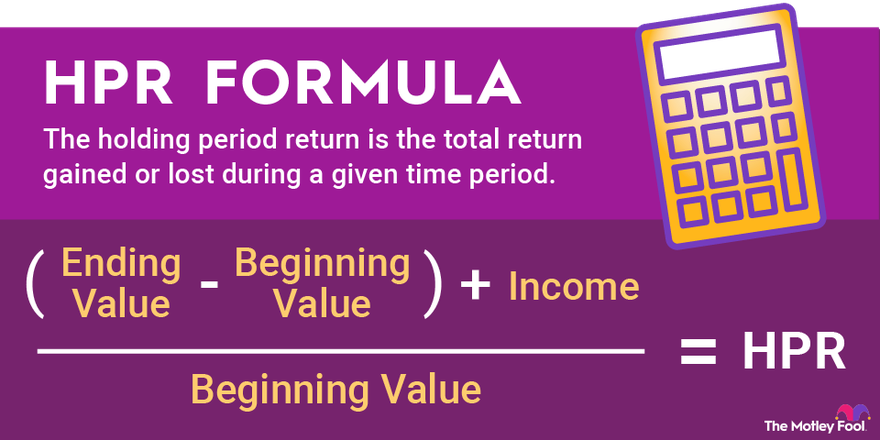

Holding period return means the total return gained or lost during a given time period. You can measure holding period return over very short time periods, such as days, or much longer periods spanning decades. Holding period return is a simple yet informative measure that most investors can come to intuitively understand.

Formula to calculate holding period return

When you've held an investment for a certain period of time, it's useful to know your total return. It's the sum of your price appreciation (how much the investment has increased or decreased in value) and your income return (how much income your investment has generated).

Holding period return is one measure of investment success or failure and can help you determine the overall performance of your investment portfolio. It can also help guide future portfolio management decisions.

Ending value is either your date of disposition or the date through which you are measuring your return. You don't necessarily have to dispose of the investment on the end date to calculate your return.

Beginning value is the amount you paid for your investment. Beginning value is also valuable from a time perspective because it indicates the beginning of your holding period.

Income can take one of two forms: dividends or interest. If you're a stockholder, you may be eligible to receive income in the form of dividends, and, if you're a bondholder, you may receive interest income. Either type of income is figured into your total return.

By subtracting the beginning value of your investment from the ending value, you arrive at the capital appreciation piece of the equation. In other words, capital appreciation refers to the amount by which your investment's price increased or decreased over the time period.

The income return, a separate measure, accounts for cash received during the same time.

The sum of your capital appreciation and income return is your total return. By dividing your total return over your beginning value, we arrive at holding period return, which is an expression of how well your investment performed in its totality over the period in question.

Example of holding period return

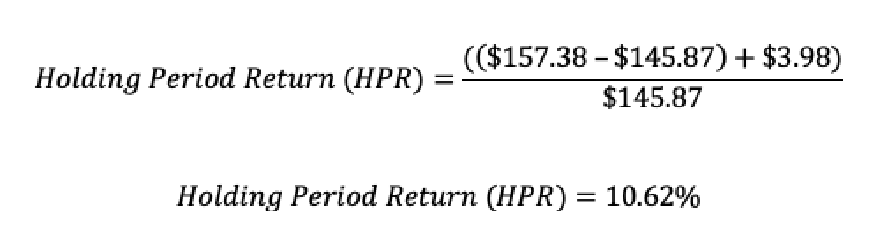

Let's look at the performance of Johnson & Johnson (NYSE:JNJ) during 2020. Let's also assume you bought JNJ at the close of Dec. 31, 2019, and held it through the close of business on Dec. 31, 2020. To start, we'll assign per-share values to each of the variables in the equation:

- Beginning value: $145.87

- Ending value: $157.38

- Dividend income: $3.98

Had you bought Johnson & Johnson stock at the end of 2019 and held it through 2020, you would have earned 10.62% on your investment, including price and dividend gains.

Because we're looking at a one-year performance, the figure is already "annualized," or expressed in yearly terms.

Had we looked at multiple years of data, we would receive a holding period return but not an annualized return.

Related investing topics

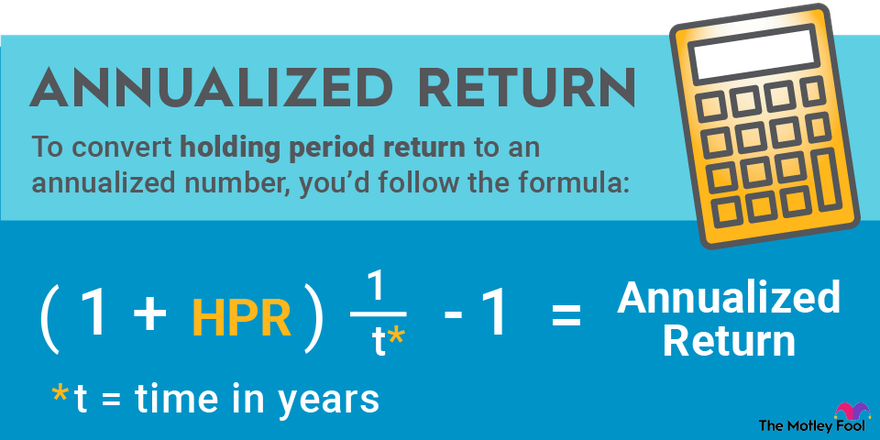

Annualized holding period return

Note that "t" represents the time in years expressed in your holding period return. In other words, if you have a holding period return that covers 10 years, you would use t = 10 to determine your annualized return. Annualized return can be very helpful in assessing long-term stock performance and can be one of many metrics used to evaluate your portfolio.