If you're investing in dividend stocks, it's important to understand how and when a dividend is paid. In most cases, stock dividends are paid four times per year, or quarterly. There are exceptions, as each company's board of directors determines when and if it will pay a dividend, but the vast majority of companies that pay a dividend do so quarterly.

In addition to the when, it's also important to know how you'll get paid. There are also several important dates to know that determine if you are entitled to the dividend. Keep reading for a breakdown of this important information that every dividend investor needs to understand.

How often are dividends paid on stocks?

The vast majority of U.S. companies that pay dividends issue the payout quarterly. There are some exceptions, including a handful of companies that pay dividends every month, most notably Realty Income, which bills itself as "the monthly dividend company." Realty Income has paid a dividend every month for over 600 consecutive months, and is now a Dividend Aristocrat.

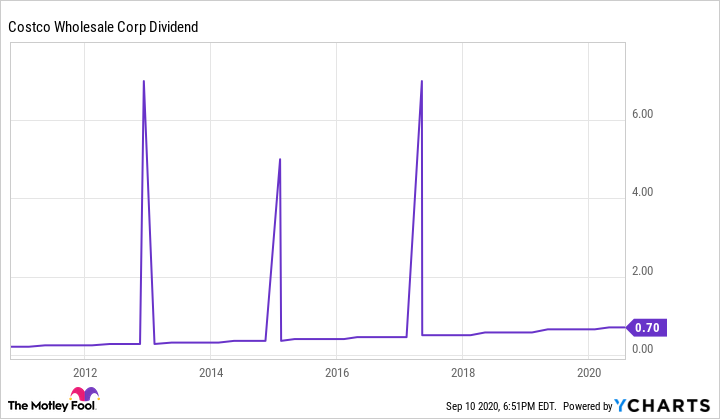

On rare occasions a company may issue what's known as a special dividend. Often this is the result of a large asset sale or some other event that results in a large nonrecurring profit, while other companies use a special dividend to return extra money to shareholders every few years. A notable example is Costco Wholesale (NASDAQ:COST), which has paid substantial special dividends three times over the past decade, in addition to its regular quarterly dividend:

Important dividend dates to know

There are three important dates to understand if you invest in any dividend stocks:

- The ex-dividend date is the first day a stock trades without the most recent dividend being factored into the share price. In other words, if you buy shares on or after this date, you will not get the next dividend the company is scheduled to pay.

- The payment date is the date a company will make the next dividend payment to shareholders. This may or may not be the date that the dividend arrives in your account; depending on the brokerage you use, there could be a delay of a day or more in getting your dividend payment. The payment date can range from just a few days to more than a month after the board of directors declares a dividend is coming.

- The record date is the date you must own shares on or before in order to be entitled to the dividend.

When do you have to buy a stock to get paid the next dividend?

Here's an example of how this works in real time. Apple (NASDAQ:AAPL) declared a dividend -- that is, made a formal disclosure that the board of directors had approved a dividend -- of $0.82 per share on July 30, 2020. The payment date was Aug. 13, to shareholders of record on Aug. 10, meaning the ex-div date was Aug. 7 (the prior Friday, since Aug. 10 was a Monday).

Let's break that down: Apple paid a dividend of $0.82 per share on Aug. 13 to all shareholders of record as of Aug. 10. This is where the ex-div date comes in. In order to be entitled to the upcoming dividend you would need to have owned or bought Apple shares before Aug. 7, the ex-div date for the upcoming dividend.

Here's a table of some popular dividend stocks to further illustrate these important dates:

| Company | Dividend Amount | Dividend Frequency | Declared Date | Record Date | Ex-Dividend Date | Payment Date |

|---|---|---|---|---|---|---|

| Apple | $0.82 | Quarterly | 7/30/2020 | 8/10/2020 | 8/7/2020 | 8/13/2020 |

| Coca-Cola (NYSE:KO) | $0.41 | Quarterly | 7/16/2020 | 9/15/2020 | 9/14/2020 | 10/1/2020 |

| AT&T (NYSE:T) | $0.52 | Quarterly | 6/26/2020 | 7/10/2020 | 7/9/2020 | 8/3/2020 |

| Realty Income (NYSE:O) | $0.2335 | Monthly | 8/18/2020 | 9/1/2020 | 8/31/2020 | 9/15/2020 |

To summarize: A company's board declares a dividend, to be paid on a certain date to shareholders of record as of a prior date. In order to be one of those shareholders of record, you need to buy or already own shares before the ex-div date, which is the business day before the record date.

How are dividends paid?

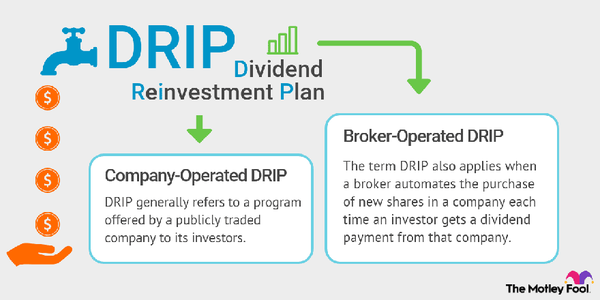

In the vast majority of cases, dividends are paid in cash by the company to your brokerage, which puts the money in your account. Some companies offer direct stock investment plans, but with low-cost -- in many cases zero-commission -- trading available from most online brokers, there's minimal benefit to using this option these days.

As to the when, the dividends show up in your brokerage account on or within a few days of the payment date, depending on your broker. If you're counting on those dividends for income, it might take a few more days to transfer that cash out of your brokerage account and into your banking accounts, so factor the additional time in for budgeting purposes.

There are also some stocks that don't pay in cash, instead paying in more shares of a company's stock. This is rare, but it does happen, so make sure you verify whether you're getting a cash or stock dividend. Generally companies make it clear if the dividend is not being paid in cash.

Again, if you want cash -- either as dividend income or to invest in other stocks -- a stock dividend means it will take a little longer to get your hands on actual money. You'll have to sell the shares, then wait for the trade to settle -- several more business days -- before your broker will let you take the cash out of your account.