On its most basic level, blockchain technology is a transaction ledger on a massive scale. Fortified by strong encryption and advanced security protocols, this ledger can serve as the basis for many different types of financial systems and cloud-computing networks. Blockchain is best known as the technology powering cryptocurrencies such as Bitcoin (CRYPTO:BTC) and Ethereum (CRYPTO:ETH), but that's just the tip of the iceberg.

The technology is more flexible than you might think. Here's what you need to know about blockchain networks.

What is a blockchain network?

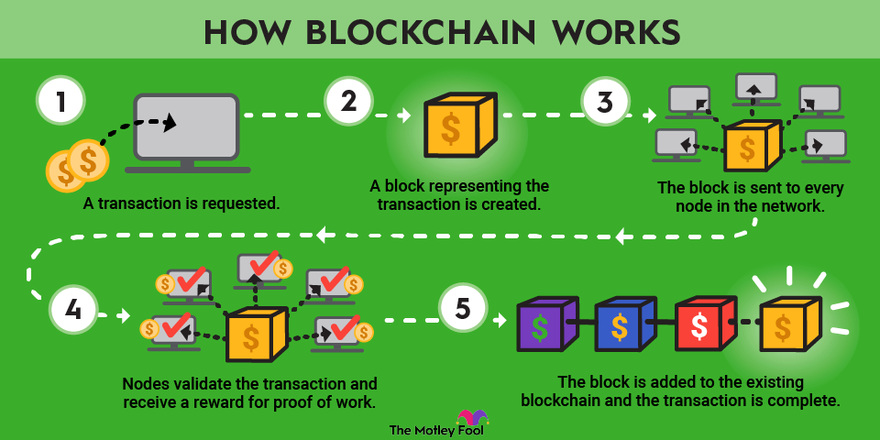

Blockchain systems rely on a peer-to-peer network of computers that analyze a shared digital ledger at regular intervals. New transactions must be confirmed by a predetermined number of computer nodes. When a new block of transactions gets the stamp of approval from enough nodes, the new data is written in stone and the blockchain moves on to considering another list of new transactions.

The transactions can involve physical goods such as cash-based monetary value, car titles, land ownership, and more. They can also handle intangible assets like patents, branding, or intellectual property.

As the name implies, you can think of a blockchain as a chain of data blocks. Each block consists of a list of transactions connected to the previous block in the chain. Each block -- including that crucial link to the previous block -- is secured by highly secure layers of encryption. The architecture makes it almost impossible to change any of the blockchain's data.

The approval system comes in many forms. In the proof-of-work architecture currently underpinning the Bitcoin and Ethereum systems, many computers solve difficult mathematical problems to earn the right to approve and lock down the next data block. In proof-of-stake systems like Ethereum rival Cardano (CRYPTO:ADA), current owners of the cryptocurrency earn the same transaction approval powers by staking their coins. This way, the largest holders of each digital currency have more power over the security and future direction of that project.

Paired with a variety of approval systems based on peer-to-peer networking and modern game theory, the unchangeable nature of these digital data blocks allows blockchain systems to run across a global network. You can also go one step further and run the blockchain system across a private network instead, sacrificing the decentralized nature of a public blockchain in exchange for another layer of data security.

What is blockchain programming?

The technology is very flexible and can be used for many different things. Remember that the data block records much more than just the basic details of each transaction such as buyer and seller, date and time, and the actual thing that changed hands. Most blockchain networks have room for a lot of additional data.

Cryptocurrencies such as Bitcoin, Dogecoin (CRYPTO:DOGE), and Litecoin (CRYPTO:LTC) don't go much further than the basic transaction records because that's all they were designed to do. There is no need to muddy the waters with advanced features if you just want to build a secure system for money transfers and long-term value storage. Each cryptocurrency provides these functions in a slightly different form. Bitcoin focuses on inflation-free value protection, while Dogecoin offers faster transactions in an inflationary value system.

Other cryptocurrencies have made fundamentally different design choices. For example, Ethereum carries both permanent information about each transaction and the temporary state of the Ethereum network, including the balance of Ethereum tokens in each digital wallet. A third branch of the blockchain network contains the platform's smart contracts. The transaction network only points to the unique smart contract addresses for each data point rather than packing all of this information into a large and hard-to-handle transaction. This design reduces the size of each Ethereum block, which, in turn, allows the whole system to run faster and more efficiently.

