Investing can be a great way to build wealth and achieve your financial goals.

But how should you invest your money? Let's say you have $10,000 available to you, whether you're a beginner at investing or have already started a portfolio. To invest this money, you first need to decide on your investment goals, your timeline for using this money, and your strategy for reacting to volatility.

Here are a few questions to guide your decisions:

- Are you saving for a particular end goal or to build your overall wealth?

- How soon do you need this money and how much of it will you need? Will the whole account balance be needed all at once or in regular withdrawals (such as on a monthly or quarterly schedule)?

- How will you react to sudden fluctuations in portfolio value along the way, both down and up? Will you invest more, stay the course, or be tempted to change strategies?

5 ways to invest $10,000

After determining your answers to these questions, you're ready to start investing your $10,000. Here are five strategies to get you started.

1. Build your emergency savings fund

Simply put, if you don't have an emergency fund yet, that's the first step you need to take in your investing journey. Park at least some of your cash in a savings account so you'll be ready when life throws you a curveball. Cash on hand in case of emergency -- three to six months' worth of expenses is a good rule of thumb -- is a necessity. Even adding part of your $10,000 to a savings account (and leaving it alone for a rainy day) is a solid start to an investment journey.

This may not feel exciting to you, given that savings rates are generally low. Even so, keeping cash available is still a good investment. If it means avoiding taking out a loan (in the form of credit card debt, for example) in a time of need, your return on investment comes from avoiding high interest rate payments.

2. Pay off high-interest loans

Along with building an emergency cash cushion, it's essential to rid yourself of high-interest debt. Liabilities and interest payments can erase the growth of wealth. Money headed to a bank in the form of an interest payment reduces what you are able to save for yourself.

It's worth noting that not all debt needs to be offloaded as quickly as possible. A mortgage on a home, for example, typically bears a very low interest rate. Paying a home off quicker than the term may be a good use of money, especially as it tends to be the single largest cash outflow for households in an average month. But first prioritize any debt that sits at a higher interest rate. Credit cards, for example, should be a primary target since they usually bear interest rates many times higher than a mortgage (often about 20% annually).

If you have a lump sum, funneling it into paying down debt can be a great long-term investment -- and one that can liberate a budget from interest payments.

3. Fund your retirement account

No matter what "retirement" will look like for you, a retirement account can support your long-term financial needs.

There are a few vehicles you can use to save for retirement. Individual retirement accounts (IRAs) can be ideal for a lump sum of money. Traditional IRAs often allow for a tax deduction, barring any income restrictions, and can be invested with taxes deferred until funds are withdrawn. Roth IRAs give no tax deduction, but funds are tax-free when withdrawn after at least five years. Bear in mind that both accounts are designed to be withdrawn from after age 59 1/2 -- although Roth contributions (but not earnings) can be taken out early without penalty. There are also annual contribution limits for IRAs, which are set at $6,000 ($7,000 if you're 50 or older) in 2020 and 2021.

While a deposit into a 401(k) or similar employer-sponsored retirement plan usually can't be made directly from your savings account, these plans are another good option. If an employer offers a match -- in which the company makes a contribution to your account based on the amount you deposit directly from your paycheck -- taking advantage of that money is a must. If you later leave that job, a company-sponsored retirement plan can be rolled into or combined with a personal IRA as described above.

4. Invest in an index fund

Retirement accounts aren't the only places you can invest. Unlike an IRA, a brokerage account has no contribution limit. Think of it like a savings account but with the option to invest instead of simply collecting interest. If you have $10,000, starting a brokerage account may be the ticket -- either with all $10,000, or with what's left over after starting an emergency fund, paying off debt, and/or maximizing an annual retirement account contribution.

Now the question becomes where to invest that cash. An index fund can be a great, relatively stable place to start, especially if you're interested in earning money without regular active management. Companies such as Vanguard offer a range of low-cost index funds for investors looking to passively capture the performance of a market or industry. Options range from funds that invest in bonds (typically lower volatility but lower return) to funds that invest in stocks (typically higher volatility but potentially higher returns).

If you will be staying invested for the long term (at least five to 10 years), and you aren't interested in babysitting your money, an index fund in a brokerage account is worth considering.

5. Invest in individual stocks

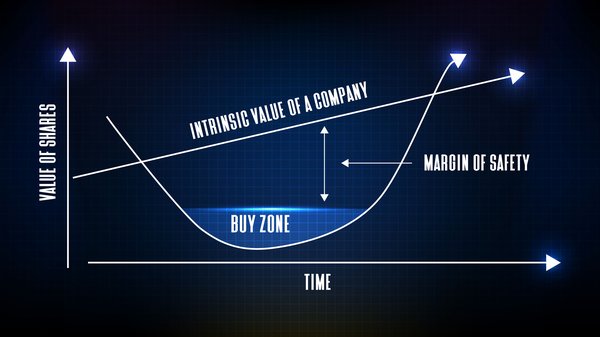

You can use a brokerage account to invest in individual stocks as well as in index funds. Stocks represent ownership in a business and can be a great means of building wealth for the long term. As they tend to fluctuate greatly in value, it's wise to diversify your portfolio of stocks by owning several at a time.

Even with $10,000, it's possible to own a well-balanced portfolio of individual stocks. Many brokerage firms, such as Fidelity, Robinhood, and Square's (NYSE:SQ) Cash App, offer the ability to purchase fractional shares. If a single stock is priced so high it eats up a large percentage of your $10,000 (say a stock priced at more than $500 or $1,000), it's possible to purchase half a share, a quarter, or even less. This can be a great way to invest in multiple businesses ranging from large and stable companies to small, up-and-coming future leaders.

Related investing topics

Maintain a long-term outlook

No matter what your goals are, deciding to invest in your future is a surefire way to build financial flexibility over time. After all, increasing your savings and reducing debt isn't just about getting "rich." Investing is all about having options to pursue what is most important to you in life. As your goals and circumstances change, revise your investment strategy using the questions outlined at the introduction of this article, but stay committed to a long-term outlook.