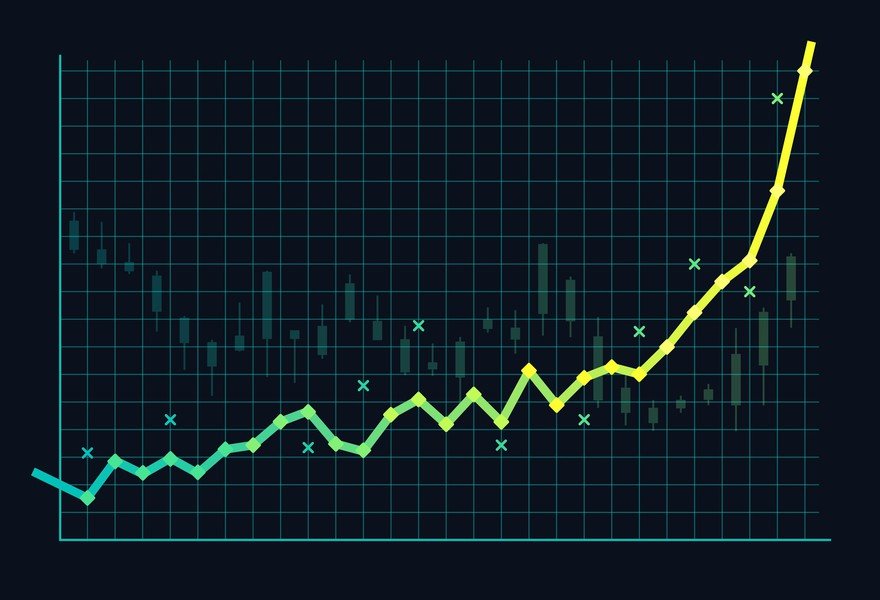

Some of the best investments over the past few years have been growth tech stocks. A growth tech stock is exactly what it sounds like -- the stock of a tech company enjoying rapid growth. Growth tech stocks tend to be comparatively expensive based on valuation metrics, and the companies aren't always profitable. A growth tech stock is highly valued for the company's ability to increase revenue quickly.

Growth stocks have suffered a setback recently after many years of strong performance. Inflation concerns, supply chain constraints, geopolitical factors, and a tightening economy have led to a shift away from big growth stocks to value stocks and other safe havens.

Top growth tech stocks

There are many growth tech stocks to consider, but the best of the bunch have long track records of robust growth, massive profit potential, and major competitive advantages. The top growth tech stocks include Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA), Adobe (NASDAQ:ADBE), Salesforce.com (NYSE:CRM), and Meta Platforms (NASDAQ:META).

1. Amazon

E-commerce and cloud computing giant Amazon is the premier growth tech stock. The company is dominant in online retail, with more than 200 million paying Amazon Prime members and an unrivaled selection of products and shipping speeds. More than half of items sold are from third-party sellers who pay Amazon lucrative fees for access to its massive customer base.

The cloud computing business is even more impressive. Amazon Web Services (AWS) is wildly profitable, and it's the leading provider of public cloud infrastructure. AWS has generated around $65 billion of revenue over the past year, and it's still growing at a high double-digit pace.

Amazon's advertising segment has also maintained robust growth. The company generates more than $30 billion annually in high-margin ad revenue, and it's the fastest-growing segment of the company.

Amazon is facing a significant slowdown in its retail operations after the massive growth it enjoyed in 2020 and 2021. Still, its investments in its logistics operations, AWS, and advertising ought to produce sustained growth for years to come as it works through the current weakness in retail.

2. Microsoft

Software and cloud giant Microsoft has benefited from the COVID-19 pandemic, although the company really didn't need the help. Microsoft Windows is the dominant PC operating system, Microsoft Office is still the top productivity suite, and Microsoft Azure is the No. 2 cloud computing provider in the world.

On top of that, Microsoft's gaming and devices businesses are experiencing solid growth. The company has a presence in the online collaboration and videoconferencing markets with Microsoft Teams, which rivals both Slack (NYSE:WORK) and Zoom (NASDAQ:ZM). Microsoft has a lot of irons in the fire, to say the least.

All this translates into impressive growth. Revenue soared 18% in Microsoft's latest quarter, and operating income went up by 19%. Azure is growing faster than market leader Amazon Web Services, with cloud services revenue increasing at almost a 50% clip. It remains a robust driver of growth for the massive software company.

3. Nvidia

Nvidia designs graphics processing units (GPUs), including chips, which are in high demand for a variety of reasons. Computer gamers buy Nvidia GPUs to enjoy higher-quality graphics and improved console performance. Data center customers buy Nvidia GPUs to accelerate workloads, particularly artificial intelligence (AI) workloads. People mining certain cryptocurrencies buy Nvidia GPUs for their processing power.

A global chip shortage, combined with a surge in cryptocurrency prices, created a severe shortage of graphics chips, which caused prices to rise and inventory to be increasingly scarce. Nvidia is profiting accordingly. Revenue climbed by 53% in the company's latest quarter, with both the gaming and data center segments producing significant growth. Its professional visualization products are also expanding in the triple digits and starting to produce a meaningful contribution to revenue growth.