What is blockchain used for?

The architecture has many different uses, and relatively simple cryptocurrencies in the Bitcoin mold only scratch the surface of what this technology can do.

The previously noted smart contracts are pieces of program code that can be executed by the Ethereum virtual machine when a predetermined set of conditions has been met. Let's say you want to sell an asset on the Ethereum network if a bidder offers a certain number of Ethereum tokens for it. You could set up a smart contract that checks the value of all incoming bids for your asset -- which could be a piece of real estate, a non-fungible token (NFT), or any other unique property -- and only accepts transactions above your minimum bid.

The virtual machine code is executed every time the preset conditions are met. This is the lifeblood of decentralized finance applications, including the aforementioned NFTs.

But that's just one small example in a vast ocean of possibilities. In practice, blockchains can manage any system that involves digital data points and/or transactions.

A few examples of blockchain solutions

Many books have been written about the real-world application of blockchain technologies. Let's settle for a handful of examples here.

Insurance carriers can automate their policies with the help of smart contracts. Pre-programmed processes can help the company evaluate the risk profile of new customers, set up the proper premium structure for each insurance contract, and manage incoming claims. The use of immutable blockchain transactions along the way ensures the system's data security and provides greater transparency for both clients and policy writers.

Money transfers in the old-school banking world typically take several days. The processing time and fees only grow if the transfer crosses international borders. By contrast, transferring money over a blockchain network can be done in minutes. Blockchain-based payment and money transfer platforms run circles around their traditional banking counterparts in terms of fees and processing speed. The sender and receiver may be subject to different local regulations, but the actual transaction largely ignores issues such as physical distance and national borders. This was one of the original reasons behind Bitcoin's invention, not to mention the international money transfer ambitions of the Ripple (CRYPTO:XRP) network. In the long run, it's fair to assume that most financial technology companies will rely on blockchain networks in some way.

It's also easy to envision personal data moving from plastic cards in your wallet to digital blockchain records. When your identity is tied to an ultra-secure blockchain record, it should be possible to implement all-digital medical records, real estate titles, online voting, and more. Many of these ideas still send shivers down the spines of many consumers and regulatory officers because they have not yet been put to the test. The automatic mistrust of unknown solutions still outweighs the potential benefits of managing private records in this way. That may very well change in the long run.

Blockchain networks can improve the supply chains in many industries. With the help of a custom blockchain and smart contracts, it's possible to track goods from the raw materials to the consumer, with unique records for every point in between. You could know at a glance where the gold and the diamonds in that ring came from, where and when they were put into a piece of jewelry, and who else may have owned it before you. The same complete supply chain tracking could apply to furniture, pieces of clothing, food, and more. Shipping companies and manufacturers have been contemplating blockchain-based tracking for years.

The global reach and tight security of blockchain networks set the stage for direct data storage. Just as a data block can hold complete records of a complex transaction, it can also contain a small piece of the data in a large file. When that file needs to be available at the drop of a hat and around the world without sacrificing data security, it makes a lot of sense to distribute it across a blockchain rather than serving up the complete file from a central server. The leading content delivery networks (CDN) and cloud computing providers are already working with blockchain solutions. More will surely follow.

How to invest in blockchain

Blockchain networks offer tons of promise for real-world implementation with game-changing implications for nearly every sector and industry. That being said, these are still the early days of cryptocurrency and blockchain technologies, and many loose ends are up in the air. The situation is arguably similar to the internet of the 1990s when many future business giants were created in garages and college campuses around the world -- but no one had quite figured out how to make money online yet.

Regulators around the world are still trying to figure out how legal and tax-related frameworks should look for the long term, especially on an international level. Also, both consumers and governments will probably need many years to build trust in these newfangled technologies.

Early investors can make a lot of money on blockchain networks and related stocks as the industry develops over the long haul, but every name won’t be a guaranteed winner. A sensible blockchain investor should approach this evolving sector with diversification and careful ticker-picking in mind.