Asset turnover, also known as the asset turnover ratio, measures how efficiently a business uses its assets to generate sales. It's a simple ratio of net revenue to average total assets, and it's usually calculated on an annual basis. Investors can use the ratio to compare two companies in the same industry and determine whether one is better at allocating capital to generate sales.

This article will teach you how to calculate asset turnover, how to use it to make better investing decisions, and where it falls short in providing an analysis.

Asset turnover formula

The formula for calculating asset turnover is very simple:

Asset Turnover = Total Sales ÷ Average Total Assets

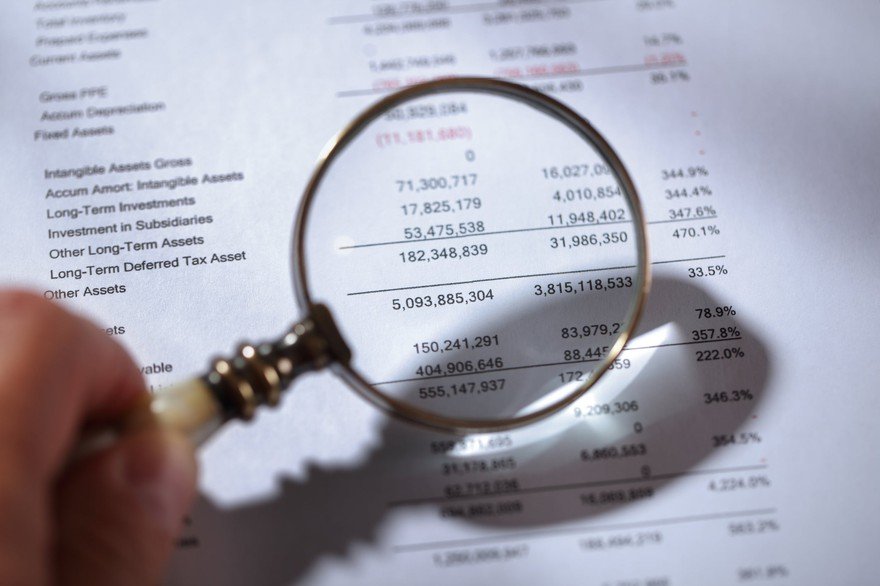

Average total assets is the average of assets on the company's balance sheet at the beginning of the period and the end of the period. Companies typically report their balance sheets showing the balances for line items from the previous year as well. This makes it easy to calculate. You simply add the total assets reported at the end of the most recent period and the total assets at the end of the previous year. Divide the number by two to get the average assets.

Total sales, or revenue, will be found on the company's income statement. You may need to add up sales from each individual quarter from the past year, or the company may provide annual sales.

Once you have numbers for total sales and average assets, divide the former by the latter to get the asset turnover ratio.

What does the asset turnover ratio tell you?

Calculating the asset turnover ratio for a single company at a single point in time isn't very useful. The metric is most useful when compared to competing companies in the industry or when tracked over time.

In general, a higher asset turnover ratio is better. A company that generates more revenue from its assets is operating more efficiently than its competitors and making good use of its capital. A low asset turnover ratio suggests the company holds excess production capacity or has poor inventory management.

If a company is showing an increase in asset turnover over time, it indicates management is effectively scaling the business and growing into its production capacity. This may be the case for growth stocks, which invest heavily in certain areas with the expectation that revenue will increase to take advantage of its capital investments.

Investors can use the asset turnover ratio to help identify important competitive advantages. If one company has a higher asset turnover ratio than its peers, take the time to figure out why that might be the case.

That said, if a company's asset turnover is extremely high compared to its peers, it might not be a great sign. It may indicate management is unable to invest enough to boost the business to its full potential. Spending more by investing in more revenue-producing assets may lower the asset turnover ratio, but it could provide a positive return on investment for shareholders. Management should be working to maximize profits even if the next investment isn't quite as profitable as the last.

What is a good asset turnover ratio?

A good asset turnover ratio will vary from industry to industry. Some industries are very asset-heavy, while others are asset-light.

A retailer whose biggest assets are usually inventory will have a high asset turnover ratio. Its sole purpose is to turn over assets. A software maker, which might not have very many assets at all, will have a high asset turnover ratio, too. But a machine manufacturer will have a very low asset turnover ratio because it has to spend heavily on machine-making equipment.

That's why it's important to compare asset turnover between companies in the same industry. In retail, a good asset turnover might be around 2.5, but investors in utility stocks generally shouldn't expect an asset turnover ratio of more than 0.5.

Example of how to use the asset turnover ratio

Let's take a look at two of the biggest retailers in the U.S.: Walmart (NYSE:WMT) and Target (NYSE:TGT). Both are big-box retailers that try to offer one-stop shopping to most of the nation. Both are also showing significant strength in e-commerce.

Here are the important inputs for calculating the asset turnover ratios for Walmart and Target over the past couple years. (Note that Walmart's fiscal 2022 lines up with Target's fiscal 2021.)

| Company (Fiscal Year) | Walmart (2022) | Walmart (2021) | Target (2021) | Target (2020) |

|---|---|---|---|---|

| Beginning Assets | $252,496 | $236,495 | $51,248 | $42,779 |

| Ending Assets | $244,860 | $252,496 | $53,811 | $51,248 |

| Average Assets | $248,678 | $244,496 | $52,530 | $47,014 |

| Revenue | $572,754 | $559,151 | $106,005 | $93,561 |

| Asset Turnover | 2.30 | 2.29 | 2.02 | 1.99 |

Comparing the two big-box retailers shows Walmart produces a meaningfully higher asset turnover ratio. Target did see its asset turnover improve more from the previous year. For the most part, however, both companies kept asset turnover flat.

As such, the numbers indicate Walmart has higher sell-through rates on its inventory and makes better use of its assets. Indeed, Walmart has done well to expand its curbside pickup and delivery service for online ordering, leading to greater utilization of its stores. However, Target isn't too far behind, especially when it comes to shipping packages to customers from its stores.

Limitations of the asset turnover ratio

The asset turnover ratio doesn't tell you everything you need to know about a company. Importantly, its focus on net sales means that it eschews the profitability of those sales. As such, asset turnover may be better utilized in conjunction with profitability ratios.

Calculating return on assets, for example, may help an investor better understand the value asset turnover from a profitability perspective. Additionally, using asset turnover as part of a DuPont analysis that calculates return on equity could provide additional insights into how a company generates profits for shareholders.

It's also worth noting that the asset turnover ratio can provide bad information without additional context. For example, a company investing heavily in anticipation of rapid growth in the future may exhibit a drop in asset turnover. Likewise, a company that liquidates assets in anticipation of a slowdown in revenue would exhibit a spike in asset turnover.

Furthermore, a company holding excess cash on its balance sheet will show a low asset turnover ratio compared to companies in the same industry with limited cash holdings. Investors may be able to adjust for excess cash, but there's no clear delimiter on the amount of cash needed for day-to-day operations and excessive amounts of cash.

Related investing topics

The bottom line

Knowing how to calculate asset turnover and how to use it to identify companies with competitive advantages can help uncover good investment opportunities. At its core, asset turnover is a measure of how well management does at efficiently using its capital. The higher the ratio, the better job management is doing.

But be wary of taking the number at face value. Always dive deeper and determine why the asset ratio stands where it is for each company you're analyzing. Examine the trends and how the company compares to other companies in the industry. Doing a little bit of research can lead to strong investment returns.