Stock ticker symbols are codes that represent publicly traded companies in the stock market. Although a stock's ticker, strictly speaking, is distinct from its ticker symbol -- the ticker is the constantly updating stream of pertinent information pertaining to a stock and the ticker symbol is the three- or four-letter code -- most investors use the term "stock ticker" as shorthand for its ticker symbol.

Stock ticker codes or symbols were originally created to shorten company names on ticker tape printed by brokerage houses. Today, a stock ticker helps you search for a specific stock online and perhaps to make a trade using your brokerage's website.

Although most stock ticker symbols are composed of three or four letters, some older companies have one- or two-letter tickers. Mutual funds and many foreign companies have five-letter ticker symbols. Most ticker symbols are either abbreviations of companies' names -- such as ABNB for Airbnb (NASDAQ:ABNB) -- or they are somehow related to the company such as Petco's (NASDAQ:WOOF) clever choice of WOOF.

How to read stock ticker symbols

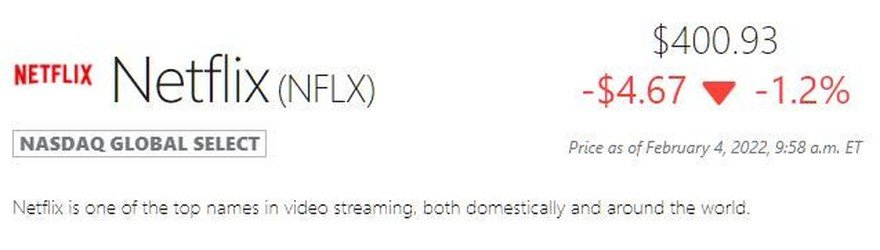

Reading a stock ticker is usually pretty easy. Let's use Netflix (NASDAQ:NFLX) as an example. The company's legal name, which is the same name the company uses to file documents with the Securities and Exchange Commission (SEC), is Netflix, Inc. The stock exchange it trades on is the NASDAQ (NASDAQINDEX: ^IXIC), and the streaming entertainment company's ticker symbol is NFLX.

This information taken together, including the stock price and information about its recent movement, is the stock's ticker -- at least in the strictest sense. "NFLX" is customarily referred to as the company's ticker despite being only the symbol representing Netflix on the NASDAQ exchange.

Types of stock tickers

Each stock exchange sets the rules for the length and format of its stock ticker symbols, which is why variations in stock tickers exist. As previously noted, most stock tickers are three or four letters, and some stock exchanges allow numbers. The New York Stock Exchange (NYSE) allows up to four letters, and the NASDAQ allows up to five letters.

Some stock ticker symbols also include modifiers, which are additional (usually fifth) letters or letters following periods in the symbols. Modifiers can be used to express the type of security, such as a mutual fund; the type of stock, such as preferred stock; or the class of stock, which denotes shareholder privileges.

Companies create different classes of shares to allow the management team to hold a higher percentage of the vote than they do equity in the company. This way, investors still receive something for their investment, but management maintains control over decisions.

Stock ticker examples

While every stock exchange has its own rules for ticker symbols, it's helpful to understand broadly how stock tickers can appear. Most of the variation is caused by the modifiers, which below are explained from A to Z:

- A: Denotes the Class A version of a stock, which confers certain rights and privileges to shareholders that may not be available to holders of other classes of a company's stock.

- B: Denotes the Class B version of a stock, which generally confers fewer rights and privileges than Class A stock, or it may be priced to be affordable to individual investors.

- C: Indicates that a company no longer meets the listing requirements of a stock exchange but has not yet been delisted.

- D: Signifies newly issued shares or a reverse stock split.

- E: Assigned to companies that are delinquent on filing with the SEC.

- F: Reserved for companies listed on foreign exchanges.

- G: For first convertible bonds, which can be converted into shares of stock at a specified stock price. First convertible bond owners are paid first in the event of asset liquidation or bankruptcy.

- H: For second convertible bonds, which also are convertible into stock. Second convertible bond owners are paid second in the event of liquidation or bankruptcy.

