Dividend investing can be a great investment strategy. Dividend stocks have historically outperformed the S&P 500 with less volatility. That's because dividend stocks provide two sources of return: regular income from dividend payments and capital appreciation of the stock price. This total return can add up over time.

Because of their lower volatility, dividend stocks often appeal to investors looking for lower-risk investments, especially those in or nearing retirement. But dividend stocks can still be risky if you don't know what to avoid. Here's a closer look at how to invest in dividend stocks.

How dividend stocks work

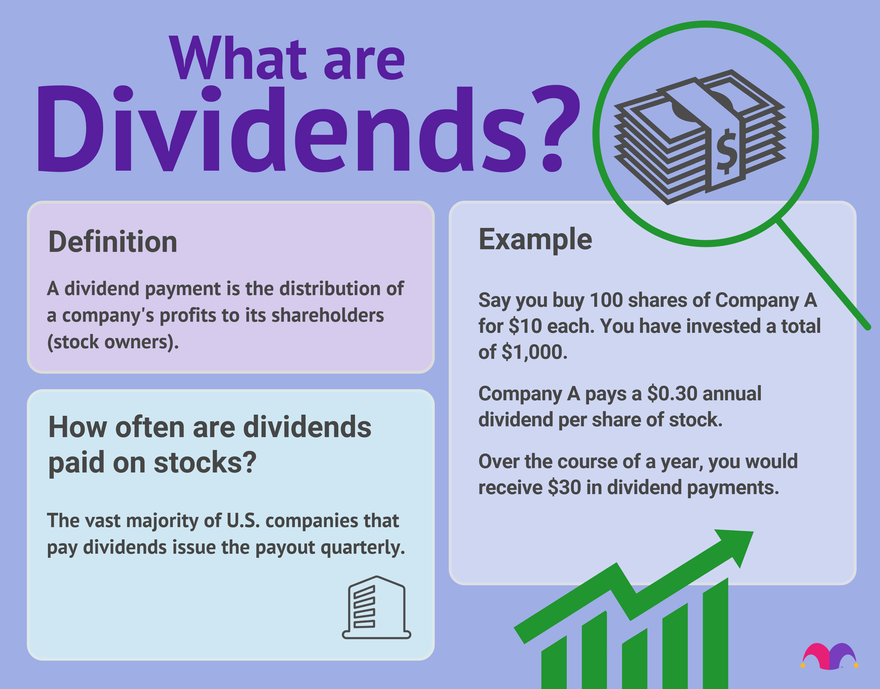

Let's look at an example. Say you buy 100 shares of a company for $10 each, and each share pays a dividend of $0.30 annually. If you invested $1,000, over the course of a year you would receive $30 in dividend payments. That works out to a 3% yield -- not too shabby.

What you choose to do with your dividends is up to you. You can:

- Reinvest them to buy more shares of the company.

- Buy stock in a different company.

- Save the cash.

- Spend the money.

Regardless of whether the company's stock price goes up or down, you would receive those dividend payments as long as the company continues to disburse them.

The beauty of stocks that pay dividends is that part of your return includes predictable quarterly payments. Not every company offering dividend stocks can maintain a dividend payout in every economic environment, which the COVID-19 pandemic has demonstrated. But a diversified portfolio of dividend stocks can produce reliable income rain or shine.

Combine those dividends with capital appreciation as the companies you own grow in value, and the total returns can rival, and even exceed, those of the broader market.

Examples of dividend stocks

Here are some well-known companies that have a long history of paying dividends, along with their dividend yields at recent stock prices and the per-share amount of each dividend:

| Company | Industry | Dividend Yield | Quarterly Dividend Amount |

|---|---|---|---|

| 3M (NYSE:MMM) | Industrial | 3.3% | $1.48 |

| Procter & Gamble (NYSE:PG) | Consumer defensive | 2.2% | $0.87 |

| Lowe's (NYSE:LOW) | Consumer cyclical | 1.3% | $0.80 |

Dividend yield and amount as of Jan. 16, 2022. Dividend amount is most recent per-share quarterly dividend paid.

All three of these companies have increased their stock dividends for more than 50 consecutive years. Because of that, they're in an elite group of companies known as the Dividend Kings. They're also part of the Dividend Aristocrats, companies with more than 25 years of consecutive dividend increases. Dividend stocks can come from just about any industry, and the amount of the dividend and percentage yield can vary greatly from one company to the next.

Dividend yield and other key metrics

Before you buy any dividend stocks, it's important to know how to evaluate them. These metrics can help you understand how much in dividends to expect, how reliable a dividend might be, and, most importantly, how to identify red flags.

- Dividend yield: This is the annualized dividend represented as a percentage of the stock price. For instance, if a company pays $1 in annualized dividends and the stock costs $20 per share, then the dividend yield would be 5%. Yield is useful as a valuation metric when you compare a stock's current yield to its historical levels. A higher-dividend yield is better, all other things being equal, but a company's ability to maintain the dividend payout -- and, ideally, increase it -- matters even more. However, an abnormally high dividend yield could be a red flag.

- Dividend payout ratio: This is the dividend as a percentage of a company's earnings. If a company earns $1 per share in net income and pays a $0.50-per-share dividend, then the payout ratio is 50%. In general terms, the lower the payout ratio, the more sustainable a dividend should be.

