A Dividend Aristocrat is a company in the S&P 500 index that has paid -- and increased -- its base dividend every year for at least 25 consecutive years.

S&P Dow Jones Indices, which owns the S&P 500 index, reviews the list of qualifying companies every year and updates the list of companies that carry Dividend Aristocrat status. Their impressive track records of growth make Dividend Aristocrats some of the most attractive dividend stocks to own.

Dividend Aristocrats list

As of June 22, 2022, there are 65 Dividend Aristocrats. Here's the full list, sorted by how many consecutive years each has increased its dividend:

| Company | Sector | Consecutive Years of Dividend Growth |

| Dover (NYSE:DOV) | Industrials | 66 |

| Genuine Parts (NYSE:GPC) | Consumer discretionary | 66 |

| Procter & Gamble (NYSE:PG) | Consumer staples | 66 |

| Emerson Electric (NYSE:EMR) | Industrials | 65 |

| 3M (NYSE:MMM) | Industrials | 64 |

| Cincinnati Financial (NASDAQ:CINF) | Financials | 61 |

| Coca-Cola (NYSE:KO) | Consumer staples | 60 |

| Johnson & Johnson (NYSE:JNJ) | Healthcare | 60 |

| Colgate-Palmolive (NYSE:CL) | Consumer staples | 59 |

| Illinois Tool Works (NYSE:ITW) | Industrials | 58 |

| Hormel Foods (NYSE:HRL) | Consumer staples | 56 |

| Stanley Black & Decker (NYSE:SWK) | Industrials | 54 |

| Federal Realty Investment Trust (NYSE:FRT) | Real estate | 54 |

| Sysco (NYSE:SYY) | Consumer staples | 53 |

| W.W. Grainger (NYSE:GWW) | Industrials | 51 |

| Becton, Dickinson & Co. (NYSE:BDX) | Healthcare | 50 |

| PPG Industries (NYSE:PPG) | Materials | 50 |

| Target (NYSE:TGT) | Consumer discretionary | 50 |

| AbbVie (NYSE:ABBV) | Healthcare | 50 |

| Abbott Laboratories (NYSE:ABT) | Healthcare | 50 |

| Kimberly Clark (NYSE:KMB) | Consumer staples | 50 |

| PepsiCo (NASDAQ:PEP) | Consumer staples | 50 |

| Nucor (NYSE:NUE) | Materials | 49 |

| S&P Global (NYSE:SPGI) | Financials | 49 |

| Archer-Daniels-Midland (NYSE:ADM) | Consumer staples | 49 |

| Walmart (NYSE:WMT) | Consumer staples | 49 |

| VF Corp. (NYSE:VFC) | Consumer discretionary | 48 |

| Consolidated Edison (NYSE:ED) | Utilities | 48 |

| Lowe's (NYSE:LOW) | Consumer discretionary | 48 |

| Automatic Data Processing (NASDAQ:ADP) | Information technology | 47 |

| Walgreens Boots Alliance (NASDAQ:WBA) | Consumer staples | 46 |

| Pentair (NYSE:PNR) | Industrials | 46 |

| McDonald's (NYSE:MCD) | Consumer discretionary | 45 |

| Medtronic (NYSE:MDT) | Healthcare | 45 |

| Sherwin-Williams (NYSE:SHW) | Materials | 44 |

| Franklin Resources (NYSE:BEN) | Financials | 40 |

| Air Products & Chemicals (NYSE:APD) | Materials | 40 |

| Aflac (NYSE:AFL) | Financials | 39 |

| Amcor PLC (NYSE:AMCR) | Materials | 39 |

| ExxonMobil (NYSE:XOM) | Energy | 39 |

| Brown-Forman (B Shares) (NYSE:BF.B) | Consumer staples | 38 |

| Cintas (NASDAQ:CTAS) | Industrials | 38 |

| Atmos Energy Corporation (NYSE:ATO) | Utilities | 38 |

| McCormick & Co. (NYSE:MKC) | Consumer staples | 36 |

| T. Rowe Price Group (NASDAQ:TROW) | Financials | 36 |

| Cardinal Health (NYSE:CAH) | Healthcare | 36 |

| Clorox (NYSE:CLX) | Consumer staples | 35+* |

| Chevron (NYSE:CVX) | Energy | 35 |

| Ecolab (NYSE:ECL) | Materials | 30 |

| A.O. Smith (NYSE:AOS) | Industrials | 30 |

| West Pharmaceutical Services, Inc. (NYSE:WST) | Healthcare | 29 |

| Linde (NYSE:LIN) | Materials | 29 |

| Roper Technologies (NYSE:ROP) | Industrials | 29 |

| Caterpillar (NYSE:CAT) | Industrials | 29 |

| Chubb (NYSE:CB) | Financials | 29 |

| Expeditors International of Washington, Inc. (NASDAQ:EXPD) | Industrials | 29 |