- I: Denotes third convertible bonds, which are convertible into stock and paid third and last in the event of bankruptcy.

- J: Used by the NASDAQ exchange to denote, in relation to shareholder votes, which stocks have voting rights.

- K: Used by the NASDAQ exchange in the same context to denote the absence of shareholder voting rights.

- L: Somewhat of a "miscellaneous" catch-all and used differently by different exchanges.

- M: For fourth-class preferred shares, which are preferred shares that have the fourth-highest dividend payment priority in the event of a cash shortfall for a company. Preferred shares are a type of fixed-income security that pays a guaranteed dividend, unlike common shares.

- N: Denotes third-class preferred shares, for which guaranteed dividends are paid ahead of fourth-class preferred shares.

- O: Signifies second-class preferred shares, which have the second-strongest guarantee of the dividend being paid.

- P: For first-class preferred shares, which have the most liquidity because the dividend guarantee is the strongest.

- Q: Indicates a company that has filed for bankruptcy protection.

- R: Denotes a stock rights offering, which is designed to enable a company to issue additional shares of stock without diluting existing shareholders' ownership percentages. Stock rights allow existing shareholders only to buy new shares of a stock at a lower price than new buyers.

- S: Shares of beneficial interest, which are a security type that confer the right to the income generated by an asset without transferring ownership of the asset itself.

- T: Denotes stock warrants or rights. Warrants are a lot like stock options.

- U: Used for new issues and typically groups shares of a stock, along with any warrants or rights that have been attached.

- V: Denotes stock that is trading before it has been formally issued. The NASDAQ exchange permits some institutional investors to buy stocks "when issued" that will soon have their initial public offerings, or IPOs. The trade is made official after the IPO.

- W: For warrants to buy a stock. Note that sometimes WS will be used instead of W, but there is no difference.

- X: Used by all mutual funds.

- Y: Indicates the stock is an American Depository Receipt (ADR), which is a type of security that allows foreign stocks to trade on U.S. exchanges. The company still trades on a foreign exchange, with the ADR converting the stock's foreign value to dollars for U.S. investors.

- Z: Another letter that is used differently by different exchanges.

A few other modifiers include:

- OB: Short for over-the-counter (OTC) bulletin board, which denotes a stock that trades in the OTC market.

- PK: Stands for pink sheets, which is synonymous with OTC. Both pink sheet and OTC stocks do not trade on major exchanges but via broker networks (that formerly relied on actual pink sheets of paper).

- SC: Denotes a company trading on the NASDAQ Capital Markets exchange, which is smaller and has less-stringent listing requirements.

Note that many of these modifiers apply only to quotations directly from stock exchanges, and in practice you are not likely to see them as a non-professional investor. For the stock ticker modifiers you are likely to see, here are some examples:

| Stock Ticker Modifier | Description | Example |

|---|---|---|

| A | For Class A shares. | Berkshire Hathaway (NYSE:BRK.A) |

| B | For Class B shares. | Berkshire Hathaway (NYSE:BRK.B) |

| F | Denotes that the company is traded on a foreign exchange. | Fairfax Financial (OTC:FRFHF) |

| P | For preferred shares. | Next Era Energy Preferred (NYSE:NEE.PRC) |

| Q | Denotes that the company has commenced bankruptcy proceedings. | Diamond Offshore Drilling (PNK:DOFSQ) |

| W | Denotes stock warrants. | DraftKings Warrants (NASDAQ:DKNG) |

| X | Signifier for mutual funds. | Vanguard 500 Index Fund (NASDAQMUTFUND:VFINX) |

| Y | For stocks that trade as American Depository Receipts. | Tencent Holdings (OTC:TCEHY) |

Related investing topics

Stock tickers are fundamental to investing

Stock tickers are useful because they can help you search for and find specific companies and funds and avoid the confusion that can be caused when organizations or funds have similar names. Understanding modifiers is also useful, although it's not always necessary.

Over time, you are likely to start memorizing the stock ticker symbols for your favorite companies, which can make keeping up with the performance of your investments an easier and quicker task.