Internal rate of return (IRR) is the expected average return of an investment. IRR is commonly used in corporate finance and is similar to the compound annual growth rate (CAGR), which is more commonly used by stock investors.

IRR is a part of the net present value (NPV) equation. A project's IRR is the return rate that makes the net present value of the project equal $0.

How to calculate IRR

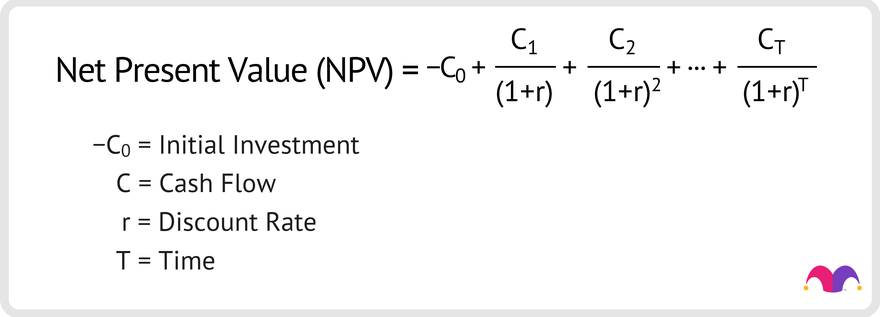

Using a program like Microsoft (NASDAQ:MSFT) Excel is the most efficient way to calculate IRR. Perhaps counterintuitively, to compute an IRR, first we need the formula for NPV:

Setting NPV to zero and solving for "r" -- the discount rate in this equation -- produces a value that represents a project's IRR. If a company's management has a choice to pursue one of two projects, then they can compute the IRR for each project and pursue the project that is the most profitable.

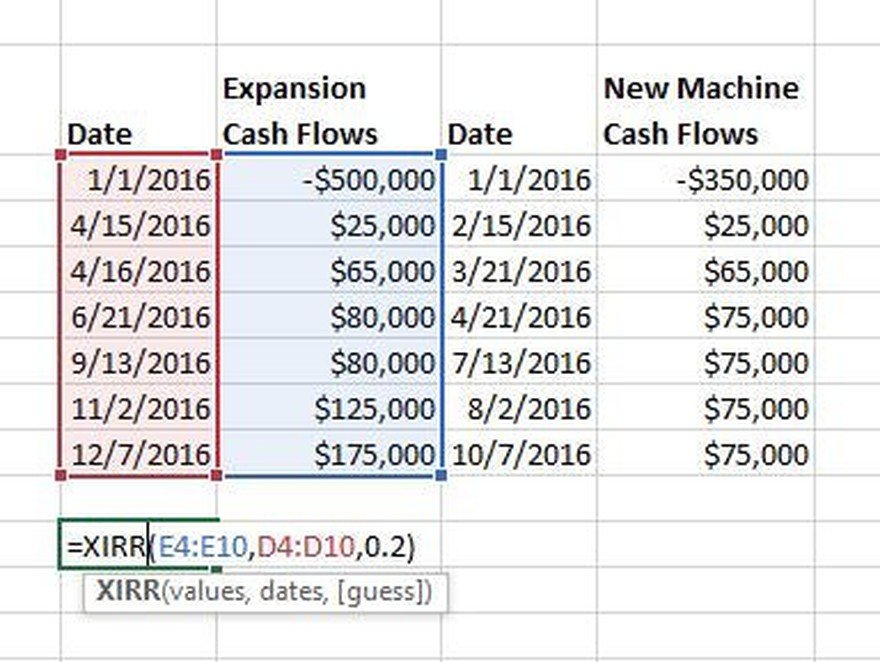

Using a fictional example, imagine that FoolCo is considering either embarking on an expansion project or purchasing a new machine. Both projects would be initially costly but would later boost the company's profits. The projected cash inflows and outflows for each proposed project are as follows:

In Excel, you can use the program's XIRR function to solve for "r" -- the IRR -- for each project. The XIRR function first asks for the dates, followed by the cash flows, and then a guess at the IRR of 20%. The guess is not required, and Excel defaults to a guess of 10% if none is entered. Pressing enter causes the function to iterate to instantly produced the correct "r" value that results in the NPV equaling zero.

Using the XIRR function to compute the IRR for both projects demonstrates that the expansion project would produce an internal rate of return of 14.5%, while the new machine purchase would generate an IRR of 26.5%. From a purely financial standpoint, FoolCo should choose to buy the new machine.

Limitations of IRR

While IRR is useful for financial professionals, it only considers cash flows. IRR calculations don't take into consideration the accuracy of the cash flow projections or other risks related to the proposed project.

A famous investor once said that a project's NPV is like the Hubble Telescope -- adjusting your position by an inch can land you in a totally different universe. IRR has essentially the same limitations.

IRR vs. return on investment (ROI)

While IRR is used primarily by companies to make business decisions, return on investment (ROI) is used by stock investors to determine investment gains on a percentage basis.

If you buy a stock for $50 and later sell it for $75, your ROI for that investment is the amount of the stock price increase divided by the amount that you paid for the stock and multiplied by 100 to express the return as a percent. The stock price increase of $25 in this example would represent an ROI of 50%.

While IRR takes into account the passage of time, ROI does not. A stock's ROI can remain the same regardless of how much time passes between purchase and sale.

Related investing topics

Is IRR important for investors?

IRR is generally not very useful for investors. While knowing whether a company is consistently choosing projects with the highest IRRs would be relevant information, management teams typically do not share projected cash outflows and inflows for proposed projects. Not having this information makes it generally impossible for investors to use IRR to make stock purchase decisions.