| Albemarle Corp. (NYSE:ALB) | Materials | 28 |

| Essex Property Trust, Inc. (NYSE:ESS) | Real estate | 28 |

| Realty Income Corporation (NYSE:O) | Real estate | 28 |

| International Business Machines (NYSE:IBM) | Information technology | 28 |

| NextEra Energy Inc. (NYSE:NEE) | Utilities | 28 |

| Brown & Brown (NYSE:BRO) | Financials | 28 |

| Church & Dwight (NYSE:CHD) | Consumer Staples | 26 |

| General Dynamics (NYSE:GD) | Industrials | 25 |

Data as of June 22, 2022. Source: S&P Dow Jones Indices and company filings. *According to best available data.

There's also a Dividend Kings list. To be a Dividend King, a company has to have boosted its dividend every year for an incredible 50 years in a row, but does not have to be in the S&P 500.

Dividend Aristocrats changes for 2022

The following companies were removed from the Dividend Aristocrats list for 2022:

- People's United Financial was acquired by M&T Bank (NYSE:MTB) in April 2022 and removed from the index

- AT&T (NYSE:T) was removed in January due to its announced plans to reduce its dividend later in 2022

Two companies joined the Dividend Aristocrats list in early 2022:

- Brown & Brown was added Feb. 1, 2022

- Church & Dwight was added Feb. 1, 2022

Potential Dividend Aristocrats changes in 2022

Barring a surprise dividend payout cut, there aren't likely to be any major changes to the Dividend Aristocrats list this year.

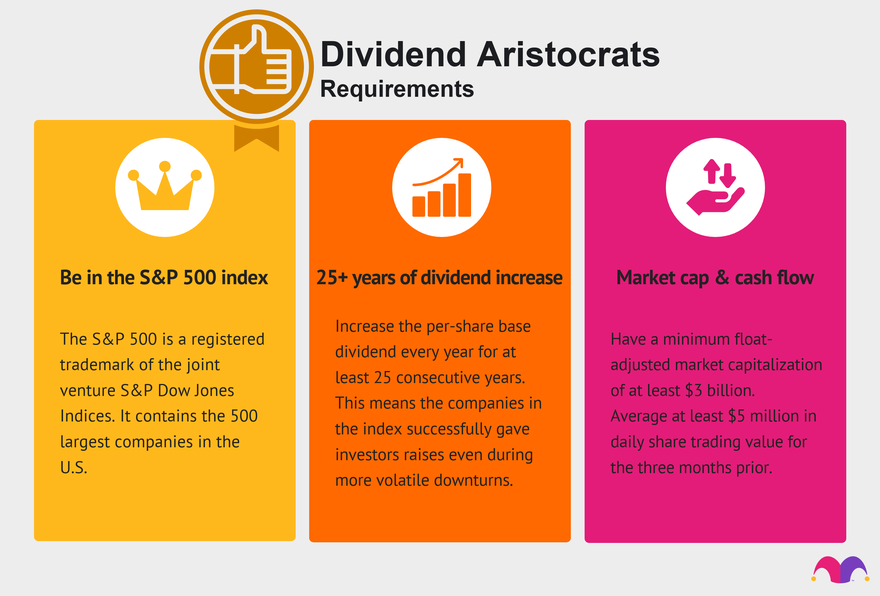

How Dividend Aristocrats are selected

The standards make it difficult for companies to get on the list. But once a company makes the list, it is likely to stay.

Below are the four criteria to become (and remain) a Dividend Aristocrat:

- Be a member of the S&P 500.

- Increase the per-share base dividend (excluding special dividends) every year for at least 25 consecutive years.*

- Have a minimum float-adjusted (excluding "closely held" shares owned by insiders or founders) market capitalization of at least $3 billion.

- Average at least $5 million in daily share trading value for the preceding three months.

*Note: The index managers can add companies that don't meet all of the criteria for sector exposure purposes.

When is the Dividend Aristocrats list updated?

The Dividend Aristocrats list is updated periodically by S&P Dow Jones Indices.

- Once each year in January, companies are added and removed based on the requirements.

- At the beginning of each quarter, the index is reweighted, meaning the size of each constituent is reset so they all make up an equal percentage of the index.

