You probably interact with artificial intelligence (AI) more often than you think. It's the algorithm arranging your Netflix (NASDAQ:NFLX) menu, the software expediting your Amazon (NASDAQ:AMZN) package, and the brains behind many of the smartphone apps you use every day.

Over time, artificial intelligence is only likely to get smarter and play a greater role in our daily lives. Already, AI represents a global market worth hundreds of billions of dollars, and its wide range of practical applications includes smartphone face recognition, predictive algorithms in internet search, smart home devices, and autonomous vehicles.

If you want to get portfolio exposure to AI companies but don't wish to identify individual AI stocks, you can invest in an AI-focused exchange-traded fund (ETF). AI ETFs provide exposure to a broad range of the best AI companies, eliminating the need to research and choose individual stocks on your own.

Best AI ETFs

| AI ETF | Assets Under Management | Expense Ratio |

|---|---|---|

| Global X Robotics & Artificial Intelligence ETF | $2.58 billion | 0.68% |

| ROBO Global Robotics and Automation Index ETF | $1.84 billion | 0.95% |

| iShares Robotics and Artificial Intelligence ETF | $448.5 million | 0.47% |

| First Trust Nasdaq Artificial Intelligence ETF | $244.4 million | 0.18% |

Keep reading to learn more about each of these artificial intelligence ETFs.

1. Global X Robotics & Artificial Intelligence ETF

Established in 2016, the Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ) is a fund that seeks to "invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence." That includes enterprises working in industrial robotics, automation, non-industrial robots, and autonomous vehicles.

BOTZ currently holds 37 stocks. Its top five holdings, which account for about 40% of the fund's assets, are:

- Upstart Holdings (NASDAQ:UPST): Operates a cloud-based AI lending platform connecting banks and other lenders with borrowers.

- Nvidia (NASDAQ:NVDA): Semiconductor maker whose chips are used in a wide variety of applications -- including autonomous vehicles, virtual computing, and cryptocurrency mining -- and are central to many AI technologies.

- Intuitive Surgical (NASDAQ:ISRG): Maker of the da Vinci robotic surgical system, which allows for minimally invasive surgeries with precise control.

- Keyence (OTC:KYCCF): Japanese company that makes factory automation products such as sensors and scanners.

- ABB (NYSE:ABB): Swiss maker of industrial automation and robotics products for use in utilities and infrastructure.

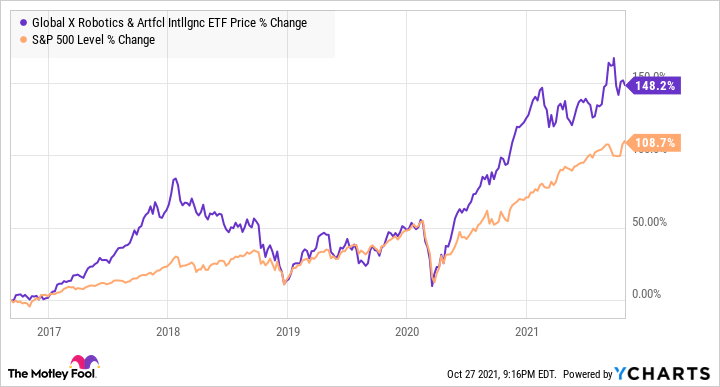

As the chart below shows, shares of this ETF have outperformed the S&P 500 (SNPINDEX: ^GSPC), and its share price has soared since the pandemic-related market bottom in March 2020.

BOTZ offered a modest dividend yield of 0.17% at the time of this writing, but it is better suited as a growth-oriented investment. Its expense ratio of 0.68% is higher than what you'd pay for an index fund, but it's also reasonable for the fund's history of outperformance.

2. ROBO Global Robotics and Automation Index ETF

The ROBO Global Robotics and Automation Index ETF (NYSEMKT:ROBO) is focused on companies driving "transformative innovations in robotics, automation, and artificial intelligence." ROBO invests in companies that are primarily focused on AI, in addition to cloud computing and other technology companies.

ROBO holds 83 different stocks, with no single one accounting for more than 2.2% of the ETF's value. Its top five holdings comprise only about 9% of the fund's total value. These five companies include Intuitive Surgical, the robotic surgical systems maker described above, and four more:

- iRhythm Technologies (NASDAQ:IRTC): A digital healthcare company focused on cardiac monitoring.

- Brooks Automation (NASDAQ:BRKS): A manufacturing automation company that provides a range of services for semiconductors and life sciences companies.

- Stratasys (NASDAQ:SSYS): A maker of 3D printing systems.

- Kardex Holding (OTC:KRDXF): A Swiss logistics company that provides automated storage solutions.

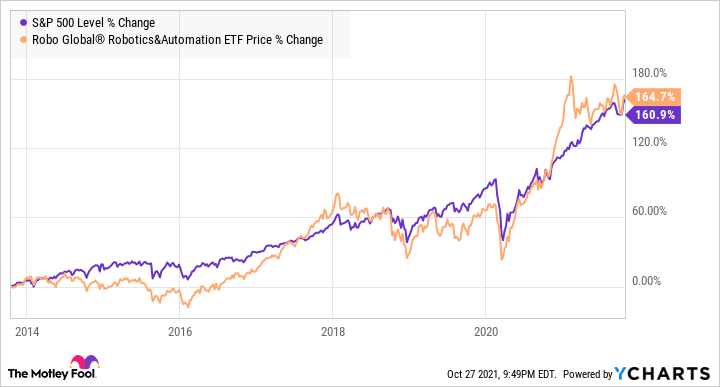

Since its inception in 2013, ROBO has essentially matched the return of the S&P 500, as the chart below shows, and it trails the broad-market index with dividends factored into the return. ROBO's dividend yield is a modest 0.18%, and its expense ratio is 0.95%.

