5. You can't reverse your decision.

Prior to 2018, you could "recharacterize" your converted Roth funds back to pretax contributions. That was the action you'd have to take to undo your Roth conversion. Today, recharacterization of converted Roth funds is prohibited by the Tax Cuts and Jobs Act. In other words, there's no going back once the conversion is done.

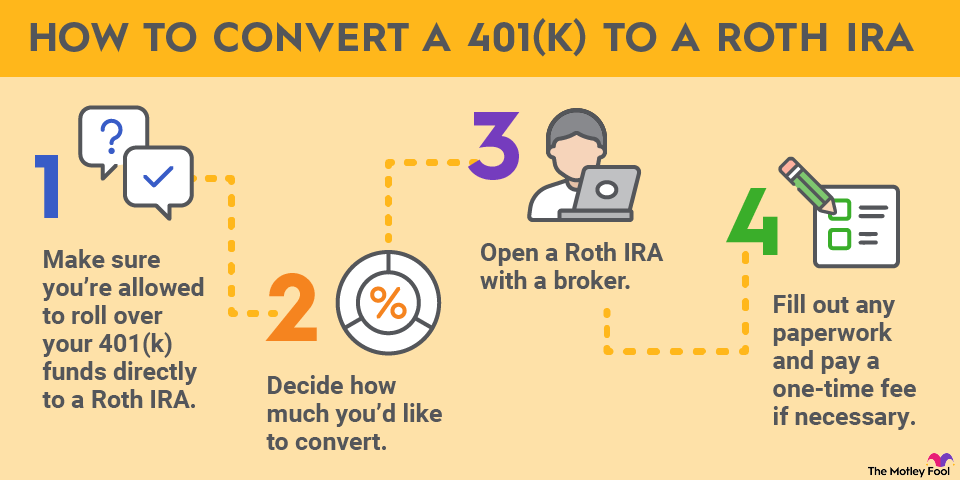

6. Roth conversions are available for 401(k)s, too.

Roth conversions aren't just for your traditional IRA balances. If you've left a job and still have funds in your former employer's 401(k), you can convert some or all of that money to a Roth IRA. This is an alternative to the conventional, nontaxable 401(k) rollover that would move your savings into a traditional IRA.

A 401(k) Roth conversion is taxed in the same way as an IRA conversion. You'd owe income taxes on pretax contributions plus any earnings.

As with an IRA, if you have any nondeductible contributions in your 401(k), the taxation gets more complicated. Generally, you'll incur taxes for converting the pro-rata share of pretax funds in your account. If you don't have nondeductible contributions, things are more clear-cut. You'd simply pay taxes on the entire converted amount.