Monthly dividend stocks offer investors the opportunity to generate recurring passive income. This frequency better aligns with the timing of many regular bills, allowing an investor to offset their expenses with dividend income. That makes monthly dividend stocks ideal for retirees or other investors who rely on their portfolios for income.

With monthly dividend payments in mind, here's a closer look at the top monthly high-yield dividend stocks for 2022. That combination makes these stocks great for earning passive income.

Top monthly dividend stocks for 2022

Nearly 50 stocks paid a monthly dividend in early 2022. However, not all of them are worth an investor's consideration. Many didn't offer an above-average dividend yield. Meanwhile, others seemed to be at a higher risk of reducing their dividends if market conditions deteriorate. That narrows the options considerably.

Here's a list of the best dividend stocks to consider in 2022:

| Monthly Dividend Stock | Ticker Symbol | Dividend Yield |

|---|---|---|

| EPR Properties | (NYSE:EPR) | 6.9% |

| Agree Realty | (NYSE:ADC) | 4.2% |

| Gladstone Commercial Corporation | (NASDAQ:GOOD) | 6.5% |

| LTC Properties | (NYSE:LTC) | 6.3% |

| Pembina Pipeline | (NYSE:PBA) | 7.9% |

| Realty Income | (NYSE:O) | 4.3% |

| SL Green | (NYSE:SLG) | 5.2% |

| STAG Industrial | (NYSE:STAG) | 3.4% |

Data source: Google Finance. Dividend yield as of Jan. 31, 2022.

Let's take a closer look at each of these top monthly dividend stocks. Each offers a much higher dividend yield than the average stock in the S&P 500 (1.3% as of Jan. 31, 2022).

EPR Properties

EPR Properties is another REIT. It specializes in owning experiential real estate such as movie theaters, eat-and-play venues, ski resorts, and gaming facilities. It secures these properties by signing triple-net leases with the venue operators.

The COVID-19 pandemic had a significant impact on experiential real estate. Many of these facilities had to temporarily close their doors or operate at reduced capacity. That impacted their ability to pay rent, which forced EPR Properties to suspend its monthly dividend in 2020.

However, with vaccines widely available, more people have the confidence to enjoy experiences outside the home again. Because of that, EPR's tenants are catching up on their rent. That allowed this REIT to resume its monthly dividend in July 2021.

While ERP Properties already offers an attractive yield, the company could increase that payout in the future as it expands its portfolio. It entered 2022 with lots of liquidity and a strong balance sheet, giving it the cash to acquire more experiential real estate. With movie theaters facing disruption from online streaming, EPR plans to target acquiring more attraction-related properties that consumers can only experience outside the home. That could improve its dividend's long-term durability.

Agree Realty

Agree Realty is a real estate investment trust (REIT). These companies often make for good monthly dividend stocks because they generate recurring rental income.

This REIT owns freestanding retail properties secured by triple-net leases, meaning the tenants bear the responsibility for building insurance, maintenance, and real estate taxes. It focuses on owning properties leased to essential retailers such as grocery, home improvement, dollar stores, and drug stores, which are less susceptible to disruption from e-commerce or a recession. This strategy enables Agree Realty to generate steady rental income to support its dividend.

Agree Realty switched from a quarterly to a monthly dividend payment schedule in January 2021. It has an excellent dividend track record overall. This REIT has increased its dividend at a 5.5% compound annual rate over the past decade.

That upward trend should continue as Agree Realty keeps expanding its portfolio. The retail REIT acquired a record $1.4 billion of properties in 2021, increasing its rental income and dividend-paying capacity. Agree Realty has a strong balance sheet to help finance its continued expansion. That leads it to forecast acquiring another $1.1 billion to $1.3 billion of properties in 2022 to support continued dividend growth.

Gladstone Commercial Corporation

Gladstone Commercial is a diversified REIT. It focuses on owning net-leased office and industrial properties in the U.S. -- each represents 48% of its portfolio -- along with some retail and medical office buildings. This REIT also concentrates on secondary markets because they offer higher investment yields.

This strategy enables Gladstone to generate very stable income, which has enabled it to pay a consistent dividend. This REIT has paid more than 200 consecutive monthly dividends either at or above the prior month's level. It offers a high yield with modest growth.

Gladstone Commercial has steadily expanded its portfolio over the years by acquiring additional office and industrial properties. It entered 2022 with ample liquidity and solid financials to support its monthly payout and continue expanding its portfolio.

LTC Properties

LTC Properties is a healthcare REIT. It primarily invests in senior housing and skilled nursing properties secured by triple-net leases, mortgage loans, and other cash-generating investment structures. This strategy provides the REIT with relatively steady income to support its monthly dividend.

The pandemic hit the senior housing sector hard, impacting LTC Properties' tenants. Several struggled to pay rent, which led some to file for bankruptcy. However, this REIT used its financial strength to weather the storm and offset some of the lost income with new investments. That's allowed it to maintain its monthly dividend.

