Risk tolerance is one of the most important -- if not the most important -- considerations when building an investment portfolio or a comprehensive financial plan. Risk tolerance is an investor’s ability to handle variability in portfolio returns, and it presents in practice as the ability and willingness to take investment risks.

Typically, older investors have a lower risk tolerance. Younger investors can generally accept more risk, given their longer expected time horizons. However, this is by no means a hard-and-fast rule. Everyone’s respective risk tolerance should be evaluated individually.

Risk tolerance defined

Risk tolerance is your ability to handle portfolio volatility. In this context, it’s more concerned with large negative movements since people are able to handle positive investment returns quite well.

Risk tolerance can be influenced by a number of factors, including goals, age, degree of portfolio reliance, personal comfort, and absolute net worth.

Goals

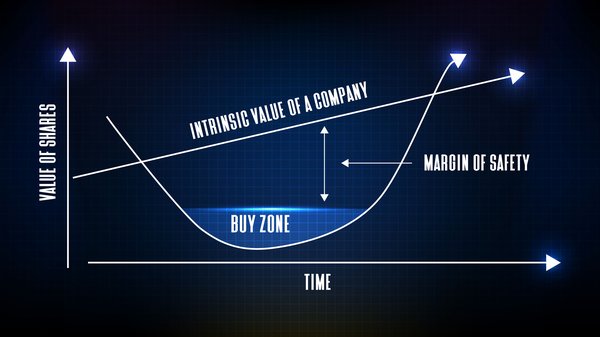

People saving for a large goal, such as retirement or college, are likely to have a higher risk tolerance the further they are from that particular goal. This is because investment returns tend to be reliably positive over long periods of time, while they can be erratic and unpredictable in the short run. Should the broad market correct or enter a bear market, long-term savers know they have a runway before their goal comes due so they can avoid selling in a panic.

On the other hand, people facing a short period of time to prepare for their stated goal, such as a down payment on a home or the repayment of a high-interest loan, will probably have a much lower risk tolerance. In these cases, staying out of the market entirely might be the right move since market fluctuations can be unpredictable. They are especially unpleasant if you’re relying on the market to make a large cash outlay.

Age

On average, younger investors have higher risk tolerances than older investors. Younger investors have plenty of working years to earn, save, and invest money, while pre-retirees and retirees may need their portfolios for everyday expenses. As a result, younger investors have a much higher ability to tolerate large negative portfolio swings. Older investors can be hurt greatly by downward market shocks, which makes financial planning essential if you’re living off investments.

While age is usually inversely related to risk tolerance, this isn’t always the case. Sometimes retirees stop working with fully funded pension plans, Social Security benefits, and a strong personal savings account. These individuals may be able to tolerate more risk in their investment portfolios.

Portfolio reliance

People who rely on their investments for living expenses will have a lower risk tolerance than those who simply invest for many decades from now. The reason is simple: If you withdraw from your growth assets when the market has fallen 20%, you’re hindering your portfolio’s ability to grow by selling shares at a discount.

If you are living off your investments, consider having at least a few years’ living expenses set aside in cash to avoid having to sell at an inopportune time later.

Personal comfort

Most investors simply -- and understandably -- don’t like watching their portfolio values decline amid a stock market downturn. If you’re someone who doesn’t want to see your balance decline, even if it means losing out on the potential for more in the long run, you might have a lower-than-average risk tolerance. While volatility is a normal part of investing, it’s entirely up to you to decide how much risk you’re comfortable taking.

Absolute net worth

It’s possible that as your net worth increases, regardless of your age, your willingness to take additional risks with your money decreases.

For example, imagine you win a big lottery payout in your 30s. In theory, you could continue to try to increase the money well into your retirement, but you might opt to preserve it instead. While your age would indicate a high risk tolerance, your circumstances might cause your risk tolerance to be lower than it would otherwise be.

