Semiconductor companies design and manufacture computer chips and related components. They are part of the technology sector but are also manufacturers, which means their business is cyclical like any manufacturing or commodity business.

Picking top-performing semiconductor stocks in the industry can be tricky, and their performance is highly volatile since sales volumes ebb and flow. But the semiconductor sector is growing rapidly as the world enters a digital-first era in the wake of COVID-19. In fact, industry titan Intel (NASDAQ:INTC) has said it sees annual global spending on semiconductors reaching $1 trillion by the end of the 2020s, up from an expected $600 billion in 2022.

Clearly, these building blocks of technology deserve investor attention.

What trends drive semiconductor stocks?

Computer chips have many uses, but up-and-coming semiconductor companies will likely focus on two areas of growth in the decade ahead:

Connectivity and mobility

Think 5G mobile networks and self-driving cars.

Computing accelerators

Graphics processing units (GPUs), which are in demand among video gaming enthusiasts and cryptocurrency miners, but especially for data centers as AI (artificial intelligence) is adopted across the economy.

In the U.S. -- which accounts for about half of global semiconductor spending, according to the Semiconductor Industry Association -- semiconductor chips are now the nation’s fourth-largest export. With one-fifth of semiconductor manufacturing budgets being spent on research and development, these small hardware components are responsible for many technological advances in other areas of the economy.

The U.S. accounted for nearly half of the $420 billion in global semiconductor spending in 2020.

Best semiconductor stocks

Here are two top picks for semiconductor industry secular growth trends:

Qualcomm

Qualcomm (NASDAQ:QCOM) is the long-time leader in mobile chip design.

Historically, Qualcomm has been a key Apple (NASDAQ:AAPL) supplier, having profited from the smartphone boom over the past decade. The smartphone market has matured in recent years, but Qualcomm has used its connectivity chip know-how to expand into new areas such as the Internet of Things and automotive technology. Additionally, 5G networks are creating a massive upgrade cycle as telecom companies update their services and consumers buy new smartphones to take advantage of the new network performance.

Qualcomm’s long-term growth is particularly tied to increases in connected devices ranging from wearable devices to “smart” household appliances to connected industrial equipment and vehicles. Profit margins on many of these end markets are even higher than the older smartphone business.

As a result, Qualcomm has avoided some of the steeper sales declines other connectivity chipmakers have experienced while positioning itself to earn higher revenue as mobile networks evolve. With 5G changing the networking landscape, Qualcomm’s mobile chip business is getting a second wind.

Nvidia

The semiconductor chip company is the industry's leading GPU maker. Nvidia (NASDAQ:NVDA) is also earning higher-than-average profit margins and using the money to invest in research and product development, pursue new markets, and expand revenue.

Nvidia started out designing GPUs for high-end computer game graphics and has been benefiting from the expanding uses of GPUs. The company has also developed an extensive software library and cloud computing platform -- often free for customers -- to facilitate the application of its chips to novel uses such as AI, machine learning, and self-driving cars.

As a GPU pioneer, Nvidia has a big head start on designing semiconductors for the AI movement. Global spending on AI is expected to increase by around 20% in 2022 and break the $500 billion mark by 2023, according to the technology research firm IDC. More than just a semiconductor designer, Nvidia is also developing an ever-expanding library of cloud-based subscription software and services (such as a business AI software platform) built on its powerful hardware.

Nvidia has been applying its technology to other areas. It completed its acquisition of the data center networking and connectivity company Mellanox in early 2020. Additionally, Nvidia has started using ARM Semiconductor designs to go after other parts of the modern data center, including the release of new central processing units (CPUs) to make further inroads against legacy chip leaders such as Intel.

Best semiconductor ETFs

If you would rather not select among the stocks of individual companies in the semiconductor industry, you can gain exposure to the more gradual overall growth of the sector by investing in exchange-traded funds (ETFs).

Two top semiconductor ETFs are:

- iShares Semiconductor ETF (NASDAQ:SOXX): The ETF contains 30 chip companies, has an annual expense ratio of 0.4%, and manages more than $7.3 billion in assets.

