Lump sum investing differs from much of the usual talk about how to invest money. Here at The Motley Fool, we talk a lot about creating a lifelong habit of investing and slowly building your portfolio by putting money into the market at a consistent pace.

The slow-and-steady strategy, known as dollar-cost averaging, works great to build a fortune over a lifetime. But there are times when, via an inheritance, a tax refund, or just good luck, an investor has a lot of money available to put in the market all at once. While the amount could be $10,000 or $100,000 or even more, it can be a tough decision whether to put the entire sum to work all at once or gradually invest it over time.

Lump sum investing, as the name implies, is the strategy of putting all of the money into the market as soon as possible. There are pros and cons to that choice. It's a decision that can cause anxiety and even lead to losses in the short term. But, despite the risk, the numbers suggest that lump sum investing can be a shrewd choice for long-term investors.

Here's what you need to know about lump sum investing, including some of those pros and cons, to determine if it's the right strategy for you.

What is lump sum investing?

Is all at once the right way to go? Often the only way to know for sure is hindsight.

With lump sum investing, all your money goes in on day one. If the market goes up from there, you'll be glad you got in early because any money you added after that would purchase shares at a higher price, giving you less bang for your buck.

On the other hand, if the market goes down from day one, your entire investment will go down as well, and you will have missed a lot of opportunities to buy in at a better price.

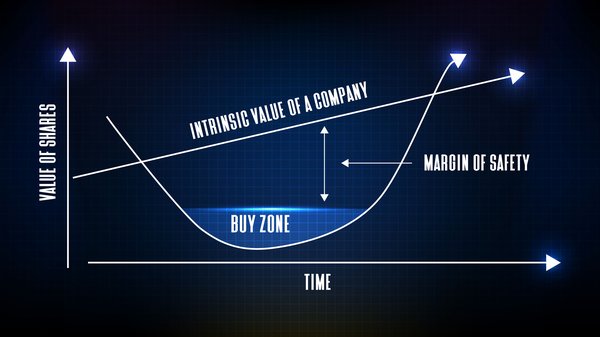

Of course, it's impossible to know how the markets will move from day to day or month to month. Individual results will always vary. And, if the market does go down immediately after you make a lump sum investment, there is sure to be some amount of regret. However, while we can't predict day-to-day movements, there is a century's worth of data showing that markets go up over time. The data suggests it's better to get in as soon as you can, making a lump sum a wise choice no matter what the markets do in the days afterward.

A 2021 report by Northwestern Mutual found that if you choose to make a lump sum investment instead of dollar-cost averaging, you are more likely to have a higher balance over time. The study looked at rolling 10-year returns on a $1 million portfolio from 1950 until the present day, and lump sum came out better no matter whether an investor bought all stocks, a mix of stocks and bonds, or all bonds.

Our philosophy of investing would tend to agree. At The Motley Fool, we aim to find great stocks and hold them forever through ups and downs and avoid market timing. Delaying investing, or investing a large sum of money in increments over time, is a form of market timing. The better move is to get in all at once and ride the ups, along with the occasional downs, for as long as possible.

The longer you are invested in great, market-beating companies, the better your portfolio will do. And that means buying in as soon as possible. As the Wall Street adage goes, "Time in the market beats timing the market." Lump sum investing maximizes time in the market.

Pros and cons of lump sum investing

There is no one best way to invest. If there was, we would all do exactly the same thing. Lump sum investing is a great choice for some situations, but it is not right for everyone in all situations. Here are some of the pros and cons to consider before deciding to make a lump sum investment.

| Pros | Cons |

|---|---|

| Time in the market beats timing the market, so it's best to get as much money invested as soon as possible. | You have to come up with a lump sum of cash to invest. |

| "Set it and forget it" means you won't have to constantly remember to add to your portfolio, and investing one lump sum on day one can remove anxiety over when to buy in. | You get the price you get, so buying in near a top could mean at least temporary portfolio losses. |

| Cash in savings accounts earn next to nothing these days, so there is a real risk money on the sidelines will actually lose value relative to inflation. | Dollar-cost averaging has been shown to help eliminate the anxiety that comes with investing because you are constantly buying in through ups and downs. With lump sum investing, you're more exposed to the potential of a sudden market crash. |

| If you still pay brokerage fees or commissions, lump sum investing means only paying once. | The best investors make a lifelong commitment to investing and don't make it a one-time thing. |

How to get started

Another advantage of lump sum investing is that there isn't much to do to get set up. It's a one-time event, so investors can simply select a brokerage account, deposit their money in the account, and then hit the "buy" button. Arguably from that moment on, there is value in not doing more because checking the value of the portfolio daily can lead to anxiety.

Brokerages have different options when it comes to automating dollar-cost averaging, but, with lump sum, any brokerage will do, so try to find one that has low costs and no commissions.

One word of warning: Diversification is a key part of investing no matter what strategy you use to buy in. It is even more important if you buy in all at once. If you choose to invest a lump sum, don't just put it all in one stock. It's best to find a handful of individual stocks. If you don't want to take the time to do the research, consider buying a mutual fund or an ETF that gives you exposure to a large number of individual stocks.

For most investors, we'd recommend a broad mutual fund or ETF that tracks an index of stocks such as the S&P 500. Index funds offer some of the easiest and most reliable options to build wealth, minimizing the time needed to pick between investments and allowing an individual to own small bits of hundreds of stocks. With mutual funds and ETFs, you never have to worry about one company's failure wiping out your portfolio.

Related investing topics

Is lump sum investing right for you?

It is important to note that this doesn't have to be an either/or decision. For most investors, a combination of lump sum investing and dollar-cost averaging is likely the best choice.

If you have a job that offers a 401(k) or other retirement plan, you are already dollar-cost averaging and nurturing a steady habit of investing. This will dramatically improve your long-term financial health and help to make sure you have an enjoyable retirement. And, if you don't have a big sum of money sitting on the sidelines available to be invested in a lump sum, there's nothing wrong with dollar-cost averaging into the market with whatever little bit you have extra at the end of the month.

But for those times when a windfall does happen, be it an inheritance, a bonus on the job, or even winning the lottery, the numbers show that investing it all in one lump sum instead of gradually putting it into the market is the best way to ensure higher returns.

When it comes to investing, the data is clear: Don't be afraid to go all in.