A lifecycle fund is a fund (commonly a mutual fund) that is automatically adjusted during its life to match an investor's risk tolerance as they near retirement. Reducing risk as you move closer to retirement helps preserve capital, ensuring you don't face a sudden loss just as you get ready to retire or after you've left the workforce.

Understanding how a lifecycle fund manages risk -- and the pros and cons that come along with that -- can help you decide whether such a fund belongs in your retirement portfolio.

How lifecycle funds work

The Thrift Savings Plan (TSP) for federal employees popularized lifecycle funds, which have since trickled down into private retirement plans. The funds offered in TSPs are very similar to those sponsored by private asset managers like BlackRock (BLK -0.00%) and T. Rowe Price (TROW -0.61%).

TSPs currently offer lifecycle funds with retirement dates in five-year intervals ranging from 2025 to 2070. For example, the L 2030 fund is designed for investors who plan to retire and start withdrawing their money around 2030.

As your retirement date nears, the lifecycle fund will automatically change its asset allocation. The allocation is adjusted based on the traditional advice that investors should take less risk as they near an age at which they'll begin making withdrawals.

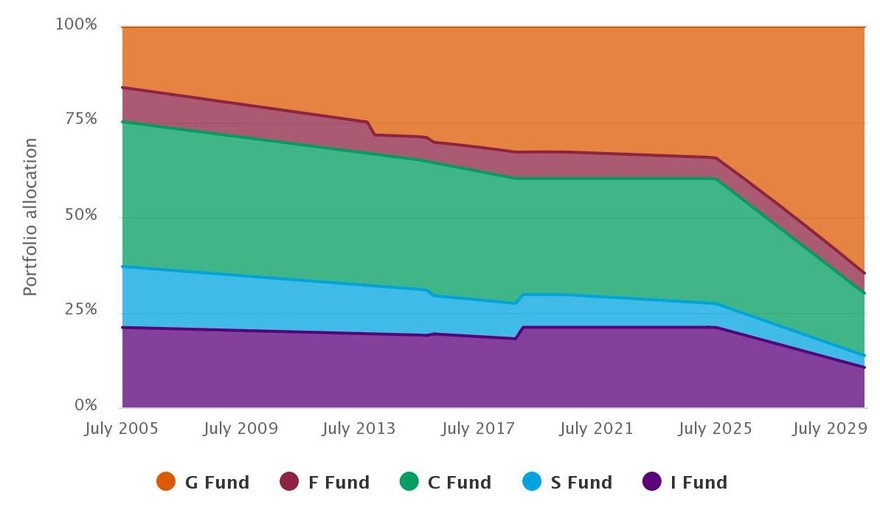

Thrift Savings Plans are very transparent about their funds' "glide paths," or how fund allocations change over time. The TSP.gov website provides visual representations. As an example, the L 2030 glide path is shown below.

Shifting asset allocation of the L 2030 Fund

As you can see, when someone is about 25 years from retirement, the lifecycle funds invest 75% of their assets in stocks. The fund gradually shifts the asset allocation from stocks to bonds but then rapidly shifts to bonds about five years from the target date.

Those final five years could be crucial to meeting a retirement goal, and a big downturn in stocks could be devastating, so bonds are an appropriate means of preserving capital near retirement. As the fund moves past the retirement date, it'll eventually start modestly increasing exposure to stocks again to maximize the potential lifetime income from the portfolio.

Should you buy a lifecycle fund?

The key advantage to a lifecycle fund is the convenience of having a set-it-and-forget-it retirement plan, but investors should be aware of their shortcomings. Relatively high fees, compared to simple index funds, are one factor that can limit returns for lifecycle funds. Be sure to check the fees you're paying for convenience and weigh the cost against the benefits.

Related retirement topics

Although they may do an adequate job of rebalancing your investments as you age, keep in mind that no two lifecycle funds ever follow the exact same path. Be sure to check the prospectuses of any funds you're considering to determine which fits your retirement strategy best.

Finally, lifecycle funds assume that your only investment and only source of retirement income is that one fund. The fund managers can't possibly know what you receive from Social Security, a pension, or any other investments you might hold. Lifecycle funds should be considered as only one part of a complete retirement plan.