A fiduciary relationship commonly exists when you hire an attorney, a real estate or insurance broker, or one of many types of financial advisors. However, there are some instances when a non-professional may be asked to serve in a fiduciary capacity. This frequently occurs in estate planning. If you agree to be the executor of your parents’ estate or serve as power of attorney for a friend in case they’re unable to manage their affairs, you’ve agreed to serve as a fiduciary.

What does a fiduciary do?

A fiduciary’s responsibilities depend on their role and the nature of the relationship. They may provide advice, negotiate on a client’s behalf, create financial plans, or manage a client’s investments. They may also be responsible for ensuring that a party’s taxes and other debts are paid, particularly if they’re serving as the executor of an estate. A fiduciary is also required to maintain complete and accurate records of transactions.

Generally, a fiduciary has the following duties:

- Duty of care: A fiduciary must make sound decisions based on available information when representing another party. But simply relying on information presented isn’t enough to meet the duty of care in some circumstances. For example, the director of a corporation is required to examine information with a “critical eye” to protect the interests of the corporation and its shareholders. A fiduciary financial advisor may need to seek the expertise of a third party, such as an attorney or certified public accountant (CPA), to meet the duty of care.

- Duty of loyalty: If you’re acting as a fiduciary, you must put the interests of the client or beneficiary ahead of your own. You must also avoid actions that could cause harm to the person or entity you’re representing. A fiduciary who comingles client funds with their own money, misleads a client, or reveals confidential client information is breaching their duty of loyalty.

Fiduciary relationships

In some cases, a fiduciary relationship is established through a contract or a legal document, such as a will or trust. In other circumstances, a fiduciary relationship is implied. For instance, it’s assumed that attorneys and clients or trustees and beneficiaries have a fiduciary relationship.

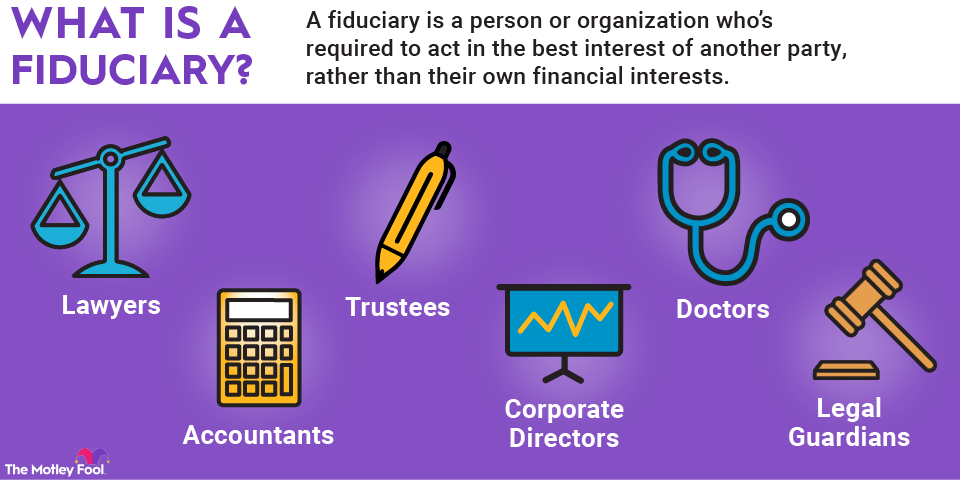

The following list provides some examples of common fiduciary relationships.