Cryptocurrencies have been capturing headlines and investor attention -- and for understandable reasons. Although there are now more than 10,000 different cryptos out there (more than triple the number at the end of 2019), early buyers of Bitcoin (CRYPTO:BTC), Ethereum (CRYPTO:ETH), and other leading cryptocurrencies have made a lot of money. When Bitcoin -- the first cryptocurrency -- came out in 2009, it was worthless. By early 2022, a single coin was worth more than $39,000.

The real question now is this: Will crypto last? After all, behind all the hype there are issues with these digital-native currencies that need to be worked out. Investors and everyday money users alike don't want to get caught holding a worthless asset. While questions abound as to how things will eventually shake out, it looks like the burgeoning crypto industry is here to stay.

A small but fast-growing user base

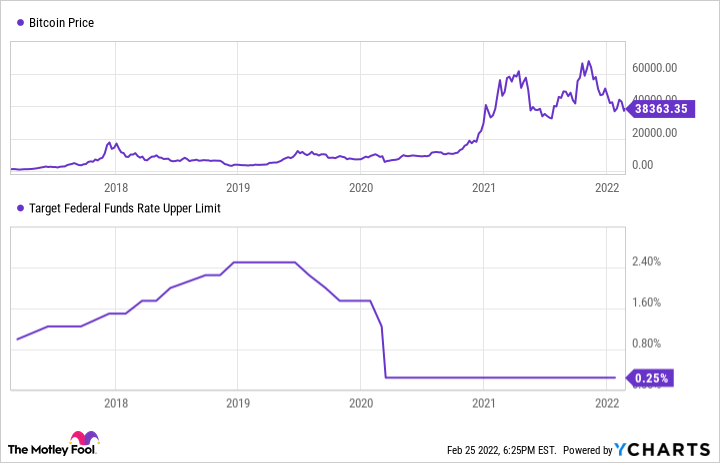

By some accounts, crypto appears to be little more than a fad. By early 2022, crypto prices had undergone a massive decline from their peak in late 2021. The Federal Reserve Board has indicated it will raise interest rates, lowering the present value of a risk asset (those that change prices such as cryptos, stocks, or bonds). Something similar happened in 2018, which was the last time the Fed was raising its benchmark interest rate, as illustrated by Bitcoin's price action.

All cryptocurrencies are very volatile and a highly speculative bet. Investors (especially new investors) should exercise prudence. However, behind the wild fluctuations in value, there is an increasing adoption of cryptocurrency. According to a poll conducted by Pew Research in late 2021, only 16% of Americans have ever invested in, traded, or used crypto. And, according to Crypto.com research, global crypto users approached 300 million early in 2022, just shy of 4% of the total global population.

As pointed out by crypto investor and content creator Lark Davis on Twitter (NYSE:TWTR), crypto uptake is mirroring the growth of internet adoption in the 1990s when comparing Crypto.com's data with internet usage data provided by the World Bank. Although 300 million crypto users is a small percentage of the global population, it's a significant number considering the whole digital-native currency concept was only introduced a little more than a decade ago. Despite wild swings in value, the allure of cryptocurrency and the technologies they're based on (blockchain, cryptography, use of digital currency native to the internet, etc.) are real and only picking up steam.

Businesses could lead the charge in crypto adoption

Many early cryptocurrency adopters have flocked to these assets in hopes of making some quick money from a spike in crypto value. But if crypto and related technologies are to have real staying power, more real-world uses and everyday reliability will need to be developed.

That's where major companies investing in cryptocurrency and related tech will come into play. Just as the internet required a lot of investment to gain real commercial momentum, so will crypto. Besides trading platforms such as Coinbase Global (NASDAQ:COIN), an increasing number of organizations are pouring money into various projects. Some, such as software developer MicroStrategy (NASDAQ:MSTR), are directly purchasing Bitcoin and holding it on their balance sheet.

Others are developing tools to allow for crypto's integration into the broader economy. For example, bank Silvergate Capital (NYSE:SI) operates a network that allows for remittance of U.S. dollars and euros 24 hours a day and seven days a week, a key capability since crypto markets never close. Silvergate also acquired the stablecoin assets from Diem Association, which was previously headed up by Facebook parent Meta Platforms (NASDAQ:FB). Block (NYSE:SQ) (formerly Square) CEO Jack Dorsey is a champion of Bitcoin and is pushing hard to develop applications for its everyday use as an actual currency (rather than just an investment). Even Alphabet's (NASDAQ:GOOGL)(NASDAQ:GOOG) Google Cloud recently launched a blockchain division to help customers build uses for the technology.

Over the long term, big businesses developing blockchain and crypto should help increase the usefulness of the technology, which, in turn, will increase its staying power. But some early applications have already taken hold, such as NFTs (non-fungible tokens) in the art and music industry. Developers are also using Ethereum and other altcoins to build "decentralized finance" (DeFi) apps that remove intermediaries such as banks to speed financial transaction times and lower fees.

The Fed has also been discussing the pros and cons of issuing its own digital currency. Meanwhile, China has already launched its own sovereign digital yuan and is testing its use on a limited basis.

Is crypto here to stay?

Investing in cryptocurrencies and related assets like NFTs is risky. This is new tech and an industry still in the very early stages of development. Just as the internet and the companies synonymous with it have drastically changed over the past two decades, so will the blockchain and crypto space. As the tech matures, various uses will start to coalesce around a few leaders. In other words, out of the more than 10,000 cryptos in existence today, most of them are likely to lose money if you were to buy them now and hold them for the long term.

But that doesn't mean crypto has no staying power. What it eventually looks like and how it will fit into day-to-day life remains to be seen. If you invest in crypto at all, do so with the knowledge that this remains a very speculative area of the investing universe. Keep any bets very small and diversified.