When Bitcoin (CRYPTO:BTC) was launched in 2009, it introduced the concept of Bitcoin mining. Miners are responsible for confirming transactions and for the creation of new coins; they receive Bitcoin rewards for their efforts.

Considering Bitcoin's value, getting it as a reward is an enticing proposition. No doubt most of us have at least briefly considered Bitcoin mining after first hearing about it. When you dig a little deeper, however, you find it's not nearly as great as it sounds. In this guide, we'll cover exactly how it works and whether Bitcoin mining is worth it in 2022.

What is Bitcoin mining?

Bitcoin mining is the process for validating Bitcoin transactions and minting new coins. Since Bitcoin is decentralized, there's no central authority managing transactions or issuing coins like there is with government-backed currencies. Bitcoin miners, who can be anyone, handle this instead.

To record transactions, Bitcoin uses a blockchain, a public ledger that contains all of Bitcoin's transactions. Miners check each block, and, once they confirm it, they add it to the blockchain.

For helping to keep the network secure, miners earn Bitcoin rewards as they add blocks. The rewards are paid using transaction fees and through the creation of new Bitcoin. However, there is a fixed maximum supply of 21 million Bitcoins. Once that many are in circulation, rewards will be paid entirely using transaction fees.

How Bitcoin mining works

The Bitcoin mining process always starts with a block that contains a group of transactions. The transactions have already gone through an initial security check by the network to verify that the sender has enough Bitcoin and has provided the correct key to their wallet.

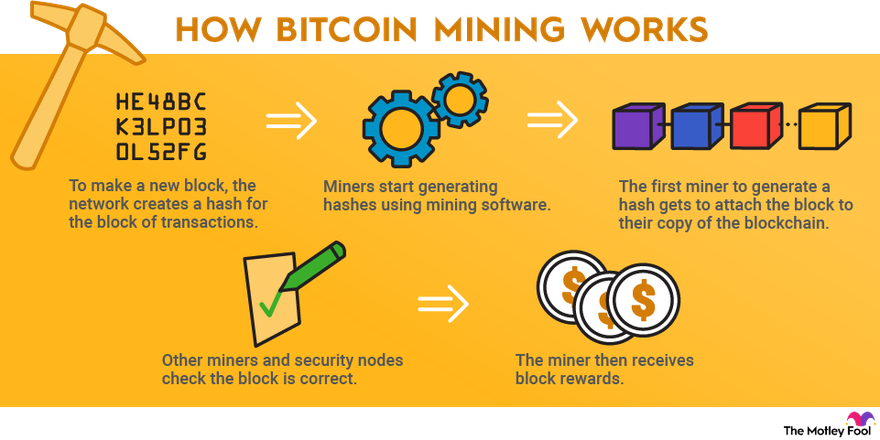

Here's what occurs next to mine a block:

- The network creates a hash (a string of characters) for the block of transactions. Bitcoin uses an algorithm called SHA-256 to do this, and it always generates hashes with 64 characters.

- Bitcoin miners start generating hashes using mining software. The goal is to generate the target hash-- one that's below or equal to the block's hash.

- The first miner to generate the target hash gets to attach the block to their copy of the Bitcoin blockchain.

- Other miners and Bitcoin security nodes check that the block is correct. If so, the block is added to the official Bitcoin blockchain.

- The Bitcoin miner then receives block rewards. Blocks offer a set amount of Bitcoin as a reward; the amount is cut in half for every 210,000 blocks that are mined (this is called Bitcoin halving).

This system Bitcoin uses is called proof of work because miners need to prove they expended computing power during the mining process. They do this when they provide the target hash.

One important thing to know about Bitcoin mining is that the network varies the difficulty to maintain an output of one block every 10 minutes. When more miners join, or they start using mining devices with more processing power, mining difficulty increases.

Types of cryptocurrency mining

There are several types of cryptocurrency mining depending on the method you choose. Here are the most popular ways to mine Bitcoin.

ASIC mining

An application-specific integrated circuit (ASIC) is a specialized device built for one purpose, and ASIC miners are designed for mining a specific cryptocurrency. These are the most powerful option for Bitcoin mining. New ASICs can cost thousands of dollars, but they're also the only type of device where you can potentially make a profit from Bitcoin mining.

GPU mining

GPU mining uses one or more graphics cards to mine crypto. A typical "mining rig" is a computer that has one or more high-end graphics cards. This kind of mining is costly up front because you need to buy the graphics cards. Although it's popular for mining other types of cryptocurrency, it doesn't work well for Bitcoin due to the lack of power compared to ASICs.

