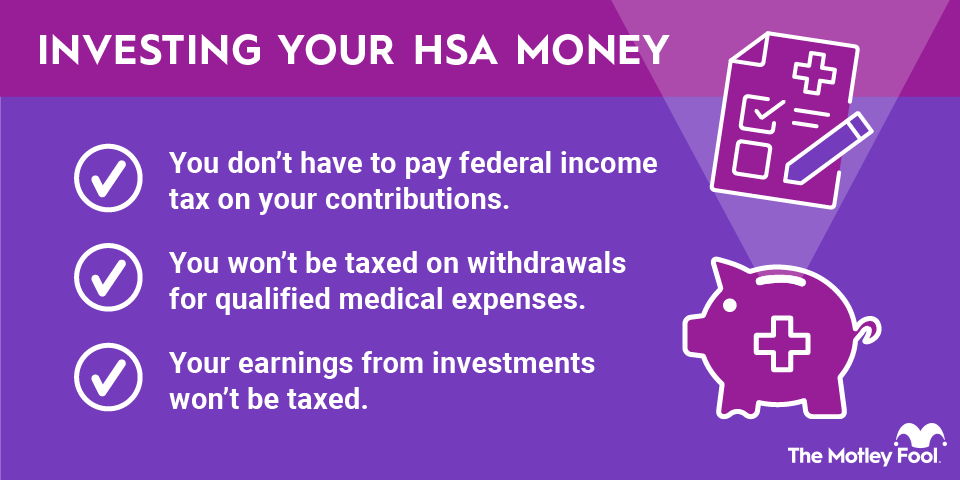

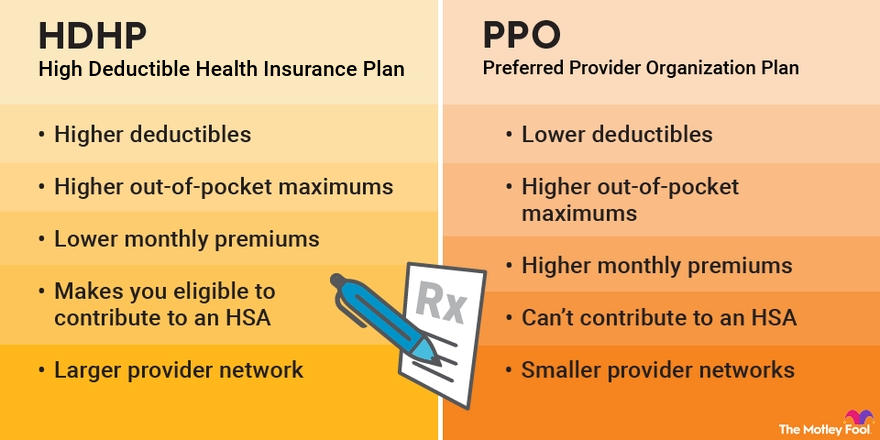

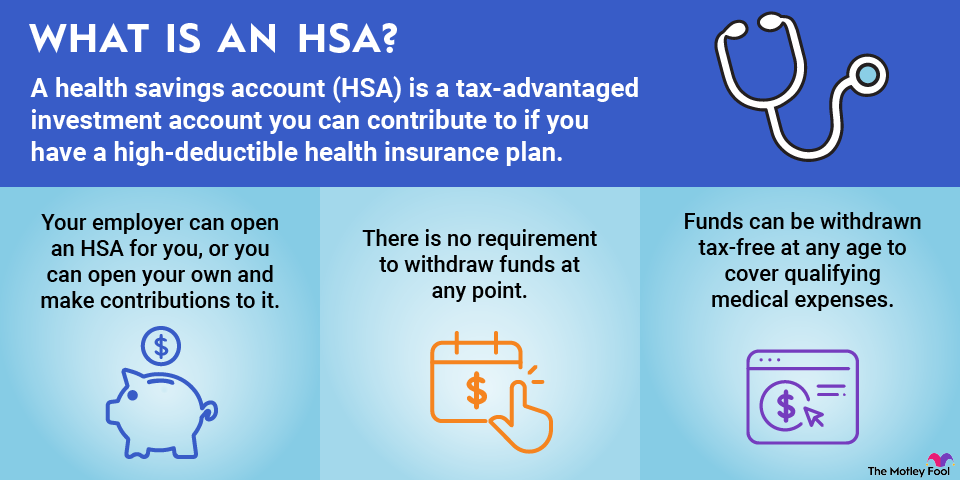

Health savings accounts (HSAs) are tax-advantaged investment accounts for individuals with qualifying high-deductible health plans (HDHP). If your health insurance plan meets the requirements to be considered an HDHP, you can make tax-deductible contributions to an HSA, allow your money to grow, and take tax-free withdrawals to cover HSA-eligible expenses.

Because an HSA offers tax savings both when making contributions and when making withdrawals, it is a valuable account for saving for medical care or retirement. However, there are rules governing the amount you can save in your HSA each year.

Here are the HSA contribution limits for 2024 and for 2025.

Maximum HSA contribution limit in 2025 and 2026

The maximum HSA contribution limit can change from year to year and varies depending on whether you have self-only (individual) coverage or a family insurance plan. The table below shows contribution limits for both 2025 and 2026.

Type of Coverage | 2025 Contribution Limit | 2026 Contribution Limit |

|---|---|---|

Self-only coverage | $4,300 | $4,400 |

Family coverage | $8,550 | $8,750 |

The IRS updates the HSA contribution limit annually. You can review IRS Publication 969 each year to determine the current limit.

It's also important to note that this is an aggregate limit that applies to your own contributions and any money your employer puts into your account. This is different from 401(k) rules, where employer matching funds do not affect your ability to contribute to your account. If your employer puts $2,000 into your HSA and you have self-only coverage, you would be allowed to contribute only $2,400 before hitting the 2026 contribution limit.

HSA catch-up contributions

HSA account holders who are 55 and older are entitled to make an additional catch-up contribution valued at $1,000 on top of the above contribution caps. Because of the HSA catch-up contribution rules, the table below shows the maximum contributions that you can make if you're 55 or older:

Type of Coverage | 2025 Contribution Limit | 2026 Contribution Limit |

|---|---|---|

Self-only coverage | $5,300 | $5,400 |

Family coverage | $9,550 | $9,750 |

Catch-up contributions are intended to help older Americans who may incur large medical expenses, or who may not have saved enough for a secure retirement and want to boost their contributions to tax-advantaged accounts as they near the end of their careers. Older Americans may want to make catch-up contributions because healthcare costs tend to increase with age, and an HSA can be a valuable type of retirement savings account.

HSAs work as a retirement savings plan because you can withdraw money penalty-free for any purpose, not just medical expenses, after age 65. Once you turn 65, you'll owe ordinary income taxes on non-medical withdrawals, the same as distributions from a 401(k) or traditional IRA.

Related Investing Topics

How does an HSA affect taxes when I contribute?

Because you can make HSA contributions with pretax funds, you can deduct the amount you've contributed from your taxable income in the year you contribute. This means that any money you contribute reduces your taxable income, which in turn saves you money on your IRS bill. It also means your take-home pay declines by a smaller amount than what you actually contributed.

For example, if you have $50,000 in taxable income and make a $3,600 deductible contribution to an HSA, you will be taxed on only $46,400 in income due to your contribution.

The specific amount you save due to your HSA contribution will depend on the size of your contribution and your tax rate. Those who are taxed at a higher rate and those who make larger contributions will realize more savings.