Preferred stocks are an interesting type of security with many qualities of fixed-income investments, but they aren't the same thing as bonds. Although they have characteristics of bonds, they also trade on major exchanges like common stocks. Even so, they are an entirely different type of investment.

With that in mind, here's an overview of preferred stocks, how they work, and what investors should know before considering them. We'll also discuss whether it's better to buy individual preferred stocks or invest through index funds.

What are preferred stocks?

Preferred stocks aren't quite stocks (at least not in the sense most people think of them), and they aren't quite bonds. They are somewhere in between the two.

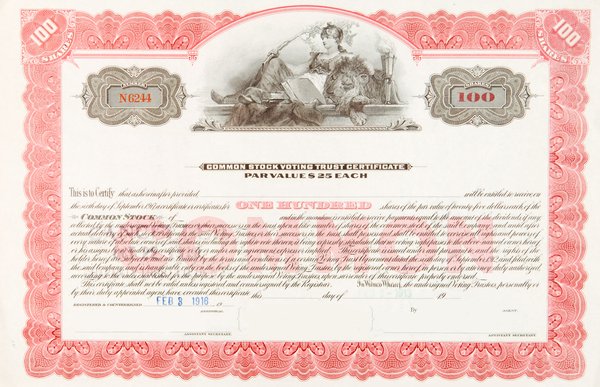

Like bonds, preferred stocks are a form of fixed-income security. They entitle the investor to dividend payments on a set schedule and are designed to generate income, not growth. Let's say you buy a preferred stock for $25 that has a 5% yield. You'll receive $1.25 per year in dividend income. This is the biggest difference between preferred and common stock.

Here's another important point. If the company's common stock doubles in value, the preferred stock isn't likely to do the same. You do not share in the equity appreciation generated by the business. Preferred stock share prices can certainly move, typically in response to interest rate fluctuations or the perceived health of the business, but the price isn't related to the profits of the underlying company.

Unlike bonds, however, preferred stocks are readily tradable on major stock exchanges. They also have a lower rank than bonds in a company's capital structure (more on that in the next section).

Preferred stock yields can be fixed or vary based on a benchmark interest rate. Preferred stocks can exist in perpetuity or have a set maturity date when the company pays investors the original (par) value of the shares and they are retired. And, like bonds, preferred stocks may be callable, meaning the company has the right, but not the obligation, to redeem the shares at a certain date if it chooses.

What to consider when buying preferred stocks

There are a few important things to consider when you're planning to invest in preferred stocks.

- Preferred stocks are subordinate to bonds when it comes to claims on a company's assets. In other words, in the event of a bankruptcy, bondholders would get paid before preferred stockholders could recoup their investment. In the capital structure of a company, preferred stockholders are superior to common stockholders (hence the name) but are not the senior debt holders. On the positive side, this is why preferred stocks tend to pay higher yields than bonds from the same company. However, it's important to keep in mind that this additional yield is compensation for the somewhat elevated level of risk faced by preferred stockholders.

- An important question is whether a preferred stock is perpetual, meaning that it continues to exist indefinitely, or if it matures at a specific date. It's also important to know if a preferred stock is callable so that the company can choose to redeem the shares and pay investors par value for them at any time.

- Another consideration is whether a particular preferred stock is convertible, meaning the shares can be converted to common stock at a predetermined conversion rate. This combines two potential perks -- the high income that preferred stocks pay with the upside potential if the common stock performs exceptionally well.

All of these details about each particular preferred stock should be in a prospectus available through the Securities and Exchange Commission (SEC) or on each company's investor relations webpage. Many companies that issue several series of preferred stock also publish handy investor guides that highlight the differences between each type. (As an example, check out Bank of America's (NYSE:BAC) preferred stock guide).

How to buy preferred stock

You can buy shares of preferred stock through your online brokerage with a simple click of the mouse, just like you would with a common stock.

Having said that, it's important to point out that the format of preferred stock symbols can vary a bit between brokers. Typically, preferred stock ticker symbols are the same as the company's common stock but with an additional letter to designate the series of preferred stock. For example, if you want to invest in Bank of America Series E preferred stock, the ticker symbol is BAC-E at many brokers. However, your broker might use a slightly different version, such as BAC'E or BAC.E. The point is that you should check with your broker to see how they format preferred stock tickers.

Investing in preferred stocks

You can certainly invest in individual preferred stocks. The vast majority of preferred stocks are issued by financial institutions, and they are also quite common among telecommunications providers and energy and utility companies. However, there are some companies in other sectors that issue preferred stock as well.

There are two big downsides to investing in individual preferred stocks. First, just like investing in individual common stocks, there's the risk associated with depending on the performance of a single company for your investment returns. Second, information on specific preferred stocks (what's available, maturity dates, stock symbols, etc.) can be difficult to find and hard to understand.

For the majority of investors, using index funds to invest in preferred stocks is the best option. The iShares U.S. Preferred Stock ETF (NASDAQ:PFF) is the largest preferred stock exchange-traded fund (ETF) by a significant margin and allows investors to put their money to work in a broad basket of preferred stocks. While the fund's 0.46% expense ratio is on the higher end for an index fund, it can still be a smart way to add preferred stock exposure to your portfolio without the homework involved with choosing individual preferred stocks. The Invesco Preferred ETF (NYSEMKT:PGX) is another good option investors may want to consider, with a similar objective and yield as the iShares fund.