Since cryptocurrencies are decentralized, much of the responsibility for storing them safely falls on the owner. If your crypto is lost or stolen, there's no one you can call to get it back. Many security-conscious crypto enthusiasts have turned to cold storage to keep their coins safe.

This type of storage isn't just used by individual investors. It's also a favorite of major cryptocurrency exchanges and some of the companies behind the best cryptocurrency stocks. To find out why, let's take a look at how cold storage works and what makes it so safe.

What is cold storage?

Cold storage is offline cryptocurrency storage. Any crypto wallet that's not connected to the internet is considered cold storage and is referred to as a cold wallet. The most common type of cold wallet is a hardware wallet, which is typically a small device that connects to a computer.

Because it's offline, cold storage offers excellent security for Bitcoin (CRYPTO:BTC) and other cryptocurrencies. Hackers won't be able to gain access to your crypto without it being connected to the internet.

How does cold storage work?

All cryptocurrency storage revolves around protecting the keys to your crypto. With cold storage, your keys are kept offline except during the transaction process.

There are two types of keys (strings of cryptographic data) for cryptocurrency: a public key and a private key. The public key identifies the specific crypto wallet during transactions. The private key is the code that allows the owner to access the crypto in the wallet.

For an example of how cold storage works, let's say that you have a hardware wallet. To use it, you first connect it to your computer. Next, you choose the option to receive crypto, which will generate an address. You can send your crypto to this address to store it on your cold wallet. The device has both your public and private keys, so once you disconnect it from your computer, that information is completely offline.

If you want to transfer crypto from your cold wallet to another address, it's a similar process. Connect the cold wallet to your computer, enter the address, and send your crypto.

Cold storage wallet vs. digital (hot) wallet

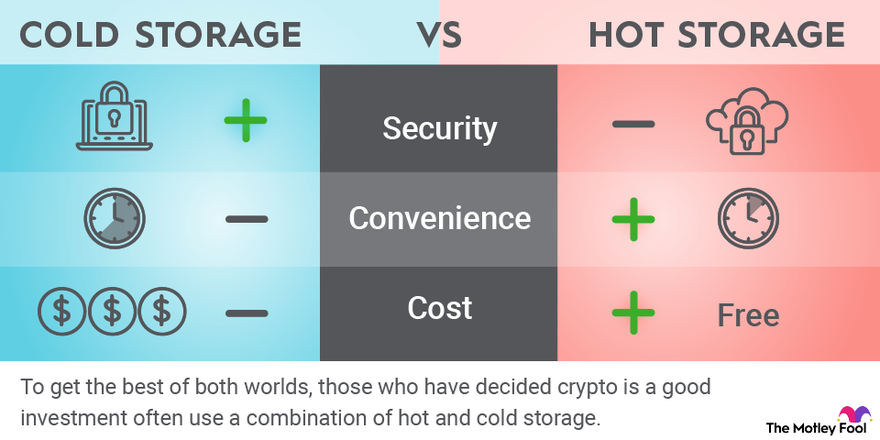

The other type of crypto storage is a digital wallet, also known as a hot wallet, which is connected to the internet. Here's how cold wallets and hot wallets compare in a few key areas:

- Security: Cold wallets are more secure. Although hot wallets can provide a high level of security, being online means they carry the risk of being hacked.

- Convenience: Hot wallets are more convenient. They allow you to quickly send and receive crypto, whereas cold wallets sacrifice speed for security.

- Cost: Most hot wallets are free. Hardware wallets are the most common form of cold storage, and they usually cost $50 to $150. There are, however, ways to make free cold wallets since it's possible to store crypto keys on a piece of paper.

To get the best of both worlds, those who have decided crypto is a good investment often use a combination of hot and cold storage. They keep the bulk of their crypto in cold storage but use a hot wallet for smaller amounts and for day-to-day trading.

Given how important it is to keep your crypto safe, cold storage is a smart option that's worth considering. A hardware wallet is a fairly inexpensive one-time purchase, especially if you're planning to make a serious investment in cryptocurrency.