CPU mining

CPU mining uses a computer's central processing unit. This is the most accessible way to mine crypto since all you need is a computer, and it worked in the early days of Bitcoin. It's no longer recommended for mining Bitcoin because CPUs don't have nearly enough processing power to compete with ASICs.

Cloud mining

Cloud mining involves paying a company to mine crypto for you. Instead of setting up your own mining device, you're essentially renting one and receiving the profits after maintenance and electricity costs are deducted. While it may sound like a good deal at a glance, cloud mining normally requires committing to a contract, and, if crypto prices fall, you're unlikely to break even.

Mining pools

A mining pool is a group of crypto miners who pool their resources and share rewards. By working together, miners are much more likely to get the chance to mine new blocks. With Bitcoin mining, it's very difficult to mine blocks if you're operating solo. Each mining pool has its own hardware requirements, with most requiring you to have either an ASIC miner or a GPU.

Is Bitcoin mining profitable?

Bitcoin mining usually isn't profitable for individuals anymore because of the costs involved and the competition.

Here are the main factors that determine how much you can make mining Bitcoin:

- Cost of the mining device: Quality ASICs range from about $1,000 to more than $15,000.

- Hash rate: The hashes per second the mining device can generate. The higher this is, the more you earn. This is expressed as terahashes per second (TH/s), or how many trillions of hashes the device generates per second.

- Efficiency: The amount of energy a mining device requires. This is expressed as watts per terahash (W/TH), or the number of watts the device needs to generate a trillion hashes.

- Electricity costs: The price you pay for electricity. The only way to make money mining Bitcoin is with cheap electricity.

- Price of Bitcoin: Bitcoin is extremely volatile, and the amount you earn will rise or fall with its price movements.

Fortunately, you don't need to do the math yourself. There are plenty of mining profitability calculators available. Plug in how much you pay for electricity, and the calculator will tell you how much passive income you can expect to earn per day, per month, and per year.

Divide the earnings by the cost of the mining device to find out how long it will take before you're turning a profit. In most cases, it's more than a year and often more than two. Keep in mind that it could end up taking even longer because of mining difficulty increases.

The other problem is that mining devices have a limited lifespan. With proper maintenance and care, three to five years is about average, but they're often obsolete by the three-year mark.

To sum it up, Bitcoin mining offers very limited profitability at best and requires a big initial financial commitment. It makes more sense to learn how to invest in cryptocurrency and put that money into buying coins.

How to start Bitcoin mining

Here's a quick guide for how to start Bitcoin mining:

- Buy an ASIC miner. You can find them at many online retailers, including Amazon (NASDAQ:AMZN), eBay (NASDAQ:EBAY), and Newegg (NASDAQ:NEGG).

- Choose a location to set up your ASIC. Miners generate quite a bit of heat, so it needs to be an area with good air circulation. You'll also need a 220V outlet.

- Set up a crypto wallet to safely store cryptocurrency. There are free crypto wallets you can download, as well as hardware wallets that offer more security and generally cost $50 to $150.

- Join a mining pool. Because of how difficult mining Bitcoin is now, being part of a mining pool is a must.

As previously noted, there are different ways to mine Bitcoin, and the process is different depending on which one you choose. The best way to have a reasonable chance at making a profit is with an ASIC and a mining pool.

Understanding the risks of Bitcoin mining

The biggest risk of Bitcoin mining is that you won't make back your start-up costs. ASIC miners aren't cheap, and those with sufficient processing power normally cost at least $1,000. Although you can find cheaper options, remember that paying less also means earning less.

It's possible to make your money back and eventually profit, but mining earnings are far from stable. If the price of Bitcoin drops, so do your earnings. And an increase in mining difficulty can cut into any profits.

While prospective miners often focus on profitability, there's also the safety aspect to consider. Bitcoin mining uses a substantial amount of electricity. It's notoriously bad for the environment, and it can be a safety hazard if you're not careful.

Mining devices can damage your home's electrical system or overload the power grid. There have also been reports of fires in poorly designed mining farms without proper cooling.

Is Bitcoin mining worth it?

If you run the numbers, you're most likely going to find that Bitcoin mining isn't worth it for you. It typically takes at least a year, and potentially more than two years, before you break even on the cost of your mining rig. That's assuming you don't run into any issues such as problems with your electrical grid or the price of Bitcoin plummeting.

You're better off buying Bitcoin with the money you planned to invest in mining. If the price increases, you'll be up on your investment, which wouldn't be the case if you were still waiting to recoup the cost of a miner. You could also consider different types of crypto investments. Here are a few options available on the stock market:

Alternatively, you can invest in cryptocurrencies directly by buying them on cryptocurrency exchanges. There are plenty of investment options available, so it's simply a matter of choosing the one that fits you best.