National Grid (NGG 0.37%) is a somewhat unusual player in the utility space, and offers a compelling 5.5% dividend yield. A quick look at the electric and gas player would likely leave investors with a positive view of the company.

However, some recent corporate changes and political issues in Great Britain speak to a bigger problem that could slip under an investor's radar yet still cause major issues. Here's what you need to know before investing here.

The quick take

On the surface National Grid is a boring utility, providing electricity and natural gas to its customers. It has done a pretty good job of this over time, including investing in its assets to keep reliability high and expanding its operations when appropriate. In the first half of fiscal 2019, for example, the company spent 2.7 billion pounds on capital investments. Its goal is to spend around 5 billion pounds in fiscal 2019, which is up from around 3.3 billion pounds in 2015.

Image source: Getty Images

Capital spending is a good thing for a utility like National Grid, which largely owns regulated assets. Essentially, in exchange for a monopoly in the areas it serves, the company has to get rate hikes approved by regulators. There's a lot that goes into those decisions, but some of the big components are reliability and investment plans. So National Grid's spending will likely help it win approval for higher rates over time.

That said, National Grid talks about its investments in pounds. That's because it's based in the U.K, where around half of its operating profits are derived, largely from electric and natural gas assets. About 40% of its operating profits come from the U.S. market, in which it also operates electric and natural gas assets. The rest of its operating profits come from "other" ventures. All in all, this isn't your typical utility -- it is way more diversified than that.

The fly in the ointment

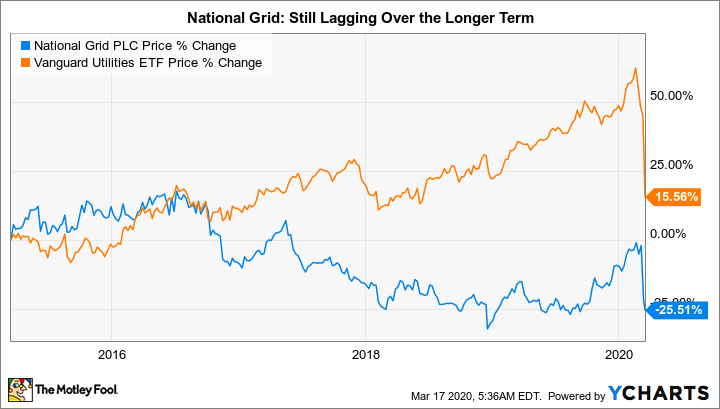

Generally speaking, diversification is a net benefit to investors, since poor performance in one area of a business can be offset by good performance in another. But here's the thing: National Grid's 5.5% dividend yield is extremely high by utility standards. As a reference, the yield on Vanguard Utilities ETF, a proxy for the utility space, is roughly 3%. So there's something else going on here. One piece of that is the fact that National Grid's multiple-country exposure increases complexity, but that's not all that's going on.

There has been a movement in the U.K. to nationalize key industries, including in the utility space. The left-leaning Labour party was the one pushing this effort under the guidance of Jeremy Corbyn. Nationalization would pretty much destroy around half of National Grid's business in one swift move. A weak showing in elections in late 2019, however, led Corbyn to announce that he intends to stand down as the head of the Labour party. Investors took this as good news, and swiftly bid up shares of National Grid, assuming nationalization was a dead issue.

The problem with this logic is that nationalization is an uncertain political process, and the winds can often change in quick and unexpected ways. Corbyn stepping down may not, in fact, end the threat. Notably, he will remain in Parliament and likely be a key voice in the Labour party. And, with the COVID-19 issue spreading across the globe, a worldwide recession looks increasingly likely. If a recession were to unfold in Great Britain, calls for government action to help the U.K.'s populace would likely increase, not decrease. And that could easily keep the nationalization issue alive for longer.

To its credit, National Grid has been taking steps to mitigate any potential damage. In late 2019 it created companies in countries that have bilateral trade treaties with the U.K. to "own" the assets in question. This move increases the protections afforded to shareholders, but doesn't eliminate the political threat posed here. That the company took this step shows just how real the threat is, and it is hard to believe that one election has eliminated the issue. Note, too, that the impact of privatization on shareholders could be material, since any effort by the U.K. government to take over utility assets will include a fight over the value of those assets (the government isn't likely to be generous with its offers). Perhaps worse, ideas around payment have included investors receiving government bonds, which isn't nearly as desirable as cash.

Better options

All in all, it is probably too soon to suggest that National Grid's privatization headwind has totally gone away. With architect Corbyn still in U.K. government, the coronavirus scare and a global recession could easily bring privatization issues back to the fore. To be fair, the political threat here could be history, too, but that only highlights the real problem: It's hard to tell for sure at this point. And that's an uncertainty that other utility options don't have to face.

In these uncertain times, the added risks National Grid faces today just aren't worth the effort for most investors. There are other high-yield options available with materially less headline risk.