- Cash dividend payout ratio: This is the dividend as a percentage of a company's operating cash flows minus capital expenditures, or free cash flow. This metric is relevant because GAAP net income is not a cash measure, and various non-cash expenses can cause a company's earnings and its free cash flow to vary significantly from one period to the next. This variability can render a company's payout ratio misleading at times. Investors can use the cash dividend payout ratio, along with the simple payout ratio, to better understand a dividend's sustainability.

- Total return: This is the increase in stock price (known as capital gains) plus dividends paid. For example, if you pay $10 for a stock that increases in value by $1 and pays a $0.50 dividend, then that $1.50 you've gained is equivalent to a 15% total return.

- Earnings per share (EPS): The EPS metric normalizes a company's earnings to the per-share value. The best dividend stocks are companies that have shown the ability to regularly increase earnings per share over time and thus raise their dividend. A history of earnings growth is often evidence of durable competitive advantages.

- P/E ratio: The price-to-earnings ratio is calculated by dividing a company's share price by its earnings per share. The P/E ratio is a metric that can be used along with dividend yield to determine if a dividend stock is fairly valued.

High yield isn't everything

Inexperienced dividend investors often make the mistake of buying stocks with the highest dividend yields. While high-yield stocks aren't bad, high yields can be the result of a stock's price falling due to the risk of the dividend being cut. That's called a dividend yield trap.

Here are some steps you can take to avoid falling for a yield trap:

- Avoid buying stocks based solely on dividend yield. If a company has a significantly higher yield than its peers, that's often a sign of trouble, not opportunity.

- Use the payout ratios to gauge a dividend's sustainability.

- Use a company's dividend history -- of both payout growth and yield -- as a guide.

- Study the balance sheet, including debt, cash, and other assets and liabilities.

- Consider the company and industry itself. Is the company's business at risk from competitors, weak demand, or some other disruption?

Sadly, a yield that looks too good to be true often is. It's better to buy a dividend stock with a lower yield that's rock-solid than to chase a high yield that may prove illusory. Moreover, focusing on dividend growth -- a company's history and ability to raise its stock dividend -- often proves more profitable.

How are dividends taxed?

Most dividend stocks pay "qualified" dividends, which, depending on your tax bracket, are taxed at a rate of 0% to 20%. That range is significantly lower than the ordinary income tax rates of 10% to 37% or more. (An additional 3.8% tax is levied on certain investment income for the highest earners.)

While most dividends qualify for the lower tax rates, some dividends are classified as "ordinary" or non-qualified dividends and are taxed at your marginal tax rate. Several kinds of stocks are structured to pay high dividend yields and may come with higher tax obligations because of their corporate structures. The two most common are real estate investment trusts, or REITs, and master limited partnerships, or MLPs.

Of course, this extra tax burden doesn't apply if your dividend stocks are held in a tax-advantaged retirement plan such as an individual retirement account (IRA). However, investing in MLPs can sometimes leave you owing taxes even on your IRA.

Dividend investment strategies

There's a misconception that dividend stocks are only for retirees or risk-averse investors. That's not the case. You should consider buying dividend-paying stocks whenever you start investing to reap their long-term benefits. Dividend stocks, especially those in companies that consistently increase their dividends, have historically outperformed the market with less volatility. Because of that, dividend stocks are a great fit for any portfolio as they can help you build a diversified portfolio.

There are a few dividend strategies to consider. The first is to build a dividend portfolio as part of your overall portfolio. When you're building a dividend portfolio, it's important to remember that paying dividends isn't obligatory for a company in the same way that companies must make interest payments on bonds. That means that if a company has to cut expenses, the dividend could be at risk.

You cannot completely eliminate the risk of a dividend cut, but you can lower the risk. Focus less on a company's dividend yield and more on its ability to consistently increase its dividend. Look for a company with a sound financial profile focused on a growing industry.

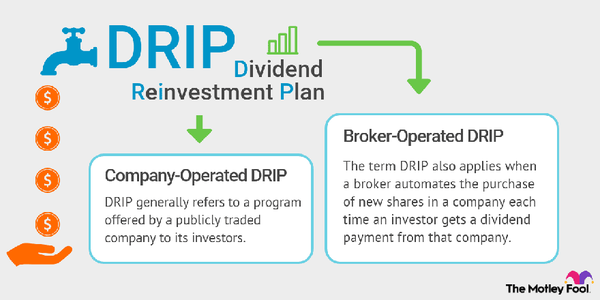

Another aspect of a dividend investing strategy is to determine how you want to reinvest your dividends. Some investors opt to reinvest their dividends manually, while others use a dividend reinvesting plan, also called a DRIP. This powerful tool will take every dividend you earn and reinvest it -- without fees or commissions -- back into shares of that company. This simple set-it-and-forget-it tool is one of the easiest ways to put the power of time and compounding value to work in your favor.

Another dividend investing strategy is to invest in a dividend-focused exchange-traded fund (ETF) or mutual fund. These fund options enable investors to own diversified portfolios of dividend stocks that generate passive income.

No matter what dividend strategy you use, adding dividend stocks to your portfolio can be beneficial. They can help reduce volatility and boost your total returns so that you can reach your financial goals a little faster.