All publicly traded companies are required to release financial statements quarterly so investors can get a sense of how the business is doing. There are three main financial statements investors should be aware of: the income statement, the balance sheet, and the cash flow statement. In this article, we'll look at what each one is and the key information investors should pay attention to.

What are company financial statements?

Financial statements are documents designed to give investors a snapshot of how a business is performing over a particular period. Financial statements answer some important questions investors should ask before buying a stock, such as:

How does the business make its money?

Have the business's revenue and earnings grown or shrunk?

How much does the business own?

How much does the business owe?

Is there more money coming in or going out?

With those questions in mind, here's a quick guide to the three main types of financial statements and what investors should pay close attention to.

Income statement

A company's income statement tells you how much money a company brought in and how much of a profit (hopefully) it earned from that revenue.

- The “top-line” number: The first major number on the income statement is a company's net sales or revenues, also known as the top-line number. In many cases a company's income statement will break down different sources of income. For example, Apple's (NASDAQ:AAPL) income statement breaks its revenue into product sales and service revenue.

- Net income (earnings): From there, the company's cost of sales is subtracted to produce its gross income. Its operating costs (like research and development) are subtracted to calculate its operating income. Then income tax expenses are subtracted, and the result is the company's net income, also known as its "earnings." Net income is often expressed both as one large number and by share (the latter being earnings per share, or EPS).

Depending on the company, there might be other information on the income statement, such as sales broken down by region or product category.

An income statement starts with the company's sales and shows step by step how it turns them into profit.

It's also worth mentioning that there are typically several columns of numbers on an income statement to show how the current period compares to the same period last year. You'll typically see the latest quarter compared with the same quarter a year before, and the company's year to date (or full year) compared to the same period from the prior year. Comparing the company's current income to the previous year’s provides a good sense of how the business is growing.

Balance sheet

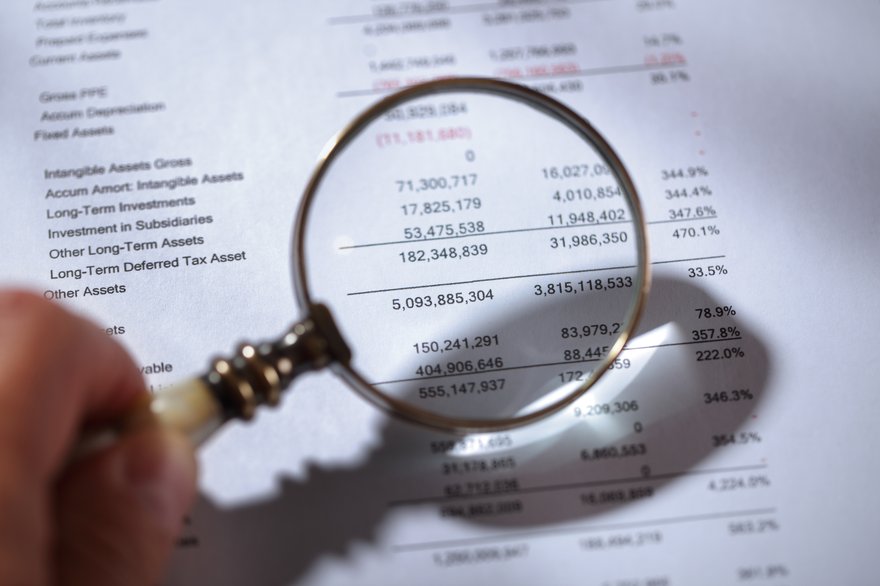

A balance sheet gives you a snapshot of a company's financial condition at a given time (typically the end of a quarter). And as with the income statement, the data is typically presented as a comparison between the current period and the same time a year prior.

There are three sections on a balance sheet:

- Assets: What the company owns. This is further broken down into current and noncurrent assets. Current assets include liquid assets and assets that can be expected to become liquid within a year. Examples include cash, short-term Treasuries, accounts receivable, and inventory. Noncurrent assets include long-term investments, real estate, and equipment used in manufacturing, just to name a few.

- Liabilities: What the company owes. These are also divided into current and noncurrent. Current liabilities include payments a company will have to make within a year, such as accounts payable and short-term debt. Noncurrent liabilities include things like long-term debts.

- Shareholder's equity: Think of shareholder's equity as what the company would have if it shut down, sold all of its assets, and paid all of its debts. Shareholder’s equity is the difference between assets and liabilities and is the company's net worth.

Cash flow statement

A company's cash flow statement shows the money flowing into and out of the business. This is broken down into a few categories:

- Operating activities: This includes the net income from the company's business, stock-based compensation, receivables collected, accounts payable that were paid, and other business-related items.

- Investing activities: If a business buys or sells stocks or bonds, this activity is included in this part of the cash flow statement. The same is true if the business buys or sells real estate or equipment.

- Financing activities: If a company issues new common stock, it is included in this part of the cash flow statement. Dividend payments are a common outflow in this section, as are stock buybacks. And if a company repays debt, that will appear as a line item here.

All of these categories added together produce the company's total cash flow. A positive number indicates that the company's cash increased during the period, while a negative number shows that the cash decreased. Just under the cash flow number will be a total of the cash and cash equivalents the company currently has.

Where to find company financial statements

You can get a company's financial statements straight from the source—the company itself. Simply go to the company's investor relations (IR) page and look for its most recent quarterly earnings report, which is usually under a "news," "press releases," or "financials" tab at the top of the page. Many companies keep their latest results as a focal point on their main IR page. For example, on Apple's investor relations page, the first item listed is a press release with the company's latest results. Directly on the press release is a link to the consolidated financial statements, which contains the three main documents discussed above.

There are certainly other ways to find a company's financial statements. For example, you can go directly to the SEC's website and look up the company's latest quarterly report. Additionally, your brokerage might offer a view of the financial statements as part of its stock quotes, which is an easy way to find them.

The bottom line is that for all publicly traded companies listed on major U.S. exchanges, financial statements are full of information, updated quarterly, and readily available to help investors like you make informed decisions.

Financial Statement FAQs

Which company financial statements are the most important?

There are three main financial statements investors should be aware of: the income statement, the balance sheet, and the cash flow statement.

Where can I find company financial statements?

You can get a company's financial statements straight from the source—the company itself. Simply go to the company's investor relations (IR) page and look for its most recent quarterly earnings report, which is usually under a "news," "press releases," or "financials" tab at the top of the page. Many companies keep their latest results as a focal point on their main IR page.