Types of risk tolerance

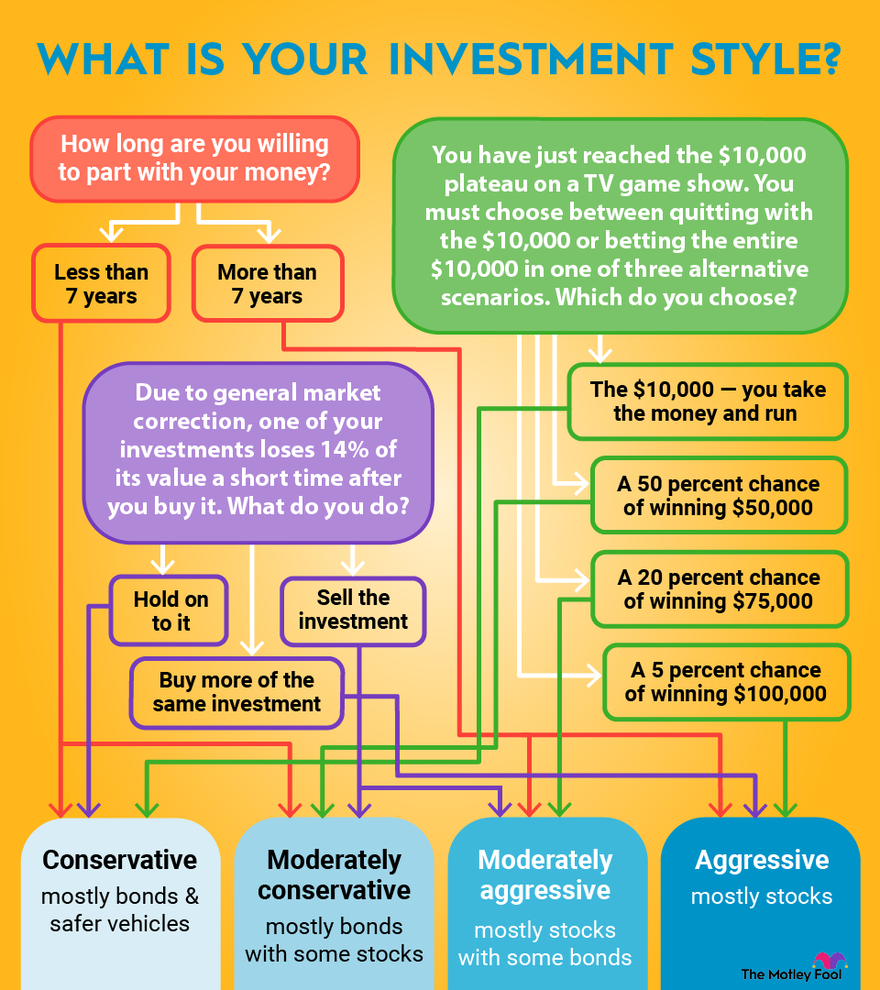

There are definitely gray areas within and between categories of risk tolerance, but the main ones are broken out as follows:

Conservative

People with a lower-than-average tolerance for investment risk. Typically, these investors will opt for an asset allocation with higher shares of cash, money market funds, CDs, some fixed income securities, and real assets.

Moderate

People with a middle-of-the-road view of investment risk. These investors may opt for even or near-even shares of risky and safer assets. For example, someone with a moderate risk tolerance might have an asset allocation of 50% common stocks, 40% fixed income securities, and 10% cash.

Aggressive

People willing and able to tolerate higher levels of risk. Usually, these investors have high portfolio concentrations of stocks and other volatile assets, potentially including speculative assets such as cryptocurrency or NFTs. These investors tend to be on the younger end of the investing population, but this is by no means a rule.

Find your risk tolerance

Consider the following questions to help inform your risk tolerance:

- What is your investment time horizon?

- Would others describe you as a risk taker?

- What is your overall attitude toward the prospect of losing money?

- What is your current net worth, and how much is the marginal dollar worth to you?

- Do you currently have multiple streams of income?

- Do you rely solely on your investments to cover everyday expenses?

- What are your short- and long-term investment goals?

- How experienced are you with investing?

- If an asset’s price fell dramatically, would you buy more, sell the position, or hold?

- If an asset could either lose 50% or gain 50% in five years, would you invest?

Risk tolerance vs. risk capacity

Risk tolerance speaks to an investor’s attitude toward investment risk, combining both their ability and willingness to absorb negative changes to their portfolio value. Your risk tolerance tends to be qualitative in nature since there is a fair amount of emotion in investing.

On the other hand, risk capacity refers to your ability to withstand financial risk from a purely quantitative perspective. In other words, depending on your life stage, you might only be able to afford a certain amount of investment risk. If you take too much investment risk as an early retiree, for example, you might be unable to cover your expenses if the market were to fall into a downturn for any extended period of time.

Risk capacity can also be defined as the amount of risk required before your ability to reach stated goals is impacted. If your goal is to retire with a $1 million investment portfolio, but you’re holding all of your saved money in cash, it will be difficult -- if not impossible -- to reach your goal without adding some stock market risk. In this example, you’d need to determine a minimum acceptable level of risk that will still allow you to reach your $1 million goal.

It’s entirely possible that your risk tolerance doesn’t match your risk capacity, and that’s completely fine. Scaling back your risks to levels you’re comfortable with is part of learning to invest and a sign of maturity. There’s no shame in knowing when you’ve had enough, even if it means a potentially lower net worth in the long run.

Related Investing Topics

Risk tolerance is critical to sound investing

Remember that risk tolerance is a moving target and one that most investors strive to define on an ongoing basis. As you develop the right risk tolerance, remember that this is a completely individual concept. You’ll need to take into account all of the factors influencing your portfolio -- taken as a whole -- to determine the appropriate risk level for you.

As you go on to build your financial plan, keep risk at the front of your mind for a more peaceful experience. Finally, be sure to build in all financial and non-financial circumstances that might impact you in the future.