Inflation is the change in prices over a given period of time. As a simplified example, a 1% inflation rate implies that an item that cost $100 last year would cost $101 this year.

Of course, inflation doesn't affect every type of purchase in the same way, and there is quite a bit more to inflation than the basic idea of things getting more expensive over time. In this article, we'll take a look at what inflation is, what causes it, how it is calculated, and what it means to investors.

What is inflation?

In the financial sense of the word, inflation refers to an increase in prices over time, which subsequently leads to a decline in the purchasing power of money. If a DVD cost $10 last year and prices inflated by 5% this year, you can expect that DVD to now cost $10.50, so you'll need 5% more money to buy it. In other words, if you had kept $10 in cash, it is now worth less. It used to be enough to buy that DVD, but it isn't now.

Inflation depends on a bunch of economic factors, and there are several ways to calculate it. The most common way to measure inflation in the U.S. is the Department of Labor's Consumer Price Index (CPI), which uses a representative basket of goods and services to determine trends in prices over time.

We'll take a closer look at the CPI and other common ways inflation is measured later, but the key point is that inflation is a comparison of the current purchasing power of money with the purchasing power of the same amount of money at some point in the past.

As a general rule, when the economy is healthy, a moderate (low single-digit) inflation rate is to be expected. Part of the Federal Reserve's mandate is to keep inflation under control, and the central bank currently targets a 2% inflation rate.

It's entirely possible to have negative inflation, meaning that prices decline over a period of time. This is known as deflation, and it is often seen in tough economic times.

Sometimes inflation can be a little misleading if the price of a certain item either skyrockets or collapses. For example, if gasoline prices drop by 50%, it can make the inflation rate look lower than it actually is because the price of one widely used commodity is costing significantly less.

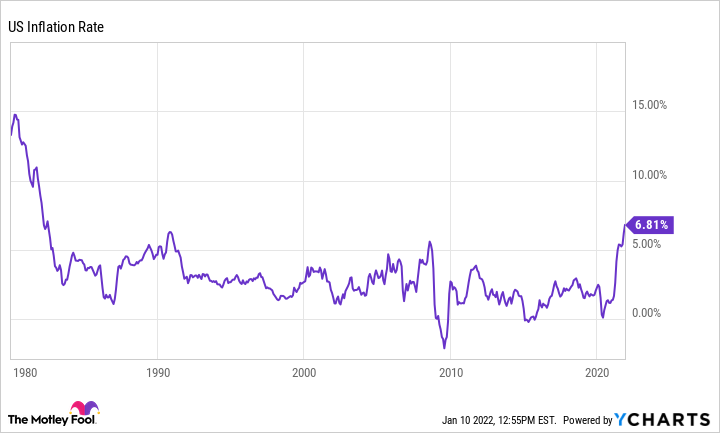

Historical inflation rates

Over the past 100 years, the inflation rate in the U.S. has averaged 3.22% per year, but this amount has varied widely. At one extreme, the inflation rate was as high as 18% in 1910, and it has reached double digits again eight times since then. On the other hand, we have actually experienced negative inflation rates, particularly in the wake of the Great Depression and the 2008-2009 financial crisis.

What causes inflation?

Before we get into the causes of inflation, it's important to point out that a modest level of inflation is part of a healthy economy. While it is never fun to watch prices go higher for everyday purchases, it is an economic phenomenon that is more helpful than harmful over the long run, as long as it's kept under control.

There are two main drivers of inflation:

- Cost-push inflation: This occurs when production costs rise for certain goods, and the producers pass the increased costs on to consumers. For example, if the price of lumber rises, it typically leads to a rise in home prices since it costs more for builders to produce homes. Labor costs are also in this category since a more costly labor force adds to the cost of producing items.

- Demand-pull inflation: This happens when demand for goods increases, and, therefore, causes prices to rise. Continuing with the homebuilding example, a low inventory of homes for sale relative to the number of buyers in the market is a good example of demand-pull inflation.

How does inflation impact stocks?

Different companies are affected by inflation in different ways. If a company can raise prices without significantly affecting demand, inflation could lead to higher corporate profits. On the other hand, if rising prices result in a decline in demand for a company's product, a high rate of inflation could be a negative catalyst.

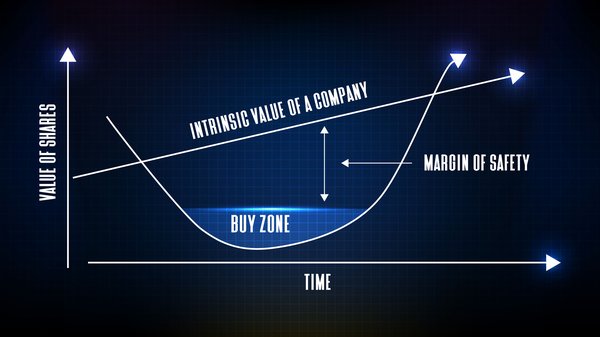

Understand what to invest in during inflation

Ways to measure inflation

As mentioned previously, the primary way inflation is determined is by comparing the Consumer Price Index, or CPI, to its historical values. We won't get too deep into the mathematics, but the CPI is designed to represent the cost of a basket of goods and services commonly purchased by urban workers. Specifically, the version of the CPI used to measure inflation is the CPI-U, or the Consumer Price Index for All Urban Consumers.

There are a few other variations of the CPI not commonly used for headline inflation numbers but could be more useful in certain situations. For example, the CPI-W is the CPI for Urban Wage Earners and is designed to be more representatives of the costs incurred by hourly wage and clerical workers.

Related Investing Topics

Why inflation is so important to investors

The main thing you should notice here is that cash actually loses value over the long run. This is why investing is so important. Stocks, bonds, and even real estate have historically produced gains significantly above the inflation rate. Savings accounts, not so much, especially in the current environment of near-zero interest rates.

So if you have a bunch of cash sitting around in a savings account, or, worse yet, under your mattress, you should seriously consider putting that money to work. You don't need to be a stock market expert either. A few basic index funds can do the job just fine. Whatever you do, don't let your money lose its value over the years. By not investing, you're literally asking to lose your money's purchasing power.