When a stock analyst changes his or her opinion of a stock, making either an upgrade or a downgrade, it can sometimes lead to a large swing in stock price. This can present opportunities for investors and drive short-term gains, but it can also cause some pain if the analyst sours on a stock.

Analysts generally rate stocks using a three-tier system:

- A stock is a buy when an analyst thinks the stock will outperform the market or its peers and thus recommends that investors buy the stock. Some analysts use other terms, including overweight and outperform.

- A stock is a hold when an analyst expects the stock not to do any better or worse than the market as a whole. While a hold rating isn't a recommendation to buy the stock, it also isn't a recommendation to sell. Other language sometimes used includes market perform and equal weight.

- A stock is a sell when an analyst thinks a stock will underperform the market and should be sold by investors. Sell ratings are rarest, because analysts are generally positive on most stocks. Other terms sometimes used include underperform and underweight.

What does an upgrade mean for stocks?

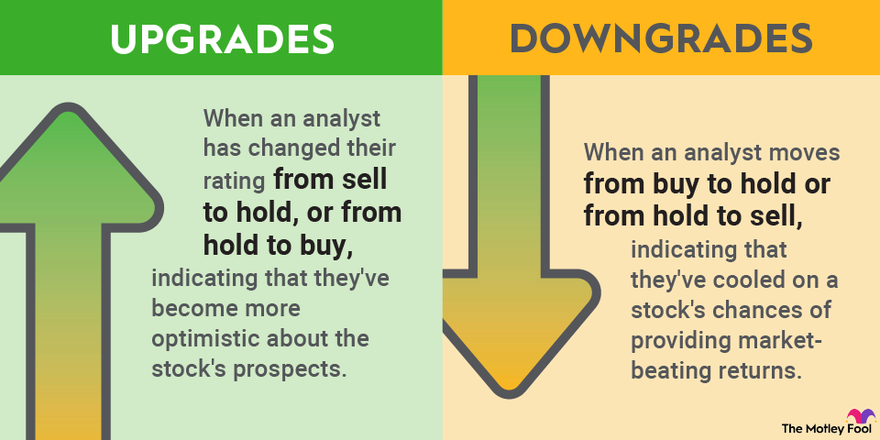

A stock upgrade means an analyst has changed their rating from sell to hold, or from hold to buy, indicating that they've become more optimistic about the stock's prospects.

Because Wall Street analysts get a lot of attention from the trading community, an upgrade tends to lift share prices in the short run. That's arguably because the clients of the analyst issuing the upgrade all flock to buy the stock following the analyst's recommendation; that increased demand for shares boosts the price.

For investors who own an upgraded stock, the upgrade can give them a short-term gain and offer an opportunity to sell the stock at a higher price if they're not as optimistic as the analyst on its long-term prospects. For investors who don't own the stock, an upgrade can make it more expensive to start a position.

Analyst upgrades are often reactionary, meaning they occur after something has already changed the story. A strong earnings report, for example, can trigger an avalanche of analyst upgrades. In this case upgrades don't really give investors any new information.

Related investing topics

What does a downgrade mean for stocks?

A stock downgrade occurs when an analyst moves from buy to hold or from hold to sell, indicating that they've cooled on a stock's chances of providing market-beating returns.

When a stock is downgraded, it can prompt traders to sell the stock on the assumption that others will be doing the same. The collective result of this selling can push down the stock price, sometimes dramatically.

A downgrade can sting for investors who own a particular stock, since it often results in a lower stock price. But for long-term investors who disagree with the analyst's conclusion, the lower price offers an opportunity to buy the stock at a discounted price, potentially boosting returns if the analyst turns out to be wrong.

Downgrades can occur in reaction to news, just like upgrades -- for example, if a company whiffs an earnings report and misses expectations. Analysts also sometimes downgrade a stock due solely to valuation. If an analyst believes a stock has increased in price too much to be justified by the underlying company's profits, the analyst could downgrade the stock despite no change in the company's long-term prospects.

While stock upgrades and downgrades often drive trading activity in a stock, long-term investors should think for themselves. Analysts' opinions can be useful, but they're far from the only thing to consider.