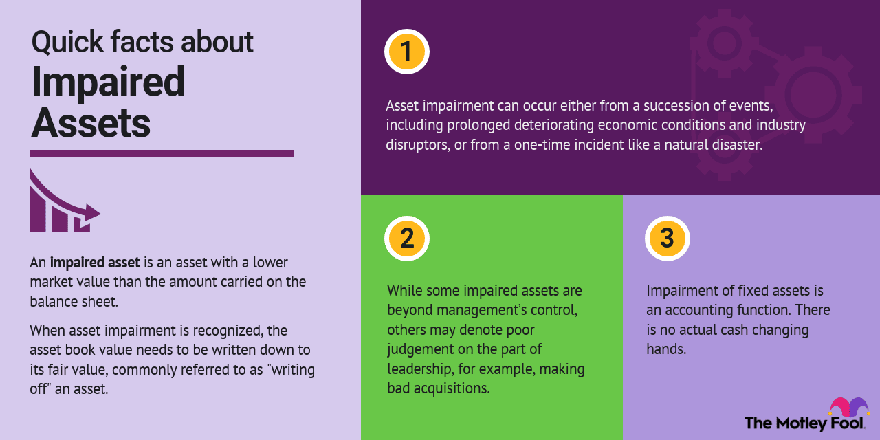

An impaired asset is an asset with a lower market value than the amount carried on the balance sheet. Asset impairment is commonly referred to as "writing off" an asset. Companies are required to book a loss and reduce an asset's value if they determine an asset is impaired. Assets such as accounts receivables, notes receivables, and goodwill are most likely to be impaired.

Asset impairment can happen to any company, but it can also be a sign of distress. Let's go over how it works and when it matters.

Understanding impaired assets

Here are the assets most likely to become impaired and what the triggering event might be:

- Accounts receivable (ARs): Accounts receivable is the money customers owe a business. Think of them like bar tabs. Businesses use contra assets to proactively write off ARs based on historical amounts that have been written off. Still, there can be unique circumstances where more ARs than expected need to be written off. This can happen during a down economy when a lot of customers default or are slow to pay. It can also happen in a normal economy when a big client defaults and the company is forced to write off the asset.

- Notes receivable: Think of these like loans owed to a bank. Because of the COVID-19 pandemic, many banks were required by the Federal Reserve to write off loans that might have gone bad. Once the economy turned, the banks booked a gain to the income statement and put performing loans back on the balance sheet.

- Goodwill: When one business buys another for more than the total book value of the acquired business, the acquiring business adds goodwill to its balance sheet to make the transaction balance. Businesses are required to test this goodwill amount each year and determine if the business that was acquired is still worth the premium paid for its assets. If it isn't, the goodwill balance is impaired.

- Fixed assets: Fixed assets include buildings, equipment, and vehicles. It's rare for a fixed asset to need impairment because most of them are depreciated every year and some fixed assets (buildings) increase in value each year. A common reason for a fixed asset to be impaired is if it is sold for less than the current carrying cost on the balance sheet.

Impairment of fixed assets is an accounting function. There is no actual cash changing hands. It's governed by the generally accepted accounting principles (GAAP) that all public companies are required to use by the Securities and Exchange Commission (SEC). If a business is public, it will hire an auditing firm to ensure that it is complying with GAAP, and the auditing firm will often be the one testing for and calculating impairments.

Accounting for impaired assets

Let's get into the nitty-gritty of asset impairment, starting with how to calculate it.

For ARs, it's pretty easy. If a client defaults, the business can write off the amount of their account. If a business has several accounts going bad at once because of an economic calamity, it can adjust the rate that it uses for bad debt expense to proactively write off more. The same is generally true for fixed assets. There may be unique instances where a fixed asset is impaired prior to its sale or disposal, but, for the most part, the business knows exactly the amount of the impairment because there's an actual transaction record.

Loans are tougher, and process that banks use to write off loans would take an entire textbook to explain. Banks have several risk levels for loans, and they're moved to higher risk levels as the payments are missed or paid late. If a loan is officially restructured with the client or the client defaults, it's totally or partially written off. Otherwise, the bank keeps an allowance account for loan losses based on historical losses but doesn't write off individual loans until forced to do so.

Goodwill is the most common asset impairment for the types of public businesses you'll see as an investor. The business is required to value each subsidiary every year and compare that value to the amount of assets (including goodwill) carried for it on the balance sheet. If the business falls short and that shortfall is expected to be permanent, the goodwill balance is adjusted, and a loss is recorded on the income statement.

Goodwill impairment can happen for a number of reasons. The subsidiary could be poorly managed, make a bad product, experience a loss of market demand, or simply have been overpriced when the acquisition occurred.

GAAP requires many assets to be tested annually for impairment, but companies should know well ahead of time what types of impairments are coming.

Example of an impaired asset

In addition to writing off bad loans, many banks took goodwill impairment charges in 2020. BBVA (NYSE:BBVA), PacWest Bancorp (NASDAQ:PACW), and Umpqua Holdings Corporation (NASDAQ:UMPQ) each wrote off more than $1 billion of goodwill. United Natural Foods (NYSE:UNFI) wrote off almost $500 million of goodwill in late 2019 when it determined that its SuperValu acquisition hadn't lived up to the price.

The biggest impairment of all could be coming with Meta Platforms (NASDAQ:FB), the parent company of Facebook. In 2014, the company paid a staggering $22 billion for WhatsApp, which had lost more than $200 million in the first half of the year. Facebook now has almost $19 billion in goodwill, but, seven years later, WhatsApp still isn't making enough money to justify that amount. Facebook's net income in 2020 was $29 billion. That means there is the distinct potential for Meta's net income to be cut in half or by one-third if it writes off WhatsApp-related goodwill.

Related Investing Topics

Why is impairment of assets important?

Impairment of assets is often a routine accounting transaction. It doesn't mean the company is in distress or the stock is overvalued by itself. However, be wary if you come across the stock of a company that is a serial acquirer and always ends up writing off goodwill after a few years. Management is likely to keep overpaying and wasting your money. Likewise, if a stock has a ton of AR write-offs each year, it may be juicing revenue by selling to unqualified clients.