The cost of equity helps to assign value to an equity investment. Cost of equity measures an asset's theoretical return to ensure that it's commensurate with the risk of investing capital. It's also the return threshold that companies use to determine whether a capital project can proceed. Investors use the cost of equity to make sure they are adequately rewarded for the financial risk they undertake.

How to find a company's cost of equity

The traditional approaches to determine the cost of equity use the dividend capitalization model and the capital asset pricing model (CAPM).

Using the dividend capitalization model, the cost of equity formula is:

Cost of equity = (Annualized dividends per share / Current stock price) + Dividend growth rate

For example, consider a company that currently pays a dividend of $0.30 per share each quarter ($1.20 per share annually) and trades at $30. If this company expects to increase its dividend by 5% per year, then its cost of equity is 9% ($1.20 / $30) + 5% = 9%.

The capital asset pricing model (CAPM) determines cost of equity using the following equation:

Cost of equity = Beta of investment x (Expected market rate of return-Risk-free rate of return) + Risk-free rate of return

The beta in this equation is a measure of how much on average a stock's price moves when the overall stock market gains or loses value. You can calculate beta yourself or use one of many online resources that list companies' betas over various time intervals and compared to various market benchmarks.

The expected market rate of return is the expected return of the overall stock market.

The risk-free rate of return is the lowest rate of return that investors are willing to accept in exchange for not assuming any financial risk -- usually approximated as the yield on three-month U.S. Treasury bills.

For example, consider a company with a beta of 1.3, meaning that its stock price is 30% more volatile than the overall market. If the expected market return is 8% and three-month Treasury bills are yielding 0.05%, then the company's cost of equity using the CAPM model is 1.3 x (8%-0.05%) + 0.05% = 10.4%.

The relationship between cost of equity and cost of capital

The cost of equity is one component of a company's overall cost of capital. That's because companies can obtain capital for investment purposes in the form of either debt or equity. Lenders charge companies interest at specific rates to borrow money, making it relatively easy to determine a company's cost of debt. A company's cost of capital is the weighted sum of its cost of debt and cost of equity, with the weighting proportional to how much debt versus equity the company has.

The importance of cost of equity in other financial models

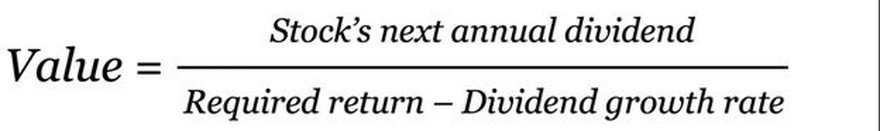

The cost of equity is essential to stock valuations since it's a key input in many Dividend Discount Models (DDMs) like the Gordon Growth Model. The formula for the Gordon Growth Model is:

In this equation, the required return is the same as the company's cost of equity. To continue with our earlier example of a company with an annual dividend of $1.20 per share, a 9% cost of equity, and a 5% dividend growth rate, the Gordon Growth Model values the stock at $30 a share. If the stock trades for more than $30, then investors aren't being adequately compensated for the risk they're taking by investing in the company.

Related investing topics

Cost of equity is an essential metric

Investors and businesses calculate companies' costs of equity to determine whether investments (in either stock or capital projects) carry risks that are commensurate with the projected returns. The cost of equity, along with cost of debt, determines a company's overall cost of capital, while cost of equity is an important input in stock valuation models. Cost of equity helps to put both risk and value into context, enabling investors to make better-informed decisions.