It's not uncommon for investors who own stocks or securities that have lost value to sell them in order to take advantage of the losses for tax reasons. It's not a bad idea, especially if it's a stock you want to sell anyway; you can use the loss to offset capital gains or even, to some extent, offset your taxable income from other sources, such as regular earnings.

But what if it's a stock you still like, and you don't really want to sell? Can't you just sell it, harvest the loss, and then buy it back immediately? In a word, no. This is precisely what the wash-sale rule exists to prevent: harvesting tax-loss benefits on an investment you don't intend to exit.

What is a wash sale?

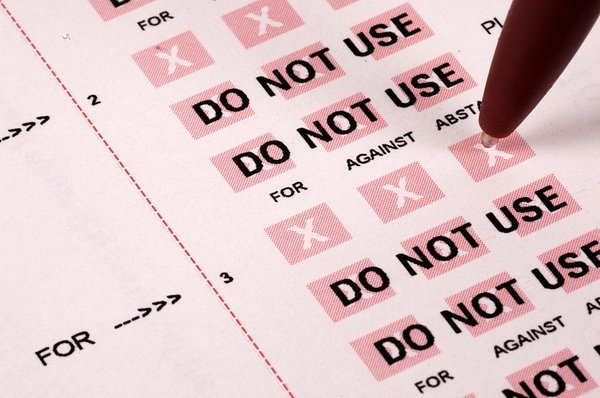

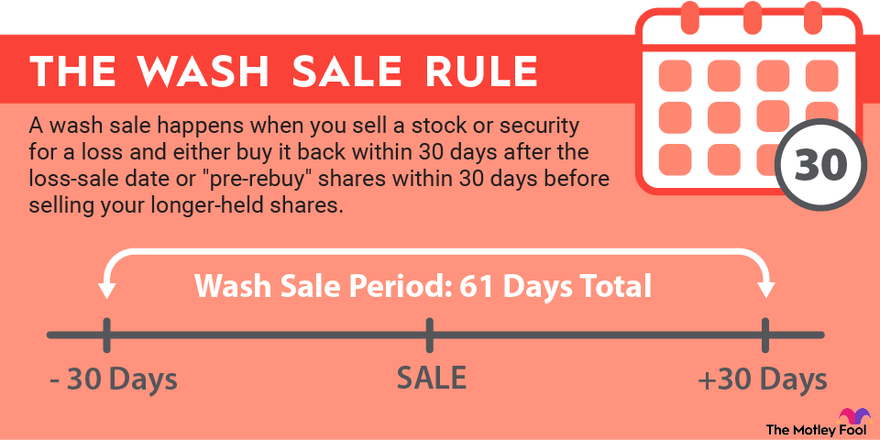

Under the wash-sale rules, a wash sale happens when you sell a stock or security for a loss and either buy it back within 30 days after the loss-sale date or "pre-rebuy" shares within 30 days before selling your longer-held shares.

In either case, the loss is not considered realized for tax purposes, with the sale and subsequent (or prior) purchase "washing" one another out. This rule is designed to prevent people from selling stock to just to claim the tax benefit, without intending to exit the investment.

Again, the rule applies to a 30-day period before and after the sale date to prevent your buying the stock "back" before it's even sold.

Wash-sale rule examples

Let's say you own 100 shares of XYZ Corp with a cost basis (what you paid for them) of $10,000, and you sell them on June 1 for $3,000. That works out to a $7,000 loss, and if you own the shares in a taxable brokerage account, you can claim that loss when you file your taxes.

However, if you were to rebuy shares anytime between June 2 and July 1, then the sale is considered a wash sale, and the loss doesn't qualify as a taxable loss. It works the same way if you buy shares within 30 days before your sale as well; in this case, if you bought shares equal to what you sold on June 1 anytime on or after May 2, then it would "wash out" your taxable loss.

What happens if you buy fewer shares?

A key point about wash sales is that they work out at 1:1 for each share you repurchase. Using the example above, if you repurchased 50 shares in that 30-before-to-30-after period, it would wash out 50 shares of the taxable loss.

Wash-sale rules

Here is how the Internal Revenue Service defines a wash sale, directly from IRS Publication 550:

A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you:Buy substantially identical stock or securities,Acquire substantially identical stock or securities in a fully taxable trade,Acquire a contract or option to buy substantially identical stock or securities, orAcquire substantially identical stock for your individual retirement arrangement (IRA) or Roth IRA.

Let's summarize: A wash sale isn't solely about purchasing stocks; it can also involve acquiring options to buy stock. Moreover, the rule also counts if you buy identical shares in a different account, including a traditional or Roth IRA. In other words, you can't harvest a tax loss in your taxable account if you purchase shares within the window that creates a wash sale, even in a different account (including retirement accounts).

One final note: Wash-sale provisions work on shares that you sell for a loss, but there are no corresponding wash-sale rules for stock that you sell at a gain. That is, if you sell stock for a gain and buy it right back, you must still report the entire gain.

Related investing topics

How do you avoid a wash sale?

The first, most obvious thing to do is to avoid buying shares in the same stock within 30 days before or 30 days after selling. If you do, you lose the ability to harvest a tax loss on the number of shares you purchase.

However, if you inadvertently create a wash sale by rebuying too soon, your potential taxable loss doesn't just go up in smoke: The "lost" tax basis carries over to the replacement purchase. Simply sell again, and follow the wash-sale rules this time. You'll finally be able to harvest that tax loss.