- VanEck Vectors Semiconductor ETF (NASDAQ:SMH): The fund owns 25 stocks encompassing semiconductor chip companies from around the globe. It has an annual expense ratio of 0.35% and manages $7.1 billion in assets.

Undervalued semiconductor stocks

When looking for the best chipmakers and long-term undervalued semiconductor stocks to buy, consider these four key factors:

1. Sustainable revenue growth

Companies that gradually increase their sales over time are the best investments, but overall revenue growth matters even more for semiconductor stocks.

Many companies in this sector struggle to cope with the industry’s cyclical nature. Hardware, such as computer chips, tends to become a commodity over time. If a new market is growing quickly, other chipmakers pile on with similar products. Supply swells, prices fall, and individual company sales decline. If a semiconductor chip company isn’t constantly innovating and finding new outlets for its hardware tech, weathering the cycle can be unsustainable.

2. Above-average profit margins

Sales need to translate to profits. Companies that cannot control their expenses have low profit margins, and companies with high profit margins have a greater ability to reinvest in research and improve their operations. High gross profit, operating profit, and free cash flow generation are also positive indicators that the company is operating efficiently.

3. Attractive returns on invested capital

A company’s return on invested capital (ROIC) indicates how well it’s able to generate profit from the cash it raises via debt and equity it receives. A high ROIC means the company is likely innovating strategically and improving operations to increase efficiency.

4. Strong balance sheet

Manufacturing tends to be expensive, so it’s especially important to understand how semiconductor companies obtain the necessary financial resources to expand. Take, for example, chip manufacturers such as the world’s largest Taiwan Semiconductor Manufacturing (NYSE:TSM). For a chip business, the company has above-average debt compared to its revenue. However, it also has more cash and investments than it does debt, which signifies a healthy and profitable business that has no problems getting funding.

A company's balance sheet that has more cash than debt, and low debt relative to operating profit, is a key metric to watch. Plenty of cash relative to debt means that a company is well-positioned to pay interest and principal payments, even in a pinch.

Related topics

Are semiconductors a good investment?

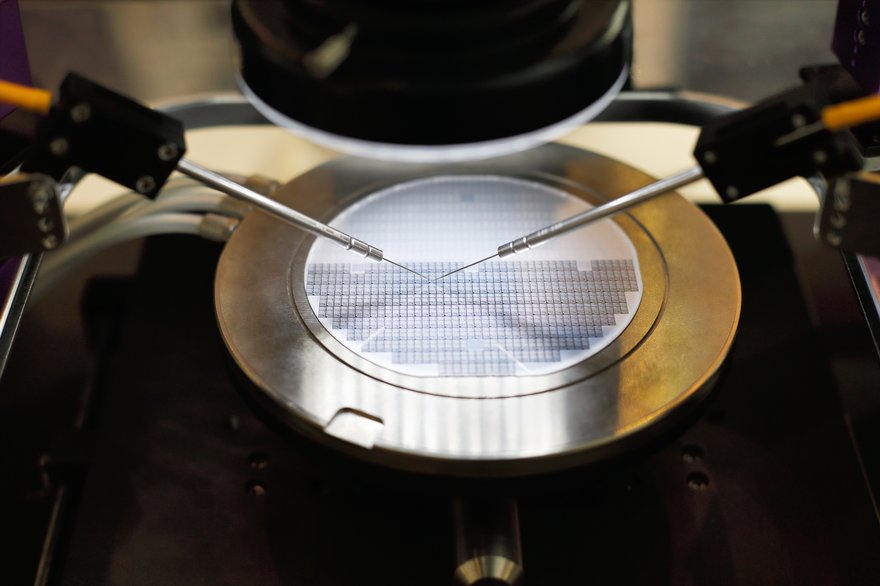

The performance of semiconductor stocks can be unpredictable, and the semiconductor industry is complicated. There are hundreds of steps involved in manufacturing the most advanced circuitry, and dozens of players are involved in producing the equipment used to make semiconductor chips.

Shares in even the most promising companies in the industry can be volatile, so investing in top-performing semiconductor stocks requires a willingness to accept a degree of uncertainty. Over the long term, though, investing in these building blocks of technology will likely continue to be profitable as demand for semiconductor chips continues to rise.