3. iShares Robotics and Artificial Intelligence ETF

The iShares Robotics and Artificial Intelligence ETF (NYSEMKT:IRBO) aims to track the results of an index of developed and emerging market companies that could benefit from the long-term opportunities in robotics companies and artificial intelligence.

IRBO was formed in 2018 and has less than $1 billion of assets under management. With 104 stock holdings, it's well-diversified. Many of its top holdings also give investors exposure to fast-growing small-cap companies.

The fund's top five investments, which account for around 6% of IRBO's assets, are:

- Ambarella (NASDAQ:AMBA): A semiconductor company that designs video components that go on chips.

- Nemetschek (OTC:NEMTF): A Germany-based software company servicing the architecture, engineering, construction, and media and entertainment industries.

- Hubspot (NYSE:HUBS): A provider of cloud-based customer relationship management software.

- Alchip Technologies (3661. TW): A Taiwanese semiconductor company that specializes in design and manufacturing.

- Splunk (NASDAQ:SPLK): Another cloud stock that uses artificial intelligence and machine learning to improve its data platform.

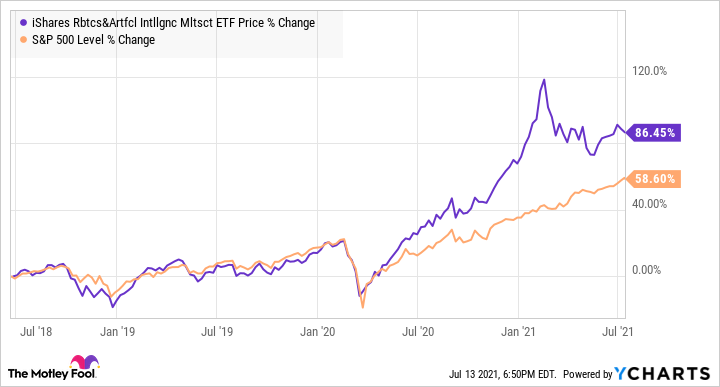

As you can see from the chart below, IRBO has outperformed the S&P 500 by a wide margin since the start of the pandemic. These recent gains are likely a reflection of how strongly cloud computing companies are performing in the recovery.

IRBO's expense ratio is competitive at 0.47%, and its dividend yield at the time of this writing is a healthy 0.6%. The fund's performance is likely to be heavily influenced by the overall performance of cloud stocks as it seems more exposed to cloud stocks and chipmakers than AI companies.

4. First Trust Nasdaq Artificial Intelligence and Robotics ETF

First Trust Nasdaq Artificial Intelligence and Robotics ETF (NASDAQ:ROBT) seeks to track the Nasdaq CTA Artificial and Robotics Index, which is made up of companies engaged in artificial intelligence and robotics in technology, industrials, and other sectors.

The ETF, started in 2018, surged during the pandemic, in part because tech stocks make up more than 60% of its holdings. The ETF currently owns 108 stocks, and the top five include Ambarella and four others:

- Gentex Corporation (NASDAQ:GNTX): A maker of automated and non-automated auto parts.

- Dynatrace (NYSE:DT): A provider of a software intelligence platform that monitors IT performance.

- Elbit Systems (NASDAQ:ESLT): An Israel-based maker of products for defense, homeland security, and commercial aviation operations.

- Cadence Design Systems (NASDAQ:CDNS): A designer of software and hardware building blocks for a wide range of products.

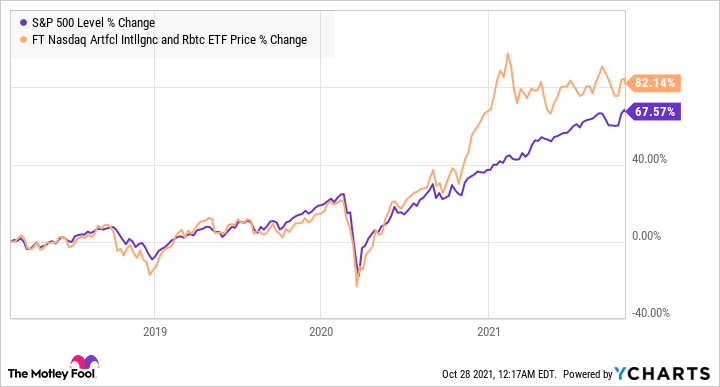

The First Trust ETF offers an expense ratio of 0.65% and a dividend yield of 0.18%. Although its trading history is relatively short, you can see from the chart below that it's beaten the S&P 500.

Which AI ETF should you own?

The best way to decide which ETF to buy is to consider which stocks a fund holds and how many of them are true AI companies. A fund's expense ratio, dividend yield, and past performance are also important. You can opt to invest in a basket of all four of these artificial intelligence ETFs to maximize your diversification.