About once every year, for most companies, you will have the right to vote your shares on a variety of topics related to the companies you own in your portfolio. These are called proxy votes.

Regular individual shareholders generally receive one vote per share owned. Some companies have multiple classes of shares, and management and other insiders will have a higher level of voting power (for example, 10 votes per share).

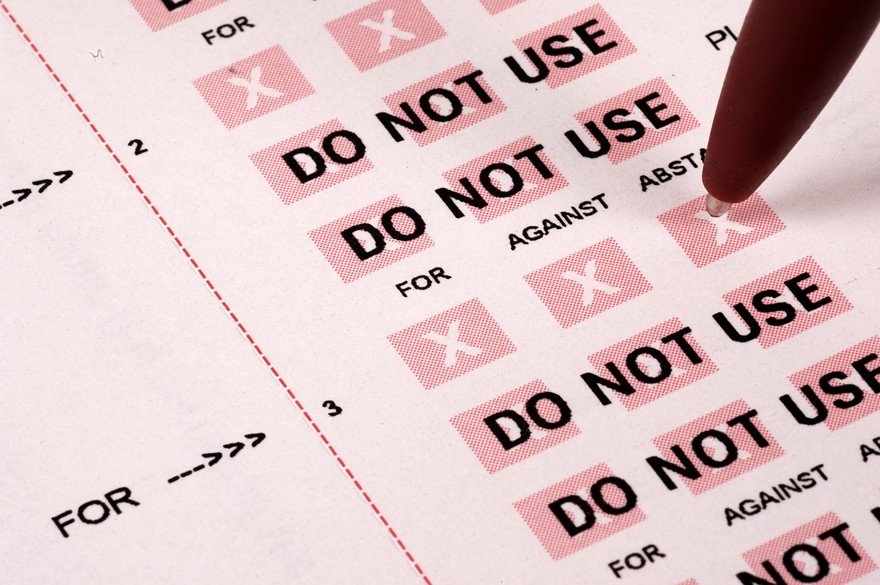

Every year, you will receive a proxy statement in the mail or electronically. This document gives you insight into a variety of important issues to consider and vote on using your proxy ballot.

What is in a proxy statement?

A proxy statement tells you a lot about a company's management and board of directors, providing details about compensation, large shareholders, and the accounting firm that audits the company books. It also includes information about shareholder resolutions and the board's responses to those proposals.

Each publicly traded company files a proxy statement with the Securities and Exchange Commission (SEC) every year, and it's used by shareholders to help cast votes on their proxy ballots. The board may provide recommendations to vote for or against a proposal, but investors should do their best to collect the facts and make a decision on their own.

Board of directors

The first order of business in most proxy statements is voting for or against individuals to serve on the board of directors. The role of the board is to oversee management, talk through a company's future plans, and lend expertise. In an ideal world, directors are looking out for shareholder value and are willing to push back against management if a situation calls for it.

Many companies have a combined CEO and board chair role, where the CEO of the company runs the board meetings. Some argue this is detrimental because the board isn't able to run in an independent, unbiased manner. Others argue this is ideal because the CEO provides important expertise about the company. Both are valid arguments, and shareholders ought to consider all the circumstances when evaluating any shareholder resolutions aimed at separating the CEO and chair roles.

Here are some questions to consider when evaluating board members:

- Are these people qualified to serve on this board?

- If they aren't new to the board, have they added value or have you been impressed with them during their tenure?

- Does the board have an array of experience and insights to drive the company forward?

- Will this addition to the board add a new perspective that is lacking or will it reinforce existing perspectives? Studies show boards with greater diversification across gender and ethnicity are more profitable.

- Are any individual directors on too many other boards? "Overboarding" can result in directors who have too many demands on their time to serve thoroughly and effectively.

- How long have board members served on the board? Long-tenured directors may lend expertise and experience, but long tenure can result in a too-cozy board that is arguably not independent even though the directors aren't literal employees.

Compensation

The second common element of a proxy statement is a vote on management and CEO compensation. Generally, there is a blend of variable compensation (restricted stock units, incentive bonuses, etc.) and fixed compensation (salary).

Take a look at the metrics used as judgment for variable compensation. Ideally, they should align with long-term value creation for shareholders (for example, return on equity or earnings per share, etc.) as opposed to more short-term metrics such as stock price.

One other important compensation metric found in the proxy statement is the CEO-to-median-worker-pay ratio. If a business compensates its employees well and fosters an environment where they feel happy and respected, it generates loyal workers. Decreased turnover can result in positive financial results due to less hiring and training required to maintain operations. You can compare the metric across companies to see how one company compares to its competitors.

Here are some questions to consider when evaluating compensation:

- How much is the median employee at this company making?

- Is the CEO-to-median-pay ratio average, below average, or above average? How does it compare to others in its industry?

- How successful has the company been in the past year, and how well should the executives be compensated for company achievements?

- What companies are in the peer groups? Do you think that is a valid comparison group?

- What are the performance metrics that drive bonuses? Are they long-term focused (return on invested capital, etc.) or short-term focused (share price, etc.)?

- What does insider ownership look like at this company?

- How long have the executives been at the company? What value have they added, and what cultural environment have they created?

Shareholder resolutions

Shareholder resolutions (also known as shareholder proposals) appear at the end of proxy statements. They are filed by everyone from individual activist investors to groups of like-minded investors to major fund shareholders.

They can cover everything from demands related to increasing shareholder value to pressures that a company address ESG issues. There are many different kinds of activists who represent different investing styles and philosophies.

It is very important to carefully read both the shareholder proposal and management's response. Even if you're just researching a company and not actually voting the proxy, you can learn interesting things about a business by reading these proposals. Shareholder proposals can reveal emerging risks that investors should keep an eye on (even if they're not active and ongoing or legacy risks) and how management is dealing with them (or not).

When you go to vote for or against shareholder resolutions, here are some elements to think about:

- Would the shareholder recommendations or demands in any proposal help build a stronger, more sustainable company? Think about these questions through the lens of long-term strength and sustainability, not short-term considerations.

- In its response to a specific proposal, has management proven that the proposal isn't applicable or that management actually is adequately addressing the issue presented by the shareholder proponent? You may be able to give the benefit of the doubt if a company's management seems to be addressing the issue.

- Take the time to read proposals carefully. Shareholder proposals can and do push certain agendas, and sometimes even figuring out what those agendas actually are can be tricky.

- Shareholder vote tallies (and proposals) can highlight major red flags. Watch out for a company that continuously ignores high shareholder votes on the same topics year after year.

- Viewing shareholder activism through the lens of current events and related risks is important, too.

Accounting firms

As a shareholder, you are also entitled to vote for or against the accounting firm the company uses. While some might argue that having the same auditor year after year represents continuity, as with boards of directors, too long of a tenure may lead to a certain degree of chumminess and be associated with less-robust outcomes. Our general guideline is to consider voting against an auditor that has been in place for more than seven years.

Related investing topics

The bottom line

We hope this has been a helpful guide to what to expect and consider when you receive your proxy statements in the mail. Shareholder democracy can be a key path to real, positive change at companies, and checks and balances are important.

Meanwhile, when companies' power to make things better (or harder) for stakeholders is in the spotlight, it's good to remember one of the rights of your stock ownership through the shareholder voting process can give you a say on issues that matter for the companies you own -- and sometimes issues that affect society at large.