or brokerage account, it's time to start choosing where to invest. If you're just getting started, an exchange-traded fund (ETF) is an excellent place to begin.

There are thousands of ETFs to choose from, many of them tracking a benchmark such as the U.S. bond market or stock market. ETFs are easy to purchase, on average have lower fees than many other investment options like actively managed mutual funds, and can accept even small deposits. If you have $1,000, learn how to invest in ETFs to begin your investing journey.

6. Use a robo-advisor

Not interested in searching for and managing an investment portfolio? Consider using a robo-advisor -- an online service that automates certain parts of a financial plan and portfolio management.

These days, there are plenty of robo-advisors to choose from. Most of them have little to no initial deposit minimum ($1,000 is more than enough to get started) and will choose a basket of funds or ETFs tailored to your long-term goals. Management fees are usually less than 0.3% per year (for every $1,000, that's $3 in annual charges to your account), and the service will help you set up a plan for making recurring deposits to help you reach your final financial destination.

Want to be more hands on? Learn more about being a retail investor.

7. Invest in stocks

If you want more control over your investments and which businesses you own, consider purchasing individual stocks. Even with $1,000, it's possible to build a well-rounded portfolio of starter stocks. Many brokerages even allow investors to purchase fractional shares of those stocks with high share price tags.

It's possible to own individual stocks in both IRAs and taxable brokerage accounts. Additionally, gains in individual stocks aren't taxed until you sell them, making this an ideal strategy for deferring taxes in a brokerage account.

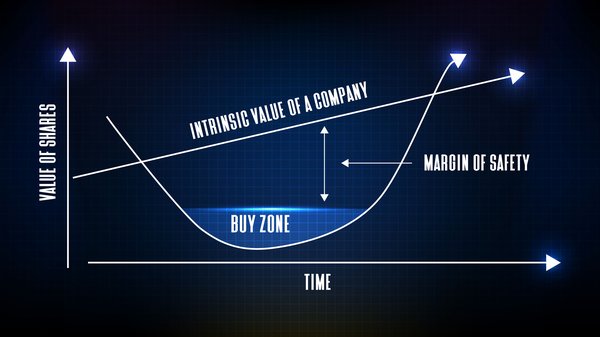

But remember: Stocks represent an ownership stake in a business. Few start a new venture with the intent of staying in business for just a short time. Owning stocks works best in much the same way. Owning a piece of a quality business becomes increasingly powerful the longer one sticks with it. So if you go this route, it's important to do some homework and make a purchase with the intent of holding the stock for at least a few years -- if not indefinitely.

Related investing topics

Don't underestimate the power of $1,000

While it may not seem like a fortune, don't underestimate the power of $1,000. Even a small starting investment can help lay the foundation for a long and profitable journey toward financial flexibility. Put that money to work and add to it as often as possible with your long-term goals in mind.