In the wake of the cryptocurrency industry’s early success at gaining traction among investors and traders, new terminology has popped up among its fan base. “FUD” is one of them. Here’s what it means, why it’s used, and how it relates to investing in the world of crypto.

FUD definition and meaning

FUD is an acronym for “fear, uncertainty, and doubt.” It is used to describe the pessimism some market participants have about cryptocurrencies and their long-term viability.

Some crypto investors will use the term FUD when a vocal investor is particularly negative about cryptocurrency and blockchain technology. For example, the best-known U.S. investor, Warren Buffett, is on record saying he has no interest in owning Bitcoin (CRYPTO:BTC) because it isn’t tangible and “doesn’t produce anything.” Some investors also point out the massive amounts of electricity that Bitcoin uses as a reason for steering clear.

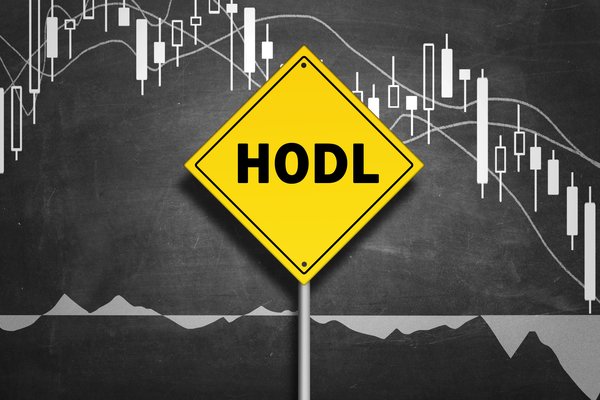

A crypto investor might describe such comments as “FUD” and instead urge fellow crypto owners to maintain a positive mindset. Instead of FUD, long-term crypto investors are encouraged to “HODL” -- originally a misspelling of “hold” but another acronym that now means “hold on for dear life.”

Related Fintech Topics

Is FUD real?

Cryptocurrencies and the blockchains they are built on are new technologies. As such, they are still being developed, bugs are being worked out, and real-world use cases are being devised. Sometimes market participants who are betting against crypto’s future will use FUD to stoke fear among investors and encourage selling. But not all FUD is propaganda.

As with all new technologies, crypto as an investment is prone to wild swings in valuation. Through early 2022, the digital currency market was down a substantial amount, along with tech stocks in general. The S&P Cryptocurrency Broad Digital Market Index was down as much as 50% in May 2022. As measured by the original cryptocurrency Bitcoin’s price, other big downturns for this emerging industry occurred in early 2020, 2018, and 2014.

The point is that while some FUD can be ignored, there are trade-offs with investing in crypto. Whenever there is big upside potential for an investment, there is plenty of risk for steep downturns as well. Thanks to soaring crypto prices during the early COVID-19 pandemic, there have also reportedly been pump-and-dump schemes trying to take advantage of the hype. Plus, as the technology is gradually improved upon, there are going to be blockchain project failures along the way -- for example, the rapid implosion of the Terra (CRYPTO:LUNA) blockchain in May 2022.

This underscores the importance of having proper expectations for the cryptocurrency industry. Don’t expect a volatility-free, get-rich-quick experience. For most retail investors, maintaining a diversified portfolio of digital assets and stocks involved with blockchain and crypto tech development is very important. Digital assets are here to stay, so there’s no need to get hung up by FUD, but a healthy dose of caution will serve crypto investors well over the long term.