The current shortage won't last forever, though, and Nvidia faces an increasingly competitive AMD (NASDAQ:AMD) in the graphics chip market. Intel (NASDAQ:INTC) is also looking to break into the market, potentially adding a third major competitor. Despite the rising competition, Nvidia should enjoy sales growth from PC gamers, metaverse hardware makers, and data center customers.

4. Adobe

Software giant Adobe is breaking records. Sales grew by 23% in 2021 to $15.79 billion, the highest annual sales in the company's history. Adobe earned an incredible amount of profit from its sales, with a net income of $4.82 billion for the year. It continued that strength into 2022 with strong first-quarter results.

Adobe's core business is creative software. The company makes Photoshop, Illustrator, Premiere Pro, and a wide variety of other creative software products. Adobe's products are often viewed as the industry standard. Although there is competition, none of it is particularly threatening given Adobe's entrenched status.

Adobe sells its products through subscriptions to its Creative Cloud. The subscription approach lowers the cost of entry into Adobe's ecosystem, removes the need to constantly sell customers on new versions of software, and generates reliable streams of recurring revenue.

Adobe also participates in the growing digital advertising and e-commerce segments through its Digital Experience and Publishing and Advertising segments. It offers analytics for marketers and other professionals to manage customers and potential customers.

With double-digit growth, extreme profitability, and a dominant set of products, Adobe is certainly a top growth tech stock.

5. Salesforce.com

Salesforce.com is the leader in cloud-based customer relationship applications for sales, marketing, and more. As more businesses shift to digital and omnichannel customer relationships, Salesforce's software-as-a-service (SaaS) plays an important role in helping businesses of all sizes.

Sales continue to grow quickly at the company and were up about 25% last year. In addition, operating margin continues to expand, reaching about 18.7%. Management expects revenue growth to slow to about 20% this year but operating margin to climb to 20%. The pattern should continue for the foreseeable future, with revenue expected to top $50 billion in fiscal 2026, almost doubling from last year.

Salesforce's lead in customer relationship management (CRM) software is supported by very high switching costs. Few managers will risk changing from a market-leading software solution that works fine for an unproven product requiring setup and training expenses.

Salesforce operates four software suites (clouds) that it can cross-sell to existing customers. That has fueled revenue growth -- and, more importantly, its margin expansion -- in recent years. With this scenario, the company ought to continue producing strong growth for years to come.

6. Meta Platforms

Facebook changed its name to Meta Platforms at the end of 2021 to signify its shifting focus toward the metaverse. While the metaverse presents a significant growth opportunity for the leader in virtual reality (VR) hardware, digital advertising is still its core business.

Management expects some setbacks in 2022 for that digital advertising business. The company saw ad revenue growth slow to about 6% in the first quarter. Management is tempering its operating expenses as it works through the current challenges with its advertising business.

Still, Meta's massive user base of almost 3 billion people across its family of apps -- Facebook, Instagram, Messenger, and WhatsApp -- makes its ad platform appealing to small and large businesses. The company is also pushing social commerce solutions to enable better ad measurement and performance on its platforms amid privacy restrictions.

Meanwhile, Meta's efforts in the metaverse are expanding very quickly. Its Reality Labs revenue grew 30% in the first quarter, fueled by the success of the Oculus Quest 2. The company has shipped more than 10 million units of the VR headset. It's investing heavily in the future of VR, which is currently generating greater losses for the company than in previous years.

With a strong core advertising business and an eye toward the future, Meta Platforms is setting itself up for continued growth.

How to find tech stocks poised for growth

The two most important factors to help you identify tech stocks poised for growth are the company's industry sector and its rate of sales growth:

- Industry sector: Tech companies in some sectors are growing more rapidly than others. Focus on those companies in industries likely to be much larger in the future such as e-commerce, cloud computing, and AI.

- Rate of sales growth: This metric is an important one to consider when judging the attractiveness of a growth stock. The ability to consistently expand revenues at double-digit rates is critical, especially as a company gets bigger. It's much easier to increase sales of $10 million by 30% than it is to expand $1 billion of sales by the same percentage. The best growth tech stocks maintain rapid growth rates as they scale.

Related investing topics

Profitability isn't all that important if you're looking for the next big tech stock. Many tech companies aggressively focus on growing as fast as possible, sacrificing profit for increasing scale. That's not a bad idea if the customer base is likely to stick around for the long haul. It makes sense for a subscription software company, for example, to spend heavily to win a customer who may generate revenue for many years to come.

When it comes to profitability, it's important that the company's performance is at least improving. Gross margin should be rising, and the company's path to turning a profit should be clear and viable.

Some growth-focused companies never turn a profit and ultimately turn out to be poor investments. And, even if you do identify the next top tech stock, remember that pricey growth stocks often have much higher volatility than the S&P 500 (SNPINDEX: ^GSPC). Massive, painful declines in stock price are common with fast-growing tech stocks, and it can take an iron constitution to endure those declines without panicking.

Growth tech stocks can provide outsized returns over the long term, and the best growth tech stocks can yield life-changing returns. But choose wisely to avoid the pitfalls that are inherent to growth investing.