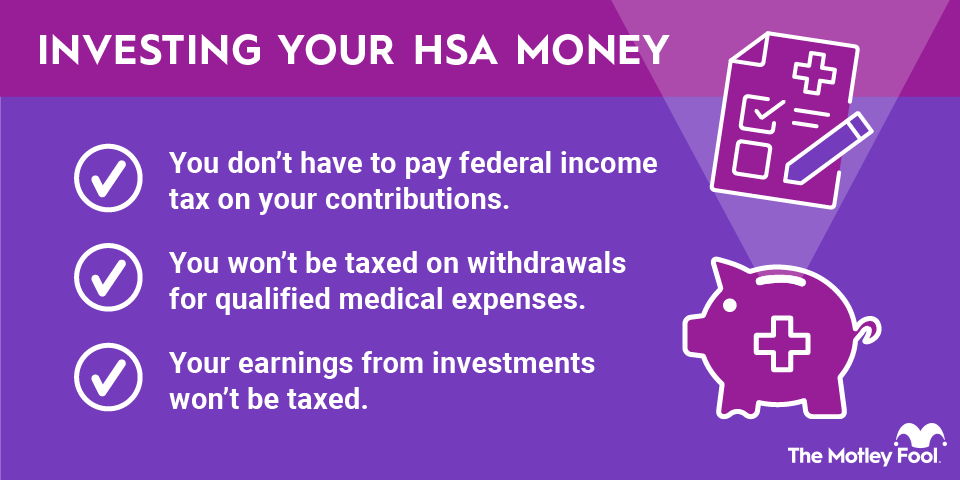

Of course, if you use the money for non-medical purposes, you'll be taxed on withdrawals at your ordinary income tax rate. You’ll also owe a 20% penalty if you're younger than 65. Still, you have a chance to invest with pre-tax dollars and defer taxes on gains with this account even if you take this approach, much as you do with a 401(k).

Your investment options depend on where you hold your HSA account, but you’ll often have a selection of index funds similar to what a 401(k) offers. Often these funds allow you to gain broad exposure to the entire stock market or to specific types of companies, such as large, mid-sized, or small companies. You may also have access to bond funds, real estate funds, or emerging market funds.

Should you invest the money in your HSA?

If you plan to use the money in an HSA within two to five years of contributing it, though, you should generally opt to leave it in cash or a cash equivalent so you aren’t subject to stock market volatility.

However, if you want to leave your money to grow to cover healthcare costs later in life or as an additional retirement account, you should strongly consider investing the money so you can earn returns.