With market conditions improving as the pandemic wanes, LTC Properties' rental income should increase in 2022. Add in its recent investments, and this REIT's high-yielding monthly dividend seems sustainable.

Pembina Pipeline

Pembina Pipeline is a Canadian energy infrastructure company. It operates pipelines, processing plants, storage terminals, and export facilities. The company primarily leases the capacity to utilize its assets to other energy companies under long-term, fixed-rate contracts. These agreements enable Pembina to generate steady cash flow.

Pembina has a solid dividend history as it has steadily grown its payout over the years. It should be able to continue increasing its dividend in the future as it completes additional energy infrastructure expansion projects. Pembina has an extensive backlog of secured projects and several more in its development pipeline to fuel future dividend growth.

In addition to continuing to support the movement of fossil fuels, Pembina is investing in lower-carbon projects. It's working with another Canadian energy infrastructure company on a carbon dioxide transportation and sequestration system to go along with its wind energy assets. It's also exploring opportunities in hydrogen. These moves into cleaner alternatives should help fuel continued dividend growth in the coming years.

Realty Income

When it comes to monthly dividend stocks, Realty Income is the clear leader. It bills itself as The Monthly Dividend Company. It has paid more than 600 consecutive monthly dividends as of early 2022. Further, Realty Income has increased its dividend more than 100 times since its initial public offering (IPO) in 1994, while increasing the payout at a 4.5% compound annual rate. That gives this REIT more than 25 years of dividend increases, qualifying it as a Dividend Aristocrat.

Realty Income should be able to continue providing investors with a steadily growing monthly income stream in the future. It acquired fellow REIT VEREIT (NYSE:VER) in 2021. In addition, it bought roughly $6 billion of properties in smaller deals. This acquisition spree will help boost its cash flow per share by more than 9% in 2022.

Realty Income has lots of room to keep growing. It estimates that the global market opportunity for the single-tenant net-lease real estate it targets is $12 trillion. Meanwhile, it has a strong balance sheet even after completing last year's acquisitions to continue buying more properties. Because of that, Realty Income should be able to keep expanding its portfolio in 2022 to support continued dividend growth.

SL Green

SL Green is another REIT and the largest office landlord in New York City. While the city's office sector has faced some pandemic-related challenges, SL Green has held up relatively well. That's due in large part to its focus on owning some of the highest-quality office properties in the city.

That's benefiting this REIT as the city's office market recovers and office tenants focus on leasing quality space for their employees. This office REIT exceeded its leasing target in 2021 and expects to sign even more leases in 2022. The demand shows that companies expect to return to their Big Apple offices in the future.

Meanwhile, office buildings remain highly sought after by institutional investors such as pension funds because they generate predictable income. That has allowed SL Green to sell select properties at attractive prices. It used that cash to repay debt, repurchase stock, fund new developments, and make acquisitions. These factors have also enabled this REIT to continue paying a growing dividend. In 2021, it notched its 11th consecutive dividend increase, making it a Dividend Achiever. With market conditions on the upswing, and new developments paying off, SL Green should be able to continue expanding its dividend in the future.

STAG Industrial

STAG Industrial is another REIT with a monthly dividend. It focuses on owning industrial real estate such as warehouses and light industrial facilities. These properties are in high demand. The pandemic accelerated e-commerce adoption and increased manufacturing in the U.S. to combat supply chain issues. That has kept occupancy levels high while pushing up rental rates, enabling STAG to generate steadily rising rental income.

STAG has been able to boost its dividend over the years. A big growth driver has been the REIT's ability to consistently expand its portfolio. STAG has added more than 400 properties to its portfolio since its IPO a decade ago, increasing its portfolio to more than 500 buildings.

This industrial REIT expects that steady expansion to continue. It's targeting $1 billion to $1.2 billion of property purchases each year. Add that to the growing rental income from its existing properties, and STAG should be able to continue increasing its monthly dividend.

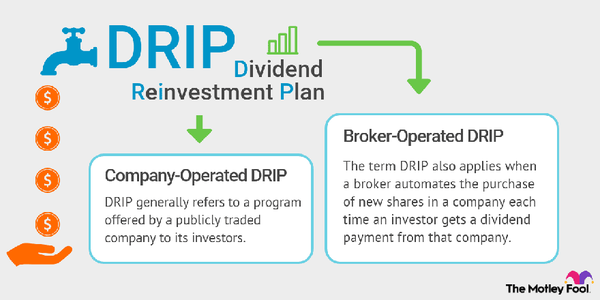

Invest in monthly dividend stocks for recurring income

Monthly dividend stocks make it easy for investors to earn passive income. They can use that money to cover their monthly expenses or reinvest their dividends and set themselves up to generate even more recurring cash flow in the future when they need it. While dozens of companies pay monthly dividends, these safe monthly dividend stocks stand out as top options for those seeking an attractive income stream that should grow in the future.