Investors who own dividend-paying stocks face the question of what to do with this cash. You have several options:

- Spend it. Use the cash to supplement your income.

- Save it. Bank the money to fund a future expense.

- Invest it. Combine the dividend with other payments or sources of cash to buy shares of a different company or fund.

- Reinvest it. Use the money to buy more shares of the same company.

Here's a look at this latter strategy to help determine if it's right for you.

What is dividend reinvestment?

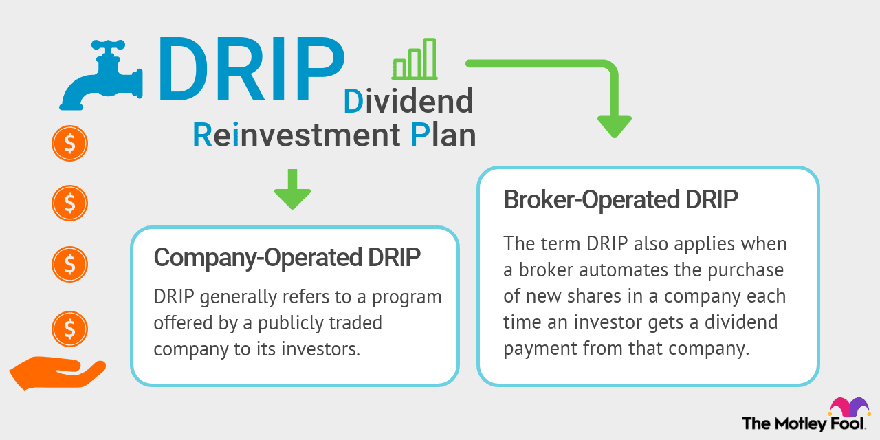

Dividend reinvestment is using the cash dividend paid by a company or fund to buy more shares of that same investment. Any investor can use this strategy since most brokerage accounts have automatic dividend reinvestment programs that automate the purchase of new shares in that same stock, exchange-traded fund (ETF), or mutual fund. Similarly, many dividend-paying companies offer investors the opportunity to participate in a dividend reinvestment plan (also known as a DRIP). Meanwhile, even if a broker or company doesn't provide an automatic dividend reinvestment plan, an investor can manually reinvest their payments.

How does dividend reinvestment work?

Dividend reinvestment is a simple process. When a company pays a dividend, the broker or company uses that cash to buy more shares of the underlying investment, which is completely automated if an investor signs up for automatic dividend reinvestment or a DRIP program. As a result, instead of receiving a cash payment, an investor will get more shares of the company or fund based on the current market rate. If the dividend payment is less than the full share cost, an investor will receive fractional shares. Further, these purchase transactions are usually commission-free.

Here's an example to help investors understand how dividend reinvesting works. An investor owns 100 shares of a company that pays a $1 quarterly dividend. Thus, they would receive $100. However, because this investor signed up for their brokerage account's automatic dividend investment program, it gets reinvested into buying more shares. If shares trade at $25 apiece at the time of this dividend payment, this investor would then own 104 shares.

In the next quarter, this same investor would receive $104 in dividends. If the stock then traded at $26 per share, the investor's reinvested dividends would boost their shareholding up to 108 shares. This wealth-compounding process would continue until the investor sold the stock or turned off the automatic reinvestment program.

How to reinvest dividends

Investors can usually enroll in an automatic dividend reinvestment program through their brokerage account. They should be able to find this feature in their account settings menu. Once it's selected, investors usually have the following options:

- Automatically enroll all current and future stocks and funds.

- Enroll all the current stocks and funds in a portfolio.

- Select individual stocks and funds to automate.

Investors who chose to automatically reinvest all their current and future dividends will have a truly automated experience. This program will add new stocks or funds to the plan as soon as they enter the portfolio. Likewise, when a company initiates a dividend, it will automatically get reinvested since the initial enrollment covers all current and future dividend payers.

However, if an investor enrolls only their current stocks or a portion of their portfolio in the plan, they will have to add new ones manually. Because of that, they need to carefully consider whether they want the convenience of full automation or to retain some control over how they allocate a portion of their cash dividends.

Should I reinvest dividends?

There are many reasons why you might consider reinvesting your dividends. It's easy to set up, usually commission-free, typically allows the purchase of fractional shares, and enables investors to put cash to work quickly. However, the best reason to consider automatic dividend reinvestment is to benefit from the miracle of compounding.

That's evident in the returns a hypothetical investor could have earned in the S&P 500 with and without dividend reinvestment. For example, an investor who put $10,000 into an S&P 500 index fund in 1970 would have more than $350,000 by the end of 2019, according to data from Morningstar and Hartford Funds. That return is the price growth only, as it assumes no dividends.

However, adding in dividends changes the equation dramatically. Investors who reinvested their dividends back into that same S&P 500 index fund would have more than $1.6 million at the end of this 50-year period.

Given that much higher return potential, investors should consider automatically reinvesting all their dividends unless:

- They need the money to cover expenses.

- They specifically plan to use the money to make other investments, such as by allocating the payments from income stocks to buy growth stocks.

- They don't want to increase their allocation to a particular company or fund.

Dividend reinvestment tax

Are reinvested dividends taxable? Sometimes. Cash dividends are usually taxable even if investors reinvest that money automatically through their brokerage account or via the company's DRIP. However, tax rates can vary significantly depending on the type of dividend paid (qualified or non-qualified) and an investor's taxable income. The tax rate on qualified dividends is 0%, 15%, or 20%, depending on an investor's taxable income and filing status. Meanwhile, the tax rate of non-qualified dividends is the same as the investor's regular income bracket, which ranges from 10% to 37%.

In addition to qualified dividends earned by investors in the lowest income bracket, another type of payout that isn't taxable is those paid in stock by companies that don't give investors a choice between cash and stock. In a case like that, investors usually don't need to pay taxes on the stock dividend until they sell.

DRIP investing (dividend reinvestment plans)

Most investment brokers make it easy for an investor to reinvest all their dividends by setting up an automatic reinvestment plan. However, investors can also opt to participate in DRIPs offered directly by a dividend-paying company. These programs provide similar benefits to those offered by brokers since many are commission-free and enable investors to buy fractional shares. In addition to that, some companies sell shares via their DRIP program at a discount to the current market price.

However, not all DRIPs offer these benefits, so investors need to read the fine print carefully. For example, some companies have investment minimums such as a requirement to own a certain number of shares or a certain dollar value. Further, some also charge a service fee and a brokerage commission.

The bottom line on dividend reinvestment

Dividend reinvestment is a great way for an investor to steadily grow wealth. Many brokers and companies enable investors to automate this process, allowing them to buy more shares (even fractional ones) with each payment. That compounds their returns, which can add up over time.