Traditional 401(k)s use pre-tax dollars -- that is, your contributions reduce your taxable income for the year and you pay taxes on your withdrawals later. Roth 401(k)s work the opposite way: You pay taxes on your contributions in exchange for later tax-free withdrawals. But there's a third, lesser-known type of 401(k) contribution you may be eligible to make, known as an after-tax contribution.

After-tax 401(k) contributions blend the features of traditional and Roth 401(k)s, enabling you to save a lot more for retirement every year. Let's look at how after-tax 401(k) contributions work and how to know if they're a smart move for you.

How after-tax 401(k) contributions work

After-tax 401(k) contributions are known as "after-tax" because you owe income taxes on these contributions in the year you make them, just as with Roth 401(k) contributions. However, your earnings on after-tax contributions grow tax-deferred, like traditional 401(k) funds. When you withdraw the money in retirement or whenever you need the extra cash, you will owe taxes only on your earnings, not your contributions. This is true no matter your age or why you're withdrawing the funds.

If you choose, you can convert your after-tax 401(k) funds to a Roth IRA later on, assuming your plan allows this. You won't owe taxes on the converted amount because you already paid taxes the year you contributed the money, but future earnings will grow tax-free.

Not all plans permit after-tax 401(k) contributions, so it's important to check with your employer before exceeding the annual contribution limit.

When after-tax contributions are a good idea

Here are a few scenarios when making after-tax 401(k) contributions might make sense:

- You're a high earner: High earners who max out their tax-deferred 401(k) contributions can use after-tax contributions to set aside more money for retirement.

- You want to increase your emergency savings: You can withdraw after-tax 401(k) contributions at any time without paying taxes or penalties, so it's a great option for keeping extra emergency savings. Still, it's good practice to limit how often you take money out of your 401(k), as this hampers the growth of your savings.

- Your income is volatile: After-tax 401(k) contributions make sense if your income varies significantly from one year to the next. In your higher-earning years, after-tax 401(k) contributions enable you to contribute more money to your 401(k), and if you need some extra cash in a lower-earning year, you can draw upon your after-tax contributions without worrying about penalties and taxes.

Pros and cons of after-tax contributions

As with all types of 401(k) contributions, after-tax contributions have their pros and cons.

Pros of after-tax 401(k) contributions

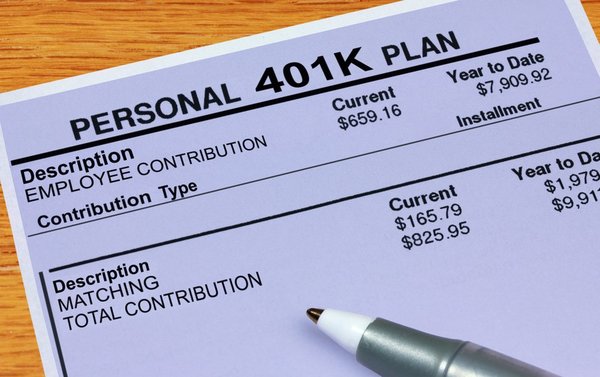

The primary advantage of after-tax 401(k) contributions is that you can contribute beyond the standard contribution limits every year. In 2021, you are allowed to defer only up to $19,500 (or $26,000 for those 50 or older) in salary to a traditional or Roth 401(k) for full tax benefits. Those amounts increase in 2022 to $20,500 and $27,000, respectively.

However, the IRS allows you to contribute up to a total of $58,000 (or $64,500 for those 50 or older) for 2021, or $61,000 (or $67,500 for those 50 or older). This includes salary-deferred contributions into your traditional and Roth 401(k), any employer match contributions, and any after-tax contributions.

After-tax contributions are also a great option for those who need to withdraw funds before 59 1/2 and don't have a Roth retirement account. Traditional 401(k) withdrawals require you to pay taxes plus a 10% early withdrawal penalty for doing this. If you withdraw only your after-tax contributions, you won't have to worry about those extra costs. However, after-tax 401(k) earnings are still subject to the usual taxes and penalties.

Cons of after-tax 401(k) contributions

Your plan may not allow after-tax 401(k) contributions. Always check with your company whether this is an option before exceeding the annual 401(k) contribution limit.

The biggest downside to these contributions is that you still owe taxes on your earnings, even though you don't have to pay them right away. You can minimize your taxable earnings by rolling the funds over into a Roth 401(k) or a Roth IRA, but not all plans allow current employees to do this.

After-tax 401(k) contributions can make sense for certain people, but it's important to first make sure you're eligible and then weigh all other options before doing so. If you have access to an IRA, for example, you may prefer to stash extra savings there first so you can reap the tax advantages these accounts offer before putting extra money into your 401(k).