Interest expense is a general term used to describe the cost of borrowing money. It can have slightly different meanings depending on the context, but in corporate finance, interest expense is generally the primary financing expense on a company's income statement.

Here we look at interest expense in the context of evaluating a company's profitability, as well as its relevance for your personal finances.

What is interest expense?

Interest expense refers to the cost of borrowing money and includes a company's interest payments on any bonds, loans, convertible debt, and lines of credit. Interest expense also includes margin interest, which is charged in taxable brokerage accounts when borrowed funds are used to purchase investments.

Interest expense does not include other fixed payment obligations of a company such as paying dividends on preferred stock. Also not included in interest expense is any payment made toward the principal balance on a debt. For example, if a company pays $1 million to its creditors and $200,000 is applied toward the principal debt, then the interest expense is $800,000.

A company's interest expense is included on its income statement and represents the interest accrued -- but not necessarily paid -- during a certain time period. Companies account for interest as it is charged, not when cash for interest payments actually leaves their coffers.

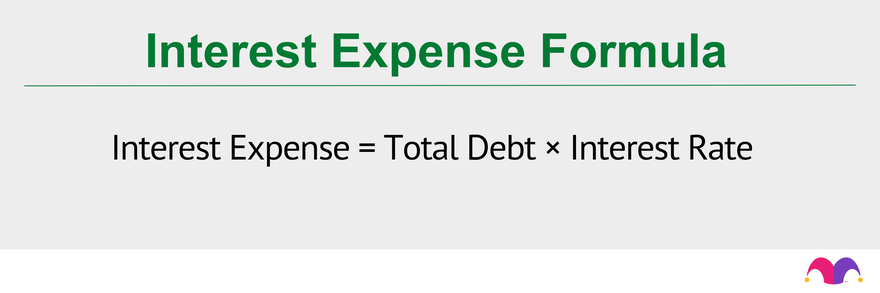

The simplest way to calculate interest expense is to multiply a company's total debt by the average interest rate on its debts.

If a company has $100 million in debt with an average interest rate of 5%, then its interest expense is $100 million multiplied by 0.05, or $5 million.

The "I" in EBIT

EBIT stands for "earnings before interest and taxes." Investors evaluate a company's earnings before subtracting interest expenses and taxes because interest and taxes are non-operating expenses -- they are not incurred directly by a company's operations. EBIT attempts to measure exactly how much a company earns from its core business operations.

Related investing topics

Interest expense for personal finance

Buying stocks "on margin" generates the interest expense most commonly associated with individual investing. Using taxable investment accounts -- not retirement accounts such as individual retirement accounts (IRAs) or 401(k)s -- investors may have the opportunity to borrow money from a brokerage to purchase stocks, bonds, or other securities. The brokerage charges an interest rate -- margin interest -- on the loaned funds. Interest expense in this context simply equals the amount of money borrowed times the stated interest rate.

You can deduct investment interest expense against any investment income -- but only if you itemize your tax deductions. The easiest way to avoid paying interest expense is to avoid buying stocks on margin.