Many investors keep up with the stocks they own or are thinking of buying by monitoring quarterly earnings reports. The U.S. Securities and Exchange Commission (SEC) requires every publicly traded company to file a timely report of their finances every three months.

But another SEC filing that's worth your time as an investor is a company's annual proxy statement. A proxy statement is a document informing shareholders about matters to be brought forth and voted upon at the next shareholder meeting. It also contains information about the board of directors and executive compensation that can be very enlightening for current and prospective shareholders.

Annual proxy statements and the SEC

The SEC requires companies to distribute proxy statements to shareholders ahead of each shareholder meeting. This ensures each stockholder can make an informed decision about the issues they'll be voting on at the meeting.

The document will provide a summary of each proposal, as well as the board's recommendation for how shareholders should vote. Still, it behooves shareholders to read the proposals and come to their own conclusions about what's best for the company and its shareholders.

Proxy statement examples

The first thing you'll find on a proxy statement is the date of the forthcoming shareholder meeting and the list of items shareholders will vote on. As noted, the board may provide a recommendation to shareholders to vote for or against a proposal.

Investors will also find background information about each member of the board and executive team, including potential conflicts of interest that may be pertinent.

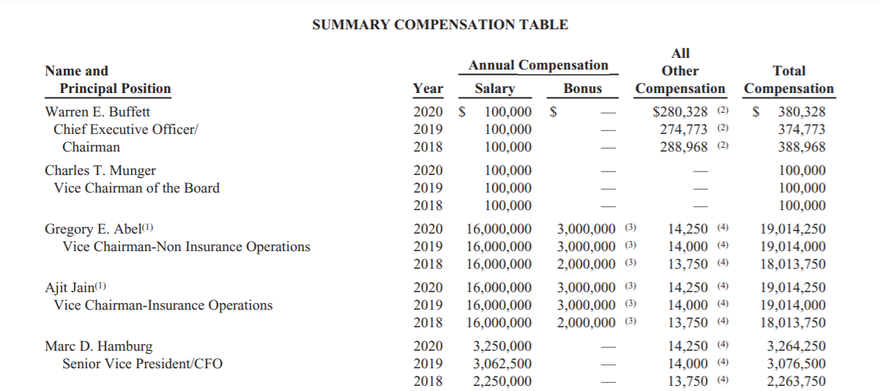

The most interesting information is how the executives and board members are compensated. Each proxy statement will break down individuals' base salary, bonus, restricted stock units, stock options, and any other equity awards.

Here's the compensation table for some of the important people at Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B).

As you can see, Warren Buffett takes a salary of just $100,000 per year, the same salary he's taken for the past 25-plus years.

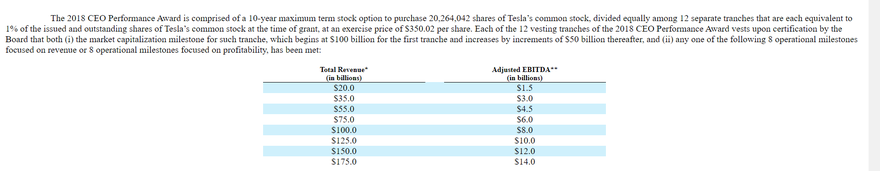

A proxy statement may also provide details on future compensation or milestone awards. For example, Tesla (NASDAQ:TSLA) established a CEO Performance Award in 2018 for Elon Musk with the following milestones:

As of the end of 2020, Musk had met one revenue milestone and three EBITDA milestones. Meanwhile, Tesla's stock price has risen to the point where Musk is eligible for all tranches upon achieving the financial milestones.

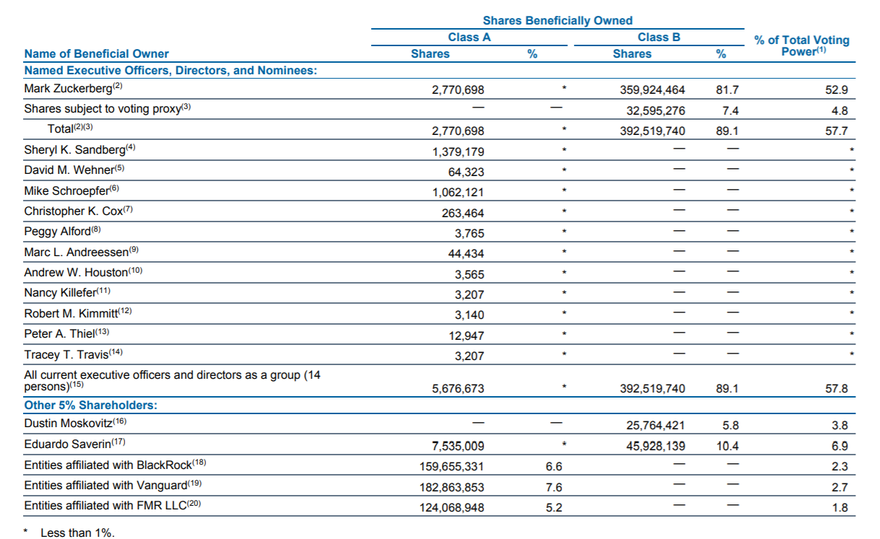

Another key piece of information investors will find on a proxy statement is a list of large shareholders and what percentage of equity interest they own and what percentage of voting interest they control. Facebook's (NASDAQ:FB) ownership table shows founder and CEO Mark Zuckerberg has full control over the company, (e.g., a majority of voting power) despite only owning 14% of the company's common stock, thanks to his control of the super-voting Class B shares.

Related investing topics

How to read a proxy statement

Proxy statements are pretty simple to read. Each proposal is reproduced in the language in which it was written. Note, however, that they can be written in such a way as to bias voters, so read carefully and be sure you understand each proposal.

Reading through the document to the area on compensation can provide some insights into how management is aligned with shareholders. If most of the management team's compensation stems from out-of-the-money call options, then the executive team has a vested interest in pushing the share price higher in order to realize their compensation. Likewise, if an owner has minimal compensation, like Mark Zuckerberg or Warren Buffett, but owns a large percentage of shares, that has the same result of aligning interests.

A yellow flag may be a switch in auditors. The proxy will explain why the board felt the need to switch auditors, and shareholders can use that to determine if there's any need to worry about the company's accounting practices.

Another yellow flag could be a lot of related party transactions. When a company does business with another company where a board member also has a vested interest, it should be done at arm's length to prevent a conflict of interest. This ensures one company isn't benefiting more than it should from a board member's position at another company.

A red flag would be a large senior-level loan. The issue here is that shareholders don't benefit from these loans, which usually carry interest rates well below the market rate and are often forgiven. Company cash could be put to better use.

Reading through a proxy statement before you invest in a company or catching up with the ones you already own shares of could help you understand management's decisions and whether they're working in your best interest as a shareholder.

Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway (B shares) and Tesla. The Motley Fool recommends the following options: long January 2023 $200 calls on Berkshire Hathaway (B shares), short January 2023 $200 puts on Berkshire Hathaway (B shares), and short January 2023 $265 calls on Berkshire Hathaway (B shares). The Motley Fool has a disclosure policy.