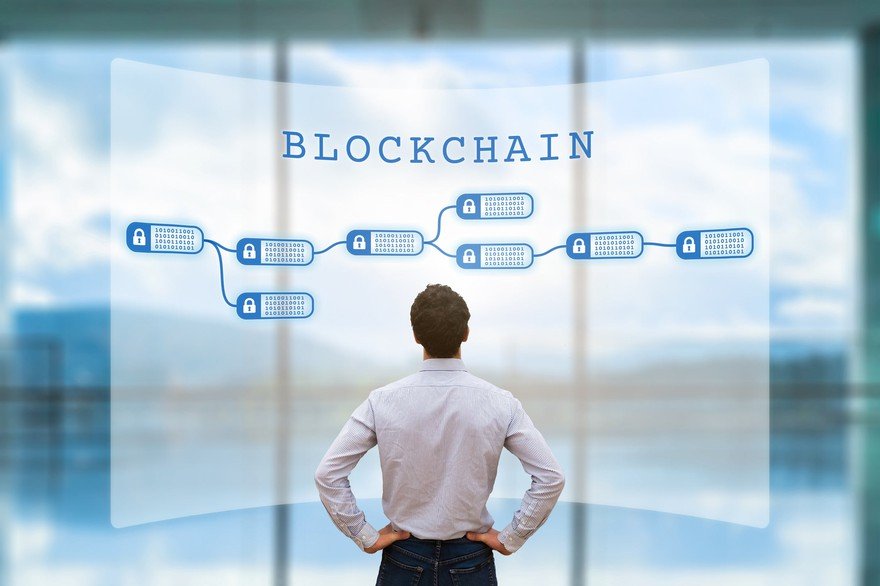

Cryptocurrency might be the most renowned application for blockchain technology, but blockchain's capabilities extend far beyond digital currencies. Many organizations use blockchain technology to improve their operations -- specifically for complex and decentralized systems. Here's how you can invest in blockchain and some factors you should consider before doing so.

Quick refresher: what is blockchain?

Before you start investing in blockchain, shore up your understanding of how it works. Blockchain is a digital public ledger that records transaction information. Each "block" of information is digitally verified and given a unique hash (or identity) and added to the public ledger. In the case of cryptocurrencies making use of blockchain, adding this new block creates a new unit (or coin) of currency.

Once again, the capacities of blockchain extend far beyond the world of digital currencies. For example, Walmart (NYSE:WMT) has been testing the use of blockchain to track the distribution of food from its myriad suppliers, making it potentially easier to isolate outbreaks of foodborne illness. Starbucks (NASDAQ:SBUX) also piloted a blockchain project for its coffee growers in Costa Rica, Colombia, and Rwanda to improve pricing transparency.

Why start investing in blockchain?

As a new technology with potential game-changing effects on the business world, blockchain is naturally garnering interest from the investment community. Here are a few factors that make it attractive:

- Blockchain could help an organization become more efficient, unlocking higher profitability over time.

- Blockchain is getting some high-profile attention from big tech firms, such as Amazon (NASDAQ:AMZN) and Salesforce.com (NYSE:CRM).

- Because of COVID-19, the world is making a rapid shift to digital. Blockchain goes hand in hand with other adjacent technologies, such as cloud computing, e-commerce, and AI.

There are also risks to consider, particularly for blockchain investments involving cryptocurrency:

- A lot of new cryptocurrencies are out there with underlying blockchain projects, and many of them don't pan out.

- Cryptocurrency prices can be highly volatile, and purchasing them may lead to loss of principal.

Ways to start investing in blockchain

Besides investing directly in stocks of companies making use of blockchain, there are other ways to get in on the action.

- Directly purchase cryptocurrencies, such as Bitcoin or Ethereum, or buy shares of a cryptocurrency trust like Grayscale Bitcoin Trust (OTC:GBTC).

- Buy an exchange-traded fund (ETF) that specifically invests in shares of companies with exposure to blockchain. Two notable examples are Amplify Transformational Data Sharing ETF (NYSEMKT:BLOK) and Reality Shares Nasdaq NextGen Economy ETF (NASDAQ:BLCN).

- Participate in crowdfunding a new cryptocurrency through an initial coin offering (ICO) -- purchasing a new cryptocurrency issued by a developer working on a new blockchain project.

- Investing in public companies involved in blockchain.Then there's the option to purchase shares of companies developing or making use of blockchain technology, such as Walmart or Starbucks. Incorporating a digital ledger system can make a company leaner and more profitable, and higher profits equal higher share prices over the long term.

