Saving and investing are two related strategies for achieving financial security. To save or to invest, you must forgo spending now to build wealth for your future.

The difference between saving and investing is whether you hold your unspent funds in cash or in some other form. Saving means setting aside cash for future use. Investing means using cash to buy other assets that you expect to produce profits or income.

Those other assets are commonly stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Real estate, cryptocurrency, and collectors' items are also investable assets.

How saving and investing differ

Saving is a cash activity. You hold back from spending cash and instead keep it in a savings account, a certificate of deposit (CD), or somewhere in your home. The goal is to have those funds available for later use.

When you invest money, you use your cash to buy another asset. The goal here is to earn profits or income. Examples of investing include:

- Buying stocks you expect to appreciate. When the value of the stock rises, you can sell it at a profit.

- Buying stocks that pay dividends. You can use the dividend income to pay bills or to buy more stocks.

- Buying real estate that earns rental income. The rents you collect should create profits after you pay your property expenses.

- Buying bond mutual fund shares that pay interest. As with dividend payments, you can use the income to pay bills or to buy more mutual fund shares. If you buy more shares, you benefit from compound interest. This is when your interest starts earning interest -- a powerful way to build wealth over time.

When you should save

You should save when you have income but little or no cash on hand. Set a goal to build a cash savings balance that can cover six months of your living expenses. This protects you against unexpected financial emergencies such as car wreck or job loss.

Saving is also appropriate for short-term financial goals. Examples include buying a home, paying for college, or funding a wedding. If your timeline for reaching the goal is five years or less, saving is a better strategy than investing.

Note that high-interest debt balances can complicate your savings efforts. Some will argue it's better to pay off debt before you save. However, living without an emergency fund is risky. Should you have a surprise expense, you'd have to borrow more to cover it. To avoid that scenario, save what you can as you repay debt.

How to pick a savings account

The right savings account will be easy to use and free of monthly charges. Consider these pointers as you weigh your savings account options:

- Is the interest rate competitive? Interest rates on savings accounts vary widely. Look for a high-yield savings account to help increase your money.

- Can you automate deposits into the account from your checking account?

- Check the fee schedule. Will you incur fees for normal account management activities?

- Is it easy to withdraw or transfer money from the account? Are there free ATMs nearby? How long will it take to transfer money back to your checking account?

- Are there extra features that make saving money easier? Some accounts have broader savings management capabilities. You might set up multiple savings goals, for example, and track your progress against each separately.

When you should invest

You should invest when you have income, a cash emergency fund, and no high-interest debt.

Cash emergency fund. This cash helps you manage the risks of investing. Any asset you buy can lose value or fail to produce the income you expected. Stocks, for example, rise and fall in value daily. It's easier to tolerate those normal ups and downs if you have another source of cash available to cover financial emergencies.

Without cash on hand, you may have to sell your investments quickly if something bad happens. Selling too soon limits your profit and/or income potential. Worse, if you sell when your asset's value is temporarily down, you may lose money.

No high-interest debt. Paying off debt provides a guaranteed return because you're spared future interest expenses. Investing is less certain in terms of return potential and timeline. Take the sure thing and repay your high-interest credit accounts before you start investing money.

How to pick a brokerage account

As with savings accounts, your ideal brokerage account should be convenient and low-cost. The selection process is similar to choosing a savings account but with one extra complication. To start, you must pick the type of investment account you need.

A taxable brokerage account is appropriate when you don't know your investing timeline. Taxable accounts have no withdrawal restrictions and no tax perks. You will owe taxes annually on any dividends, interest, or realized gains you earn.

If you are specifically investing money for retirement, consider an individual retirement account (IRA). With both a traditional IRA and a Roth IRA, your earnings are not taxable from year to year. There is trade-off, however. You may incur taxes and penalties for withdrawing IRA funds before retirement.

Once you decide on the type of brokerage account you need, start shopping for options. Compare prospective accounts on these factors:

- Available investments. More is better. At a minimum, you want access to the full range of exchange-traded stocks and funds, plus mutual funds.

- Fee schedules. Maintenance and per-trade fees should be minimal.

- Look for automation features. Ideally, you'd set up your brokerage account to pull in money and automatically invest it each month.