- On rare occasions, a stock may lose Dividend Aristocrat status.

Although the Dividend Aristocrat index doesn't change much, more companies tend to lose their status during recessions. In 2009 and 2010, 19 total companies (half of which were banks or financial institutions) fell off the list after cutting dividends due to the global financial crisis.

Is there a Dividend Aristocrats index fund?

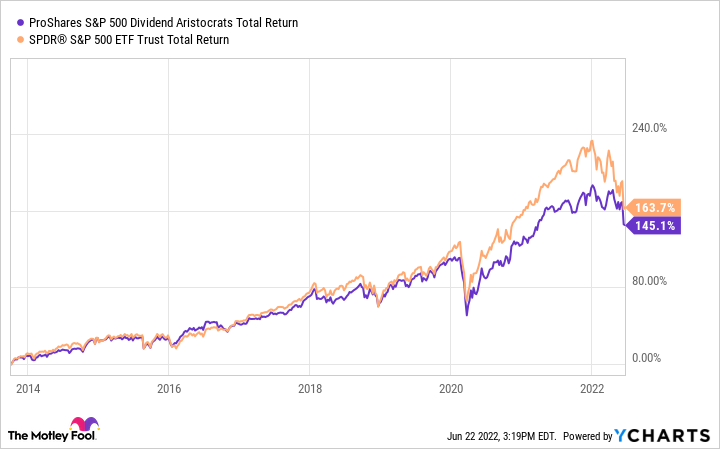

Yes, the ProShares S&P 500 Dividend Aristocrats ETF is a low-cost index fund that makes it simple to own the full Dividend Aristocrats list.

Those looking for a simple, low-cost way to invest in the entire Dividend Aristocrats universe should give this exchange-traded fund (ETF) consideration.

Are Dividend Aristocrats good investments?

Historically speaking, yes, but it depends on what you're looking for from your investment. The pros of investing in Dividend Aristocrats include:

- Reliability: Fans of dividend investing appreciate a reliable source of income.

- Industry leaders: These companies tend to be leaders in their industries, with reliable cash flow and a track record of impressive annual returns.

- Reduced volatility: Dividend Aristocrats are less volatile than the broader market.

That being said, in recent history, Dividend Aristocrats as a group have underperformed the S&P 500 in total returns. The chart below shows how the ProShares S&P 500 Dividend Aristocrats ETF (NYSEMKT:NOBL) index fund has performed in total returns -- which includes dividends -- since its inception in late 2013:

So, why would investors still look at the S&P Dividend Aristocrats?

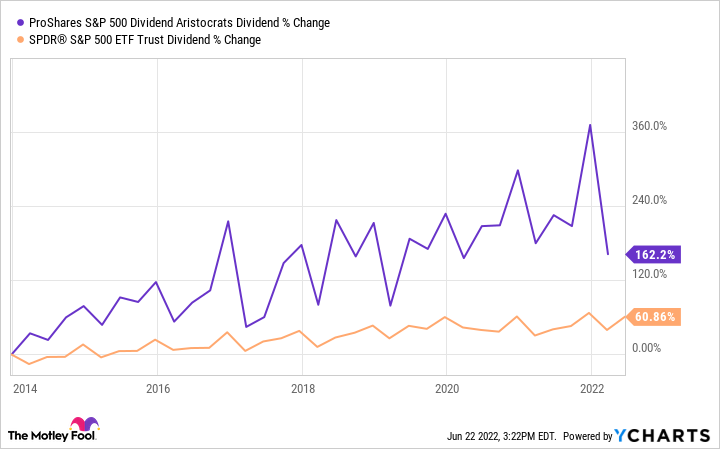

When it comes to dividend growth, Dividend Aristocrats absolutely shine. The Dividend Aristocrats Index has increased the dividend payout much faster than the S&P 500 since the ProShares S&P 500 Dividend Aristocrats ETF paid its first dividend in early 2014.

For investors looking to maximize dividend growth, Dividend Aristocrats remain compelling.

Should you buy individual Dividend Aristocrat stocks?

Your long- and short-term objectives, as well as the kinds of companies you want to own, come into play.

For instance, if you're looking for immediate income, you may want to avoid companies with lower dividend payouts. If long-term growth is your focus, you may be better off buying Dividend Aristocrats with higher growth prospects, even if they have lower dividend payouts.

Whether you're looking to pick individual stocks to suit your investing style and goals or for other reasons, such as socially responsible investing goals, Dividend Aristocrats can be an excellent starting point for finding the best-in-class dividend growth stocks.