But there are some companies making more focused bets on blockchain. Digital payments giant PayPal Holdings (NASDAQ:PYPL) allows merchants to accept payment in bitcoin via its Braintree subsidiary. Also its PayPal and Venmo digital wallet apps are working on other ways to incorporate blockchain and cryptocurrency buying and selling features.

Similarly, Square's (NYSE:SQ) Cash App digital wallet allows for the buying and selling of bitcoin. Older digital payments companies Visa (NYSE:V) and Mastercard (NYSE:MA) are also partnering with cryptocurrency and blockchain start-ups to keep their payment networks relevant as times change.

Commodities and financial derivatives exchange leader CME Group (NASDAQ:CME) is also of note since it has established the first futures and options exchange for bitcoin.

Also on the digital asset front, Facebook (NASDAQ:FB) continues to work (via its Libra project) to enable digital payments and financial services on its apps. The social media giant's aspirations have faced numerous setbacks from government regulators, but the more than 2 billion users Facebook has could make it a formidable force in blockchain if it figures out how to make it work. Salesforce has also built software into its platform to help its customers make use of blockchain in day-to-day operations or to accept payments in cryptocurrency.

As with all technology, it starts with semiconductors. Graphics processing unit (GPU) chips designed by NVIDIA (NASDAQ:NVDA) and AMD (NASDAQ:AMD) are a key ingredient in digital currencies. Even old stalwart Intel (NASDAQ:INTC) has a division to partner with companies developing blockchain to help foster innovation and development. IBM (NYSE:IBM) is another old tech company trying to evolve in a fast-changing world, and its blockchain segment has already partnered with numerous companies to help them put the new tech into real-world practice.

The three largest public cloud providers -- Amazon's (NASDAQ:AMZN) Amazon Web Services, Microsoft's (NASDAQ:MSFT) Azure, and Alphabet's (NASDAQ:GOOGL)(NASDAQ:GOOG) Google Cloud -- all have blockchain services available on their platforms. Amazon specifically could incorporate these capabilities into its massive e-commerce empire as well. While far from a focused bet, these cloud providers could be big beneficiaries down the road as digital ledger tech continues to develop and adoption rises.

Like other technologies, blockchain could provide progressive companies with an opportunity to grow and unlock new value. Early use cases revolve around financial transactions and logistics efficiency improvements, but decentralized digital ledgers could find their way into plenty of other areas of a company's operations.

Buying shares of companies that are taking their time to fully understand and deploy blockchain could be a great long-term investment strategy if you want to bet on blockchain's further development.

Expert Q&A

The Motley Fool sought blockchain insights from two finance experts, Dr. Christine Parlour, professor and Sylvan C. Coleman Chair of Finance and Accounting at the Haas School of Business, University of California, Berkeley and Dr. Jimmie Lenz, Director of Duke University's Master of Engineering in FinTech and Master of Engineering in Cybersecurity.

The Motley Fool: What innovations or trends in blockchain technology are you most excited about?

Parlour: There are quite a few exciting experiments underway. There are ongoing changes to the consensus protocols that various chains use which will make them more environmentally friendly and increase capacity. I also think that the steps toward interoperability will make the area grow by leaps and bounds. Personally, I find the ongoing experiments in various types of markets fascinating. I like understanding trading venues. The automated market makers effectively introduce a new way of providing liquidity which preliminary analysis suggests is very efficient.

The Motley Fool: In your opinion, what are the key advantages and disadvantages of investing in companies utilizing blockchain technology?

Parlour: Standard portfolio advice is to have a well-diversified portfolio. In other words, don't put all your eggs in one basket. The returns on cryptocurrencies are uncorrelated with gold, the market index, etc. Because of this, they represent a new asset class and so should be part of any portfolio. It is important to note that most crypto returns are correlated with Bitcoin, and unfortunately Bitcoin returns are very volatile -- with a considerable probability of large drops. The space is not for the faint of heart. So, if you dislike risk, put a tiny fraction of your portfolio in crypto and try not to watch it every day.

The Motley Fool: Which industries, other than finance, do you think blockchain has the potential to disrupt?

Lenz: There are a myriad of other industries that blockchain is already making inroads into; supply chain, healthcare, accounting, etc. The attributes that make blockchain attractive to finance are also common to other areas. In particular are those legacy areas that have significant frictions, like finance, that provide little or no value, but that cost everyone more in terms of cost, time, and security. And speaking of security, I do believe that this is an area, in all types of organizations, that will benefit from blockchain.

I see blockchain not only as a technology, but also as an opportunity to change the approach to the way we think about things. Maybe in the future we will mature this into the way that project management has the Six Sigma approach?