Pros and cons of saving

Relative to investing, saving offers three advantages:

Pro: Cash doesn't change in value. Your savings account balance doesn't fluctuate in response to external factors. The stock market could lose 50% of its value in a day, and your savings balance won't change.

Pro: You can use your savings immediately. Cash is liquid. That means you can use it directly to buy things, pay bills, and repay debts. You can't "spend" stocks and bonds. You must convert them into cash first.

Pro: Saving enables you to invest. You cannot invest unless you've saved first. This is true on two levels:

- To invest in the stock market, you must deposit cash into a brokerage account. You then use that cash to buy securities. The first step of depositing the funds is an act of saving.

- The best practice is not to invest unless you have a cash savings balance. If an emergency pops up, you'd use your cash to cover the expense. This protects you from having to sell your investment assets before they've appreciated.

Saving has two disadvantages relative to investing.

Con: Savings provide negative returns after inflation. The spending power of cash does decline over time. This is due to rising prices, also known as inflation.

A normal inflation rate is 2% annually. At that rate, $100 cash on Jan. 1 will only buy $98 worth of stuff by year's end.

Inflation is the reason you'd hold cash in a high-yield account versus a checking account or under the mattress. The interest helps offset inflation. For example, 2% inflation nets to 1.5% if you're earning 0.5% on your savings balance.

Con: Savings returns are lower than investing returns. You need cash on hand for emergencies, but there's a cost to that beyond the negative real returns. When you hold cash, you're forgoing the chance to invest and earn inflation-beating returns.

Pros and cons of investing

Investing outshines saving in its return potential.

Pro: Investing return potential is high. Over the long term, the average annual growth of the stock market is about 7% after inflation. At that growth rate, invested assets double in value about every 10.5 years.

To access market-level growth, you'd invest in broad market index funds with low fees.

There are two downsides to investing versus saving.

Con: Your assets can lose value. Your investments are only worth what someone is willing to pay for them. That can go up or down based on factors outside your control.

Con: You must sell your assets before you can use the funds. To use the value locked in your investments, you must find a buyer, settle on a price, and collect your cash. With publicly traded stocks and bonds, this process takes a few days. Other assets such as real estate can take months to sell.

Related investing topics

Should you invest or save?

Prioritizing saving over investing can be tough. Here are some guidelines to help you decide which comes first.

Saving is the higher priority when:

- Your cash savings doesn't cover three months of living expenses. As previously noted, cash on hand keeps you afloat through unexpected financial challenges such as job loss, injuries, and other emergencies.

- You're targeting a short-term financial goal. If you want to buy a home within five years or pay for your daughter's wedding next year, it's best to save. Investing is too risky when the timeline is short.

You're ready to invest when:

- You can afford to keep the money invested. Investing requires a minimum timeline of five years. In shorter timeframes, the stock market can be volatile. The shorter your timeline is, the less likely you are to see the results you want.

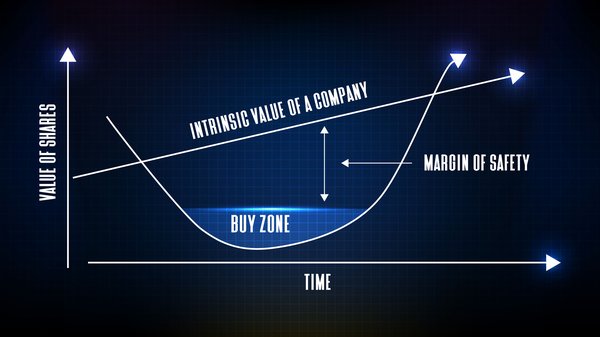

- You are preparing for retirement or another long-term goal. Investing is ideal for long-term goals. With stocks in particular, a longer timeline allows you to practice buy-and-hold investing. This involves buying shares in quality companies and letting them appreciate for decades. It's the simplest way to build wealth with stocks.

You can also save and invest at the same time. For example, you might contribute enough to your 401(k) to max out your free employer matching contributions. Meanwhile, you can add to your cash savings until you reach your target balance.

Once you reach your cash savings goal, you can pause those deposits and increase your 401(k) contributions to ramp up your retirement saving.

Saving and investing are two levers you can pull to achieve financial security. Saving is for your short-term needs, and investing is for the long term. Master the skill of using both to achieve your financial goals, and you'll find prosperity on the other side.