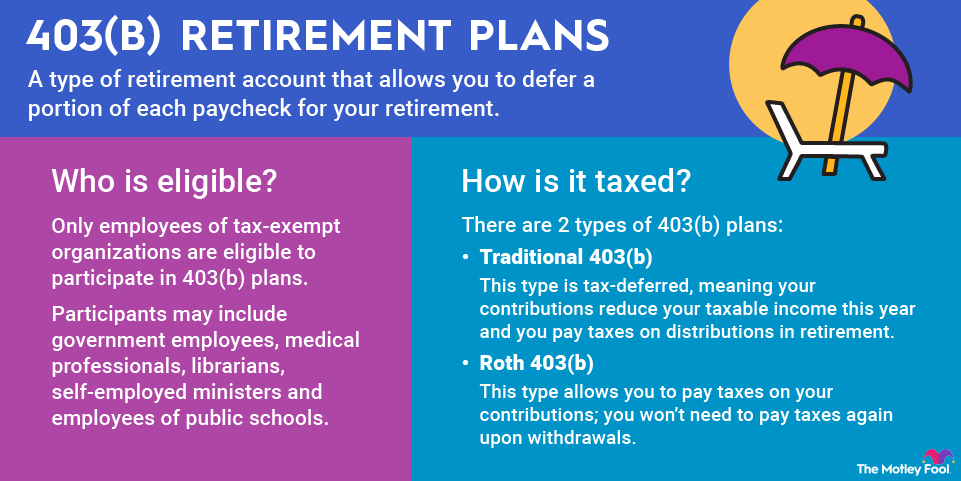

Roth 403(b) contribution limits

You can contribute to a Roth 403(b) annually no matter how much money you earn. For many employees, 403(b) contribution limits are identical to 401(k) contribution limits.

In 2025, these annual limits are:

- $23,500 for employees younger than 50

- $31,000 for workers ages 50-59 and 64 and older, who are eligible for a catch-up contribution of up to $7,500

- $34,750 for workers ages 60-63 under new Secure Act 2.0 rules

- $70,000 for employee and employer contributions combined for workers younger than 50

- $77,500 for employee and employer contributions combined for workers ages 50-59 and 64 and older

- $81,250 for employee and employer contributions combined for workers ages 60-63

In 2026, the annual limits are:

- $24,500 for employees younger than 50

- $32,500 for workers ages 50-59 and 64 and older, who are eligible for a catch-up contribution of up to $7,500

- $35,750 for workers ages 60-63 under new Secure Act 2.0 rules

- $72,000 for employee and employer contributions combined for workers younger than 50

- $80,000 for employee and employer contributions combined for workers ages 50-59 and 64 and older

- $83,250 for employee and employer contributions combined for workers ages 60-63

Note that these are aggregate contribution limits, meaning that they apply across all of your employer-sponsored retirement accounts.

Internal Revenue Service (IRS) rules provide extra flexibility on catch-up contributions for 403(b) plan participants. If you’ve worked for your employer for at least 15 years and have a 403(b) plan, then you can contribute an additional $3,000 per year even if you’re younger than 50. The lifetime cap on this additional contribution is $15,000.

Roth 403(b) withdrawal rules

Money that you contribute to a Roth 403(b) account cannot be withdrawn at any time without tax or penalty. Qualified withdrawals, which are not subject to tax or penalty, are those that occur after you reach 59 1/2 and have held the Roth 403(b) plan for at least five years. (Certain exceptions are permitted, such as if you become permanently disabled.) Non-qualified withdrawals from a Roth 403(b) account are subject to income tax and a 10% penalty on the earnings portion of the withdrawal.

As of 2024, Roth 403(b) accounts are no longer subject to annual required minimum distributions (RMDs). Those with traditional 403(b)s still need to take RMDs starting at age 73. If you want to avoid taking RMDs, you can explore the option of a Roth IRA rollover.